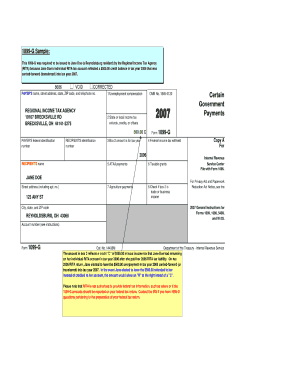

1099 G Form

What is the 1099 G?

The 1099 G form is a tax document used to report certain types of government payments. It is primarily issued by state and local governments to individuals who have received unemployment benefits, state tax refunds, or other government payments. In Kansas, the 1099 G form specifically reports unemployment compensation received during the tax year. This form is essential for taxpayers to accurately report their income and fulfill their tax obligations.

How to obtain the 1099 G

To obtain your Kansas 1099 G form, you can access it online through the Kansas Department of Labor's website. Typically, the form is made available after the end of the tax year, usually by January 31 of the following year. If you cannot find it online, you may also contact the Kansas Department of Labor directly for assistance. Ensure that you have your personal information ready, as it may be required for verification purposes.

Steps to complete the 1099 G

Completing the Kansas 1099 G form involves several straightforward steps:

- Gather necessary information, including your Social Security number and the total amount of unemployment benefits received.

- Access the form online or through your state’s labor department.

- Fill in your personal details accurately, ensuring that your name and Social Security number are correct.

- Report the total amount of unemployment benefits received in the designated box on the form.

- Review the form for accuracy before submitting it to the IRS with your tax return.

Legal use of the 1099 G

The Kansas 1099 G form is legally binding when completed and submitted correctly. It serves as an official record of the unemployment benefits you received, which must be reported on your federal tax return. Failure to report this income can result in penalties or audits by the IRS. It is important to retain a copy of the form for your records and to ensure compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 G form. Taxpayers must report all unemployment compensation received as taxable income. The IRS requires that the information on the 1099 G matches the taxpayer's records. If there are discrepancies, it could lead to issues during tax filing. It is advisable to consult the IRS instructions for Form 1040 to understand how to report the information accurately.

Filing Deadlines / Important Dates

For the Kansas 1099 G form, the filing deadline typically aligns with the general tax filing deadline, which is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to keep track of important dates to avoid late filing penalties. Additionally, the Kansas Department of Labor usually issues the 1099 G forms by January 31, allowing taxpayers ample time to prepare their tax returns.

Quick guide on how to complete 1099 g 5441101

Effortlessly Prepare 1099 G on Any Device

The management of online documents has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly and without delays. Manage 1099 G on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-centric process today.

The Easiest Method to Edit and Electronically Sign 1099 G with Ease

- Find 1099 G and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign 1099 G to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 g 5441101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas 1099 G form?

The Kansas 1099 G form is used to report certain government payments, including unemployment benefits and state tax refunds. It's essential for individuals to accurately report this income on their tax returns. Understanding the Kansas 1099 G is crucial for compliance and avoiding any potential tax issues.

-

How can airSlate SignNow assist with Kansas 1099 G forms?

airSlate SignNow allows you to easily manage and eSign Kansas 1099 G forms electronically. This streamlines the process of collecting signatures and ensures that forms are processed quickly. With SignNow, you can efficiently handle all your document needs regarding Kansas 1099 G forms.

-

What are the pricing options for using airSlate SignNow for Kansas 1099 G eSigning?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while efficiently managing Kansas 1099 G forms. Visit our website for detailed pricing information and choose the plan that works best for you.

-

Are there any integrations available with airSlate SignNow for Kansas 1099 G processes?

Yes, airSlate SignNow provides a variety of integrations that enhance your workflow for Kansas 1099 G forms. You can integrate SignNow with popular applications like Salesforce, Google Drive, and Dropbox. These integrations help you streamline your document management process, making it easier to deal with Kansas 1099 G forms.

-

What benefits does airSlate SignNow offer for Kansas 1099 G eSignature?

By using airSlate SignNow for Kansas 1099 G eSignature, you gain the benefits of speed, convenience, and security. The platform provides a user-friendly interface that simplifies document signing and management. Furthermore, it ensures that your Kansas 1099 G forms are securely signed and stored.

-

Can I track the status of my Kansas 1099 G forms with airSlate SignNow?

Absolutely! airSlate SignNow features advanced tracking options for your Kansas 1099 G forms. You can easily monitor the status of sent documents, receive notifications, and ensure they are completed promptly, giving you peace of mind throughout the process.

-

Is it easy to set up airSlate SignNow for Kansas 1099 G documentation?

Yes, setting up airSlate SignNow for handling Kansas 1099 G documentation is straightforward. The platform is designed for ease of use, allowing you to create, send, and manage your Kansas 1099 G forms in just a few clicks. You can start quickly and efficiently without extensive training.

Get more for 1099 G

- Personal property tax waiver jefferson county mo form

- 2519 application for duplicate titleregistration receipt form

- Nc 1099 form

- Nc d407 k1 form

- Nc 4 rev 1 00 fillable form

- E595e streamlined sales and use tax agreement webfill 107 certificate of exemption this is a multistate form

- W 3n form

- Form 13 nebraska

Find out other 1099 G

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe