Form 4797 Instructions 2013

What is the Form 4797 Instructions

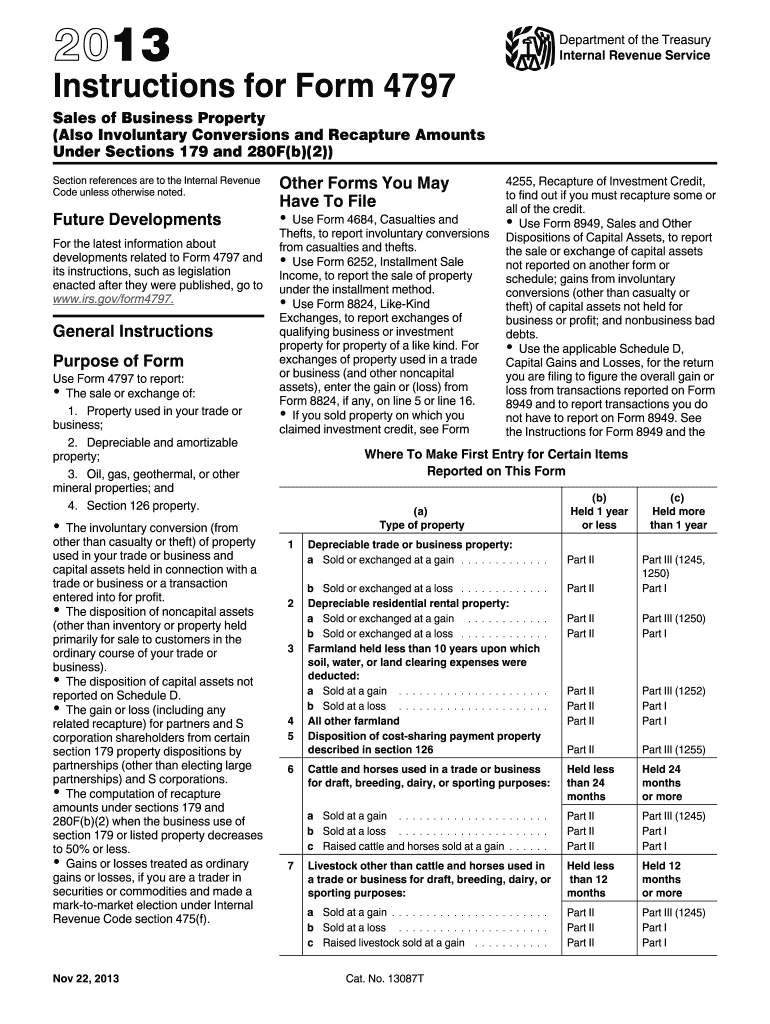

The Form 4797 Instructions provide essential guidelines for taxpayers who are reporting the sale of business property. This form is primarily used to report gains and losses from the sale or exchange of assets used in a trade or business. Understanding the instructions is crucial for ensuring accurate reporting and compliance with IRS regulations. The instructions detail the necessary information required for completion, including how to calculate gains or losses, and the specific sections of the form that must be filled out based on the type of property sold.

Steps to complete the Form 4797 Instructions

Completing the Form 4797 requires several steps to ensure accuracy and compliance. Start by gathering all necessary documentation related to the sale of the business property, including purchase and sale agreements, and any related expenses. Next, follow these steps:

- Identify the type of property sold and determine the appropriate section of the form to complete.

- Calculate the adjusted basis of the property, which includes the original purchase price and any improvements made.

- Determine the selling price and any selling expenses incurred during the transaction.

- Complete the relevant sections of the form, ensuring that all calculations are accurate.

- Review the completed form for any errors before submission.

Legal use of the Form 4797 Instructions

Understanding the legal implications of the Form 4797 Instructions is vital for taxpayers. The form must be completed accurately to avoid potential penalties or audits from the IRS. The instructions outline the legal framework under which the form operates, including compliance with federal tax laws. It is important to note that eSignatures can be used when submitting the form electronically, provided that the electronic signature meets the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Timely filing of the Form 4797 is essential to avoid penalties. The filing deadline typically aligns with the annual tax return due date, which is usually April 15 for individual taxpayers. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that the form is submitted by the extended deadline to maintain compliance. Keeping track of these dates helps prevent unnecessary complications during tax season.

Examples of using the Form 4797 Instructions

There are various scenarios where the Form 4797 Instructions apply. For instance, a business owner selling a piece of equipment used in their operations would need to report any gain or loss from that sale. Another example includes a real estate investor selling a property that was used for rental purposes. Each scenario requires careful consideration of the instructions to ensure that all relevant information is reported correctly, reflecting the true financial outcome of the sale.

Required Documents

To accurately complete the Form 4797, certain documents are necessary. Taxpayers should gather the following:

- Purchase and sale agreements for the property sold.

- Records of any improvements made to the property.

- Documentation of selling expenses, such as commissions or fees.

- Previous tax returns that may affect the reporting of gains or losses.

Having these documents on hand will facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete 2013 form 4797 instructions

Effortlessly prepare Form 4797 Instructions on any device

Digital document handling has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents since you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and eSign your documents without delays. Manage Form 4797 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Form 4797 Instructions with minimal effort

- Obtain Form 4797 Instructions and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 4797 Instructions to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 4797 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 4797 instructions

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What are the Form 4797 instructions for reporting the sale of business property?

The Form 4797 instructions provide guidance on how to report the sale of business property, including the types of properties that must be reported, and how to calculate gains or losses from the sale. It's essential to follow these instructions closely to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with completing Form 4797?

airSlate SignNow simplifies the process of completing Form 4797 by allowing users to fill out and eSign their documents electronically. With our user-friendly interface, you can quickly input the necessary information and securely send it to all relevant parties.

-

Are there any costs associated with using airSlate SignNow for Form 4797 instructions?

Yes, airSlate SignNow offers various pricing plans to fit your business needs. Our cost-effective solution includes access to features that streamline the completion of Form 4797 instructions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 4797 documents?

airSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and document tracking, all tailored to assist you in managing your Form 4797 documents efficiently. These features enhance productivity and ensure a seamless signing experience.

-

Can I integrate airSlate SignNow with other software for filing Form 4797?

Yes, airSlate SignNow integrates seamlessly with various software applications to facilitate the filing of Form 4797. This integration allows users to import data directly and ensures that all necessary information is accurately included in the form.

-

What are the benefits of using airSlate SignNow for Form 4797 processing?

Using airSlate SignNow for Form 4797 processing offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and processed quickly, allowing you to focus on other important business tasks.

-

Is airSlate SignNow compliant with IRS requirements for Form 4797?

Absolutely! airSlate SignNow is designed to comply with IRS requirements, ensuring that your Form 4797 instructions and documents are processed according to federal regulations. This compliance gives you peace of mind when filing your forms.

Get more for Form 4797 Instructions

- Student employee confidentiality agreement miami university form

- Immigrationcourtsidecom quotthe voice of the new due process form

- Ttuhsc immigration questionnaires ampamp formstexas tech

- Office of human resources maternitypaternityadoption form

- Moody bible institute reference forms

- Non driver pre employment application pdf thomas concrete form

- Termination of employment letter texas tech university ttuhsc form

- 2300 940 clearance of personnel for separation or transfer form

Find out other Form 4797 Instructions

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast