Form it 641Manufacturer's Real Property Tax Creditit641 Tax Ny

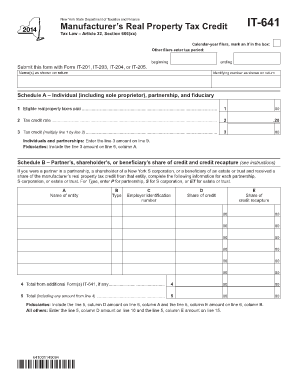

What is the Form IT-641 Manufacturer's Real Property Tax Credit?

The Form IT-641, also known as the Manufacturer's Real Property Tax Credit, is a tax form used in New York State. This form allows qualifying manufacturers to claim a credit against their real property taxes. The credit is designed to encourage investment in manufacturing facilities and promote economic growth within the state. By reducing the tax burden on manufacturers, the state aims to foster a more competitive business environment.

How to Use the Form IT-641 Manufacturer's Real Property Tax Credit

Using the Form IT-641 involves several steps to ensure that manufacturers can accurately claim their tax credits. First, businesses must determine their eligibility based on the specific criteria outlined by New York State. Once eligibility is confirmed, manufacturers can fill out the form, providing necessary details about their property and the amount of tax credit they are claiming. The completed form should then be submitted to the appropriate tax authority as part of the annual tax filing process.

Steps to Complete the Form IT-641 Manufacturer's Real Property Tax Credit

Completing the Form IT-641 requires attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary documentation, including property assessments and tax bills.

- Confirm eligibility by reviewing the criteria set forth by the New York State Department of Taxation and Finance.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credit based on the guidelines provided in the form instructions.

- Review the completed form for any errors or omissions.

- Submit the form along with your tax return by the designated deadline.

Eligibility Criteria for the Form IT-641 Manufacturer's Real Property Tax Credit

To qualify for the Manufacturer's Real Property Tax Credit, certain eligibility criteria must be met. Businesses must be classified as manufacturers under New York State law and must own or lease real property that is used for manufacturing purposes. Additionally, the property must meet specific assessment and valuation requirements. It is essential for applicants to thoroughly review these criteria to ensure compliance and maximize their potential tax benefits.

Filing Deadlines for the Form IT-641 Manufacturer's Real Property Tax Credit

Filing deadlines for the Form IT-641 are crucial for manufacturers to keep in mind. Typically, the form must be submitted as part of the annual tax return, which is due on April fifteenth for most businesses. However, if the due date falls on a weekend or holiday, the deadline may be adjusted. It is advisable for manufacturers to stay informed about any changes to filing deadlines to avoid penalties and ensure timely processing of their claims.

Form Submission Methods for the IT-641 Manufacturer's Real Property Tax Credit

The Form IT-641 can be submitted through various methods, providing flexibility for manufacturers. Options include:

- Online submission through the New York State tax portal, which allows for electronic filing.

- Mailing the completed form to the appropriate tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, which may offer assistance for any questions regarding the form.

Quick guide on how to complete form it 641manufacturers real property tax creditit641 tax ny

Effortlessly prepare Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and seamlessly. Manage Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to alter and electronically sign Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny with ease

- Locate Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny and click on Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 641manufacturers real property tax creditit641 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny?

Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny is a tax form used in New York State to claim the Manufacturer's Real Property Tax Credit. This form allows eligible businesses to receive tax credits for property taxes paid on real estate used for manufacturing purposes, helping reduce their overall tax burden.

-

How does airSlate SignNow simplify the eSigning process for Form IT 641?

With airSlate SignNow, users can easily send Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny for eSignature within minutes. Our intuitive platform ensures that all parties involved can sign the document electronically, which enhances efficiency and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for Form IT 641?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. Users can choose from different tiers, allowing them to eSign and manage documents like Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny at an affordable rate.

-

What features does airSlate SignNow offer to support Form IT 641?

AirSlate SignNow provides a range of features tailored for the efficient handling of Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny. These include customizable templates, automatic reminders, document tracking, and secure cloud storage, ensuring that users manage their tax forms effortlessly.

-

Can I integrate airSlate SignNow with other software for processing Form IT 641?

Yes, airSlate SignNow seamlessly integrates with various third-party software to streamline the processing of Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny. Integration with tools like CRM systems, accounting software, and email platforms enhances workflow efficiency and keeps documentation organized.

-

What are the benefits of using airSlate SignNow for Form IT 641?

Using airSlate SignNow for Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny offers numerous benefits, including time savings, increased accuracy, and secure document handling. Our platform's ease of use helps businesses focus on what matters most while ensuring compliance with tax regulations.

-

How secure is my data when using airSlate SignNow for Form IT 641?

AirSlate SignNow prioritizes data security for users managing Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny. With advanced encryption methods and compliance with legal standards, your information remains protected throughout the eSigning process.

Get more for Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny

- Voter registration application north carolina state board of form

- Authorization for release of personal information to cumberland

- Essential personnel child care epcc form

- Release of information maryland state department of education

- Family child care regulations division of early childhood form

- Sample parent letter requesting immunization records form

- Insulation certification form

- Afchfa licensing record clearance request form

Find out other Form IT 641Manufacturer's Real Property Tax Creditit641 Tax Ny

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement