Form 500cp

What is the Form 500cp

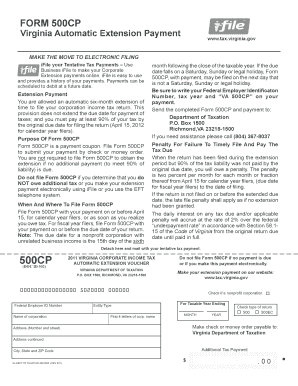

The Form 500cp, also known as the Virginia Form 500cp, is a document used primarily for tax purposes in the state of Virginia. It is specifically designed for individuals or businesses seeking to report certain tax-related information to the Virginia Department of Taxation. This form is essential for ensuring compliance with state tax laws and regulations.

How to use the Form 500cp

Using the Form 500cp involves several key steps to ensure accurate completion. First, gather all necessary information related to your tax situation, including income details and deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements of the Virginia Department of Taxation.

Steps to complete the Form 500cp

Completing the Form 500cp requires attention to detail. Follow these steps:

- Begin by entering your personal information, including name, address, and Social Security number.

- Provide information about your income sources, including wages, self-employment income, and other earnings.

- Detail any deductions or credits you are eligible for, as these can significantly affect your tax liability.

- Review the completed form for accuracy, ensuring all figures are correct and all required fields are filled.

- Submit the form according to the guidelines provided by the Virginia Department of Taxation.

Legal use of the Form 500cp

The legal use of the Form 500cp is crucial for maintaining compliance with Virginia tax laws. This form must be filled out truthfully and accurately to avoid potential legal issues, including penalties for misreporting income or failing to file. The information provided on the form is subject to verification by state tax authorities, and any discrepancies can lead to audits or additional fines.

Key elements of the Form 500cp

Several key elements must be included when filling out the Form 500cp:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed accounts of all income sources.

- Deductions and Credits: Information on allowable deductions and tax credits.

- Signature: A signature is required to validate the information provided.

Form Submission Methods

The Form 500cp can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically through the Virginia Department of Taxation's website.

- Mail: The form can also be printed and mailed to the appropriate tax office.

- In-Person Submission: Individuals can choose to submit the form in person at designated tax offices.

Quick guide on how to complete form 500cp

Effortlessly Prepare Form 500cp on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly option to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, alter, and electronically sign your documents swiftly without interruptions. Handle Form 500cp on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Form 500cp with Ease

- Find Form 500cp and then select Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, frustrating form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 500cp and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 500cp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia Form 500CP?

The Virginia Form 500CP is an important document for businesses that make certain tax payments in Virginia. It is a consolidated payment form for corporate taxes, allowing organizations to report and pay their corporate income tax obligations efficiently. By utilizing tools like airSlate SignNow, you can easily manage and eSign your Virginia Form 500CP.

-

How can airSlate SignNow help with the Virginia Form 500CP?

airSlate SignNow simplifies the process of preparing and submitting the Virginia Form 500CP by providing an easy-to-use platform for document management. You can upload your form, add electronic signatures, and securely share it with relevant stakeholders, ensuring a smooth submission process. This streamlines your tax obligations and saves time.

-

Is there a cost associated with using airSlate SignNow for the Virginia Form 500CP?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. The cost of using the platform for managing documents, including the Virginia Form 500CP, can vary based on the level of features and integrations you choose. Typically, users find it to be a cost-effective solution compared to traditional methods.

-

Can I integrate airSlate SignNow with other software for handling the Virginia Form 500CP?

Absolutely! airSlate SignNow offers integrations with several popular software solutions, making it easy to streamline your processes. Whether you're using accounting software or CRM systems, you can connect these tools to manage the Virginia Form 500CP seamlessly within your existing workflow.

-

What features does airSlate SignNow provide for the Virginia Form 500CP?

Key features of airSlate SignNow include electronic signing, document tracking, and customizable templates, all of which enhance the management of the Virginia Form 500CP. These features help ensure that your documents are signed promptly and that you can easily monitor their status throughout the process.

-

Are there any benefits to using airSlate SignNow for the Virginia Form 500CP?

Using airSlate SignNow for your Virginia Form 500CP comes with numerous benefits, including improved efficiency and reduced turnaround times. The ability to manage documents electronically means you can eliminate paperwork and delays, allowing for quicker tax submissions and potential overhead cost savings.

-

How secure is airSlate SignNow for handling sensitive documents like the Virginia Form 500CP?

airSlate SignNow prioritizes security, using advanced encryption and authentication protocols to protect your sensitive documents, including the Virginia Form 500CP. The platform complies with industry standards to ensure that your data remains confidential and secure during the entire signing process.

Get more for Form 500cp

- S cd 401s web 11 02 corporation tax return 2002 north carolina department of revenue for calendar year 2002 or other tax year form

- C cd 405 web 12 00 corporation tax return 2000 north carolina department of revenue submit forms in the following order annual

- 2012 new jersey property tax reimbursement senior freeze application form ptr 1 2012 new jersey property tax reimbursement

- Fl 303 s declaration regarding notice and service of request for temporary emergency ex parte orders spanish judicial council 438156248 form

- Jdf 861 r1214 petition for appointment of conservator for minor page 3 of 6 2013 2014 colorado judicial department for use in form

- Family readiness group information sheet

- Payroll system access request form request type type of finance finance utah

- Kern rrd 0320 form

Find out other Form 500cp

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself