Ct Tr 1 2007

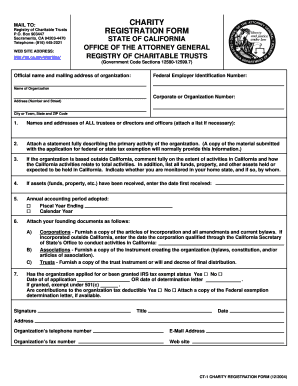

What is the Ct Tr 1

The Ct Tr 1 form is a specific document used in the United States for tax purposes. It is primarily associated with the reporting of certain transactions and activities to the relevant tax authorities. This form plays a crucial role in ensuring compliance with federal and state regulations. Understanding its purpose and requirements is essential for individuals and businesses alike.

How to use the Ct Tr 1

Using the Ct Tr 1 form involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the transactions or activities being reported. This may include financial records, identification details, and any supporting documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the specific requirements set by the tax authority.

Steps to complete the Ct Tr 1

Completing the Ct Tr 1 form requires attention to detail. Follow these steps:

- Gather all relevant documents and information.

- Access the Ct Tr 1 form online or obtain a physical copy.

- Fill in personal and transaction details as required.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring it is sent to the correct address.

Legal use of the Ct Tr 1

The Ct Tr 1 form must be used in accordance with legal guidelines to ensure its validity. This includes adhering to deadlines for submission and maintaining accurate records of all transactions reported. Failure to comply with these regulations can result in penalties or legal repercussions. It is important to stay informed about any changes in legislation that may affect the use of this form.

Key elements of the Ct Tr 1

Several key elements are essential when completing the Ct Tr 1 form:

- Identification Information: Personal or business details that identify the filer.

- Transaction Details: Specifics about the transactions being reported, including dates and amounts.

- Signature: A signature may be required to validate the form.

- Supporting Documentation: Any additional documents that substantiate the information provided.

Form Submission Methods

The Ct Tr 1 form can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities offer electronic filing options for convenience.

- Mail: The form can be printed and mailed to the designated address.

- In-Person: Some may choose to submit the form in person at local tax offices.

Quick guide on how to complete ct tr 1

Finalize Ct Tr 1 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without unnecessary delays. Manage Ct Tr 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to adjust and eSign Ct Tr 1 with ease

- Find Ct Tr 1 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct Tr 1 and guarantee excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct tr 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct tr 1 in relation to airSlate SignNow?

Ct tr 1 refers to the document signing and transaction processing capabilities of airSlate SignNow. This feature allows users to efficiently create, send, and eSign documents, streamlining business workflows.

-

How does airSlate SignNow handle pricing for companies using ct tr 1?

Pricing for airSlate SignNow is designed to be cost-effective, particularly for those leveraging ct tr 1 features. Various plans allow businesses to choose according to their document signing volume and specific needs.

-

What are the key features of airSlate SignNow related to ct tr 1?

The key features of airSlate SignNow that enhance ct tr 1 include customizable templates, secure cloud storage, and audit trails. These features ensure that your document signing process is efficient, secure, and compliant.

-

What benefits can I expect from using ct tr 1 with airSlate SignNow?

Using ct tr 1 with airSlate SignNow helps reduce turnaround times for document approvals and enhances team collaboration. Additionally, it improves access to crucial documents from anywhere, ensuring you can work seamlessly.

-

Can airSlate SignNow integrate with other tools while using ct tr 1?

Absolutely! AirSlate SignNow supports integrations with various tools such as CRM systems and project management software, enhancing the functionality of ct tr 1 capabilities. This ensures a seamless workflow across different platforms.

-

Is there a mobile app for airSlate SignNow and ct tr 1 users?

Yes, airSlate SignNow offers a mobile app that allows users to manage ct tr 1 activities on the go. This means you can send, sign, and store documents from your mobile device anytime and anywhere.

-

How can I get support for using ct tr 1 with airSlate SignNow?

AirSlate SignNow provides comprehensive support for ct tr 1 users through various channels, including a knowledge base, live chat, and email support. The goal is to ensure you have all the assistance you need to make the most of your document signing experience.

Get more for Ct Tr 1

- Doh 4264 form

- Health home mco and cm standards new york state department form

- Environmental health manual procedure csfp 146 form

- Nys accession number form

- Health home application to serve children new york state form

- Opwdd ddro manual for childrens waiver form

- Doh 4392 form

- Report for legal blindness ny state form

Find out other Ct Tr 1

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word