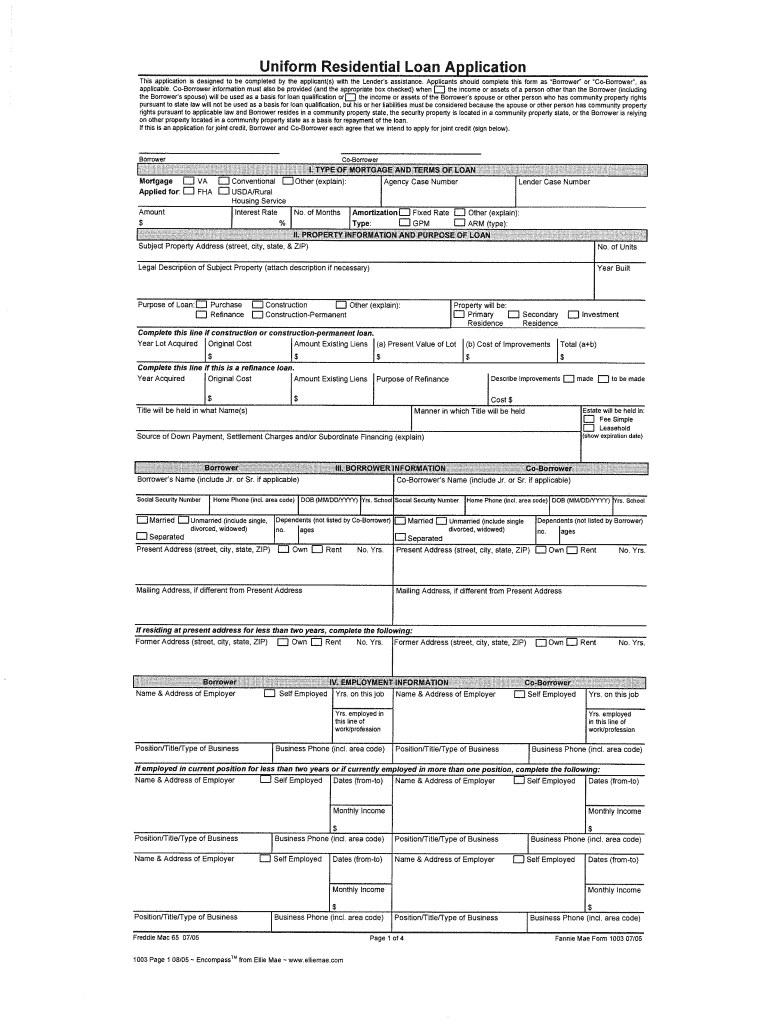

Mortgage Application Form Castle Services LLC

What makes the mortgage application form castle services llc legally valid?

As the society takes a step away from office working conditions, the completion of paperwork more and more happens electronically. The mortgage application form castle services llc isn’t an any different. Handling it utilizing electronic means differs from doing this in the physical world.

An eDocument can be considered legally binding on condition that particular needs are fulfilled. They are especially vital when it comes to signatures and stipulations associated with them. Typing in your initials or full name alone will not guarantee that the institution requesting the sample or a court would consider it executed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your mortgage application form castle services llc when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make document execution legitimate and secure. It also offers a lot of possibilities for smooth completion security wise. Let's quickly run through them so that you can stay certain that your mortgage application form castle services llc remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: adds an extra layer of protection and validates other parties' identities via additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information safely to the servers.

Filling out the mortgage application form castle services llc with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete mortgage application form castle services llc

airSlate SignNow's web-based service is specifically designed to simplify the organization of workflow and improve the whole process of competent document management. Use this step-by-step guide to fill out the Get And Sign Mortgage Application Form — Castle Services LLC quickly and with perfect precision.

The way to fill out the Get And Sign Mortgage Application Form — Castle Services LLC on the web:

- To get started on the document, utilize the Fill camp; Sign Online button or tick the preview image of the document.

- The advanced tools of the editor will lead you through the editable PDF template.

- Enter your official identification and contact details.

- Utilize a check mark to point the choice wherever required.

- Double check all the fillable fields to ensure total precision.

- Use the Sign Tool to add and create your electronic signature to airSlate SignNow the Get And Sign Mortgage Application Form — Castle Services LLC.

- Press Done after you complete the document.

- Now you may print, download, or share the document.

- Address the Support section or get in touch with our Support crew in the event you have any questions.

By utilizing airSlate SignNow's comprehensive solution, you're able to perform any essential edits to Get And Sign Mortgage Application Form — Castle Services LLC, create your personalized electronic signature within a couple fast steps, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Mortgage Application Form Castle Services LLC

Instructions and help about Mortgage Application Form Castle Services LLC

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Related searches to Mortgage Application Form Castle Services LLC

Create this form in 5 minutes!

How to create an eSignature for the mortgage application form castle services llc

How to generate an signature for the Mortgage Application Form Castle Services LLC online

How to make an signature for your Mortgage Application Form Castle Services LLC in Google Chrome

How to make an signature for signing the Mortgage Application Form Castle Services LLC in Gmail

How to generate an electronic signature for the Mortgage Application Form Castle Services LLC right from your smartphone

How to generate an electronic signature for the Mortgage Application Form Castle Services LLC on iOS

How to generate an signature for the Mortgage Application Form Castle Services LLC on Android devices

Get more for Mortgage Application Form Castle Services LLC

- Final disposition form pasco county clerk

- Daily activity ampac dora roberts rehabilitation form

- Jpay money order deposit form for ohio

- I129 5711998 form

- Jamvat contact number form

- Platoon sergeant initial counseling example form

- Ee incident report form 073106 ghilotti construction company

- Form 500cp

Find out other Mortgage Application Form Castle Services LLC

- How Do I eSignature Idaho Healthcare / Medical Document

- Can I eSignature Idaho Healthcare / Medical Document

- Help Me With eSignature Idaho Healthcare / Medical Document

- How Can I eSignature Idaho Healthcare / Medical Document

- Can I eSignature Idaho Healthcare / Medical Document

- How To eSignature Idaho Healthcare / Medical Document

- How To eSignature Idaho Healthcare / Medical Document

- How Do I eSignature Idaho Healthcare / Medical Document

- Help Me With eSignature Idaho Healthcare / Medical Document

- How Do I eSignature Idaho Healthcare / Medical Document

- How To eSignature Idaho Healthcare / Medical Form

- How Can I eSignature Idaho Healthcare / Medical Document

- Can I eSignature Idaho Healthcare / Medical Document

- How Do I eSignature Idaho Healthcare / Medical Form

- Help Me With eSignature Idaho Healthcare / Medical Document

- How To eSignature Idaho Healthcare / Medical Form

- Help Me With eSignature Idaho Healthcare / Medical Form

- How Do I eSignature Idaho Healthcare / Medical Form

- How Can I eSignature Idaho Healthcare / Medical Document

- Help Me With eSignature Idaho Healthcare / Medical Form