941n Fill in Form

What is the 941n Fill In Form

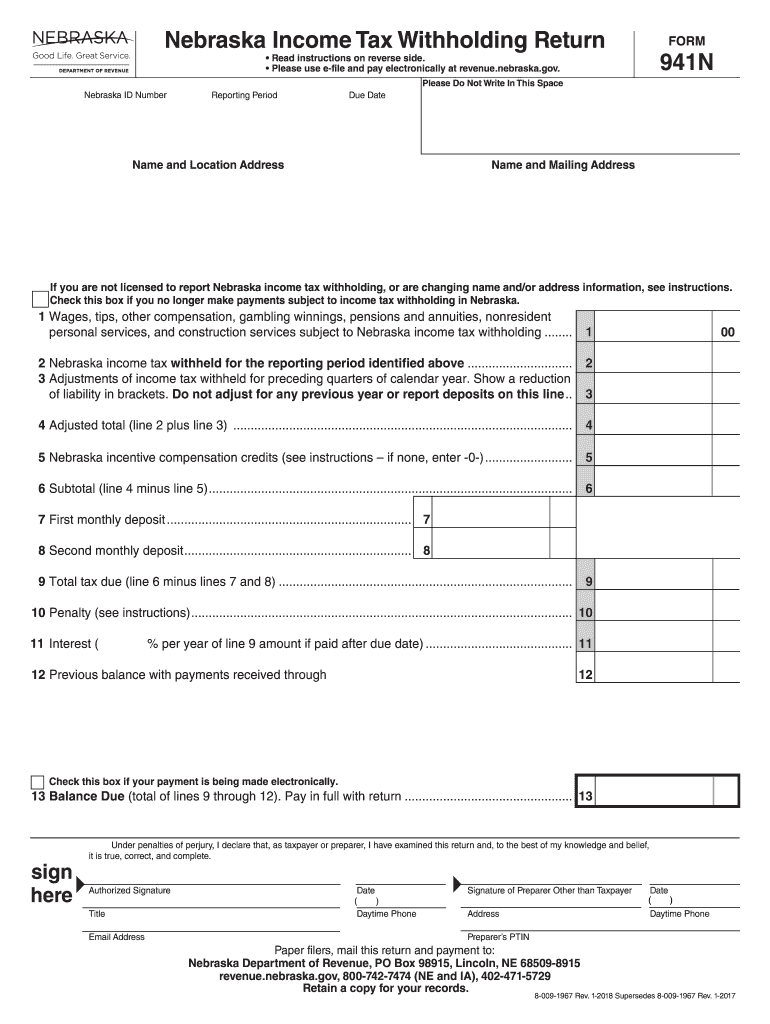

The 941n Fill In Form is an essential tax document utilized by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is specifically tailored for certain employers who are not required to file the standard Form 941. Understanding the purpose and requirements of the 941n Fill In Form is crucial for ensuring compliance with federal tax regulations.

How to use the 941n Fill In Form

Using the 941n Fill In Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial records, including employee wages and tax withholdings. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, review it for any errors or omissions. Finally, submit the form according to the guidelines set forth by the IRS, either electronically or via mail.

Steps to complete the 941n Fill In Form

Completing the 941n Fill In Form requires attention to detail. Follow these steps for successful completion:

- Gather employee wage information and tax withholding details.

- Fill out the form, starting with the employer's identification information.

- Report total wages paid, taxes withheld, and any adjustments needed.

- Double-check all entries for accuracy.

- Sign and date the form to validate it before submission.

Legal use of the 941n Fill In Form

The 941n Fill In Form is legally recognized as a valid document for reporting tax information when completed according to IRS guidelines. To ensure its legal standing, it must be filled out accurately and submitted by the designated deadlines. Additionally, employers should maintain copies of the completed forms for their records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the 941n Fill In Form are critical for compliance. Typically, the form must be submitted quarterly, with specific due dates falling on the last day of the month following the end of each quarter. For example, the deadlines for the first, second, third, and fourth quarters are April 30, July 31, October 31, and January 31, respectively. Staying informed about these dates helps avoid penalties and ensures timely reporting.

Form Submission Methods (Online / Mail / In-Person)

The 941n Fill In Form can be submitted through various methods to accommodate different preferences. Employers may choose to file the form electronically using IRS-approved e-filing software, which often streamlines the process and provides immediate confirmation. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submissions are generally not available for this form, making electronic and mail options the most viable choices.

Quick guide on how to complete 941n fill in form

Effortlessly Prepare 941n Fill In Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage 941n Fill In Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 941n Fill In Form without hassle

- Obtain 941n Fill In Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this function.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign 941n Fill In Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941n fill in form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941n Fill In Form and how can airSlate SignNow assist with it?

The 941n Fill In Form is a document used by employers to report income taxes withheld and payroll taxes. airSlate SignNow streamlines the process by allowing users to easily fill in, sign, and send the 941n Fill In Form electronically, ensuring efficient and secure document management.

-

Is there a cost associated with using airSlate SignNow for the 941n Fill In Form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. The cost for using airSlate SignNow to manage the 941n Fill In Form is competitive, providing great value with features that enhance productivity and document security.

-

What features does airSlate SignNow offer for filling out the 941n Fill In Form?

airSlate SignNow provides features like an intuitive form builder, electronic signatures, and document tracking to help users efficiently handle the 941n Fill In Form. These tools simplify the process, reduce paperwork, and ensure compliance with legal standards.

-

How does airSlate SignNow enhance the signing process for the 941n Fill In Form?

With airSlate SignNow, the signing process for the 941n Fill In Form is quick and hassle-free. Users can invite signers, track their progress, and receive instant notifications once the document is signed, ensuring that your payroll reporting is timely and accurate.

-

Can I integrate airSlate SignNow with other applications for managing the 941n Fill In Form?

Yes, airSlate SignNow offers robust integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This connectivity allows users to seamlessly manage the 941n Fill In Form alongside their other business processes.

-

What benefits can businesses experience when using airSlate SignNow for the 941n Fill In Form?

Businesses can benefit from increased efficiency, reduced paperwork, and enhanced security when using airSlate SignNow for the 941n Fill In Form. The platform minimizes errors and supports compliance, thereby streamlining overall operations.

-

How secure is the data when using airSlate SignNow to handle the 941n Fill In Form?

airSlate SignNow prioritizes data security with encryption and secure cloud storage. When using airSlate SignNow for the 941n Fill In Form, businesses can trust that their sensitive information is protected against unauthorized access.

Get more for 941n Fill In Form

Find out other 941n Fill In Form

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement