Inheritance Document PDF 2003-2026

What is the inheritance document PDF?

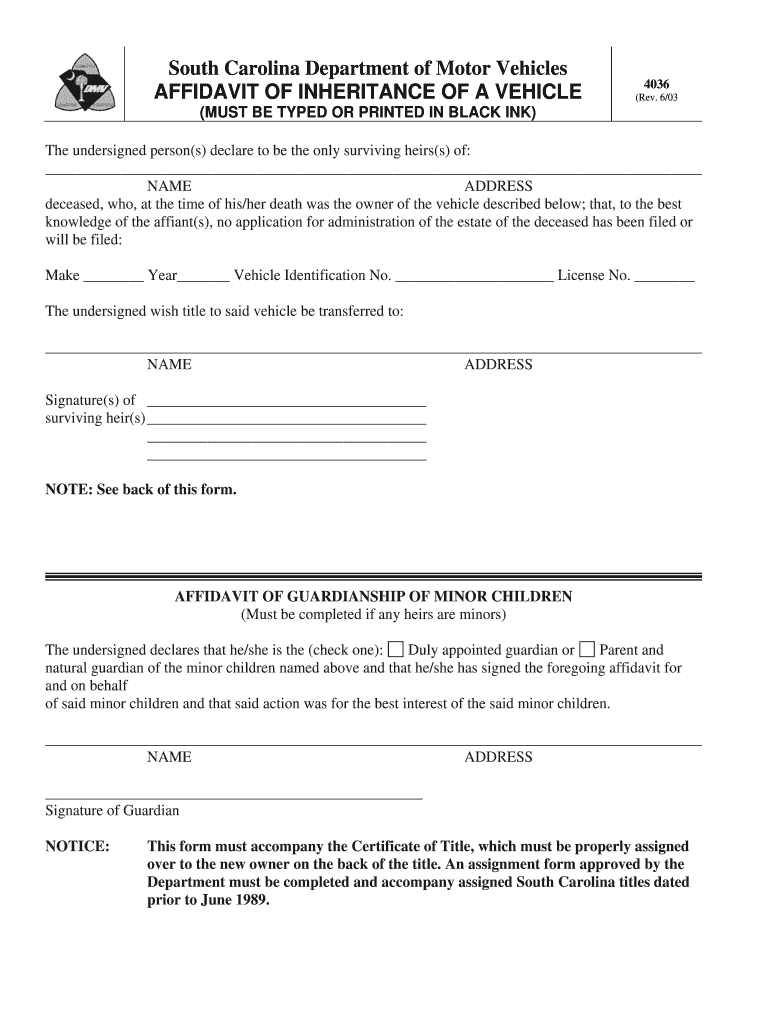

The inheritance document PDF is a legal form used to establish the transfer of assets or property from a deceased individual to their heirs. This document serves as proof of inheritance and is essential for settling the deceased's estate. It typically includes details such as the deceased's name, the names of the heirs, a description of the inherited assets, and any relevant legal language necessary to validate the document.

Steps to complete the inheritance document PDF

Completing the inheritance document PDF involves several key steps to ensure it is legally binding and accurately reflects the wishes of the deceased. First, gather all necessary information, including the deceased's full name, date of death, and a detailed list of assets. Next, fill in the document with this information, ensuring accuracy in all fields. It is crucial to include the names and contact information of all heirs. After completing the form, sign and date it to affirm its validity. If applicable, have the document notarized to enhance its legal standing.

Legal use of the inheritance document PDF

The inheritance document PDF is legally recognized in the United States when it is filled out correctly and meets state-specific requirements. It is often required by financial institutions and government agencies to transfer ownership of assets such as bank accounts, real estate, and personal property. To ensure its legal use, the document should comply with the laws of the state where the deceased lived and where the assets are located. It is advisable to consult with a legal professional to confirm that the document adheres to all necessary regulations.

Key elements of the inheritance document PDF

Several key elements must be included in the inheritance document PDF to ensure its effectiveness. These elements typically consist of:

- Decedent's Information: Full name, date of birth, and date of death.

- Heirs' Information: Names, addresses, and relationship to the deceased.

- Asset Description: Detailed list of all assets being inherited, including property, bank accounts, and personal belongings.

- Signatures: Signatures of the heirs and, if applicable, a notary public.

- Date: The date the document is completed and signed.

State-specific rules for the inheritance document PDF

Each state in the U.S. has its own rules and regulations regarding inheritance documents. These rules can affect how the document is completed, what information must be included, and how it is submitted. For example, some states may require additional documentation, such as a death certificate or a will, to accompany the inheritance document. It is important to research the specific requirements for the state in which the deceased lived to ensure compliance and avoid potential legal issues.

Who issues the inheritance document?

The inheritance document is typically prepared by the heirs or an attorney representing the estate of the deceased. While heirs can fill out the document themselves, many choose to consult with a lawyer to ensure that all legal requirements are met and that the document is properly executed. In some cases, courts may also issue an official document confirming the distribution of assets, especially if the estate is going through probate.

Quick guide on how to complete i need picture of inheritance form

Simplify your life by signNowing Inheritance Document Pdf form with airSlate SignNow

Whether you need to register a new vehicle, apply for a driver's permit, transfer ownership, or complete any other task related to automobiles, dealing with such RMV forms as Inheritance Document Pdf is an unavoidable necessity.

There are various ways to access them: by postal mail, at the RMV service center, or by obtaining them online from your local RMV website and printing them out. Each of these methods can be time-consuming. If you’re looking for a quicker way to fill them out and validate them with a legally-binding eSignature, airSlate SignNow is the optimal choice.

How to fill out Inheritance Document Pdf effortlessly

- Click on Show details to view a brief overview of the form you are interested in.

- Select Get form to initiate and access the form.

- Follow the green label indicating the required fields if applicable.

- Utilize the top toolbar and make use of our advanced functionality set to edit, comment, and enhance your form.

- Add text, your initials, shapes, images, and other elements.

- Click Sign in in the same toolbar to create a legally-binding eSignature.

- Review the form content to ensure it’s free of errors and inconsistencies.

- Click Done to complete the form.

Utilizing our solution to complete your Inheritance Document Pdf and other related documents will save you a signNow amount of time and effort. Enhance your RMV form completion process from the very start!

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

Create this form in 5 minutes!

How to create an eSignature for the i need picture of inheritance form

How to generate an electronic signature for the I Need Picture Of Inheritance Form in the online mode

How to create an electronic signature for your I Need Picture Of Inheritance Form in Google Chrome

How to make an electronic signature for signing the I Need Picture Of Inheritance Form in Gmail

How to create an eSignature for the I Need Picture Of Inheritance Form right from your mobile device

How to create an eSignature for the I Need Picture Of Inheritance Form on iOS

How to generate an eSignature for the I Need Picture Of Inheritance Form on Android

People also ask

-

What is an inheritance document and why is it important?

An inheritance document is a legal record that specifies how a person's assets and properties will be distributed after their passing. It plays a crucial role in ensuring that your wishes are honored and can help prevent disputes among heirs. Utilizing airSlate SignNow for creating and signing inheritance documents ensures seamless compliance and legal validation.

-

How does airSlate SignNow assist in creating inheritance documents?

airSlate SignNow provides user-friendly templates and tools to draft your inheritance document efficiently. With easy-to-use features, you can customize the document to meet your specific needs. This streamline process saves time and simplifies the preparation of important legal documents.

-

What are the pricing options for airSlate SignNow when creating an inheritance document?

airSlate SignNow offers various pricing plans to fit different budgets and business needs. Each plan includes features that facilitate the creation and eSigning of documents, including inheritance documents. Explore our pricing page to find a plan that offers a cost-effective solution for your document management.

-

Can multiple parties eSign an inheritance document using airSlate SignNow?

Yes, airSlate SignNow facilitates multiple party eSigning, allowing all relevant stakeholders to securely sign the inheritance document. This feature ensures that the document is legally binding and compliant with regulations. Collaborating with multiple users is effortless, streamlining the signing process.

-

Is it secure to use airSlate SignNow for inheritance documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, employing advanced encryption and compliance measures. This ensures that your inheritance document is protected from unauthorized access while remaining easily accessible to authorized signers. Trust in our commitment to document security.

-

What integrations does airSlate SignNow offer for managing inheritance documents?

airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when managing inheritance documents. Whether you use CRM systems or cloud storage solutions, these integrations simplify document handling and improve your overall efficiency. Check our integrations page for the full list.

-

Can I update my inheritance document after it has been signed?

Yes, you can make adjustments to your inheritance document, even after it has been signed. airSlate SignNow allows you to easily create amendments or create a new version of the document. Always ensure that all parties are notified of changes to maintain transparency and legality.

Get more for Inheritance Document Pdf

Find out other Inheritance Document Pdf

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure