Ar941pt Form

What is the ar941pt?

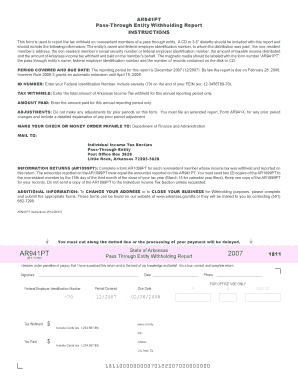

The ar941pt is a tax form used in Arkansas for reporting and remitting state income tax withheld from employees' wages. This form is essential for employers to ensure compliance with state tax laws and to provide accurate information to the Arkansas Department of Finance and Administration. The ar941pt form captures details about the total wages paid, the amount of state income tax withheld, and any adjustments necessary for accurate reporting. It is crucial for maintaining proper records and fulfilling tax obligations.

Steps to complete the ar941pt

Completing the ar941pt involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the reporting period. This includes total wages paid to employees and the corresponding state income tax withheld. Next, accurately fill out each section of the form, ensuring that all figures are correct. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties. Keeping a copy for your records is also advisable.

Legal use of the ar941pt

The ar941pt must be used in accordance with Arkansas state tax laws. It serves as a legal document for reporting withheld income taxes, and it is essential for employers to use the form correctly to avoid legal repercussions. The information provided on the form must be accurate and reflect true payroll data. Failure to comply with the legal requirements associated with the ar941pt can result in penalties, including fines or audits by the Arkansas Department of Finance and Administration.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the ar941pt to ensure compliance with state regulations. The form is typically due on a quarterly basis, with deadlines set for the last day of the month following the end of each quarter. For example, the deadlines for the 2023 tax year are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 of the following year for the fourth quarter. It is essential to submit the form on time to avoid any penalties.

Required Documents

To complete the ar941pt, employers need to gather several key documents. These include payroll records that detail total wages paid to employees during the reporting period and the amount of state income tax withheld. Additionally, employers should have records of any adjustments or corrections made during the reporting period. Having these documents readily available ensures a smooth and accurate completion of the form.

Who Issues the Form

The ar941pt is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for collecting income taxes and ensuring compliance with tax laws in Arkansas. Employers can obtain the ar941pt from the department's official website or through their local tax office. It is important for employers to use the most current version of the form to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete ar941pt

Accomplish Ar941pt effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and without hold-ups. Handle Ar941pt on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ar941pt with ease

- Locate Ar941pt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Ar941pt and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar941pt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ar941pt?

airSlate SignNow is a powerful platform designed to facilitate the sending and electronic signing of documents. The specific functionality related to ar941pt allows users to efficiently manage document workflows. It ensures that all necessary documents are signed, stored, and retrieved effortlessly.

-

How much does it cost to use airSlate SignNow with features like ar941pt?

airSlate SignNow offers a range of pricing plans that include features like ar941pt. Pricing varies based on user needs and company size, providing both basic and professional plans. Most businesses find that the cost is competitive, especially considering the efficiency it brings to document management.

-

What key features does airSlate SignNow offer for ar941pt users?

For users of ar941pt, airSlate SignNow includes features such as customizable templates, audit trails, and real-time notifications. These features streamline the signing process and enhance document security. Additionally, the platform allows for multiple signature requests on a single document, increasing efficiency.

-

Can airSlate SignNow integrate with other tools alongside ar941pt?

Yes, airSlate SignNow offers extensive integration capabilities, allowing it to work seamlessly with various software applications. This includes integration with CRM and project management tools, maximizing the utility of ar941pt. Users can automate workflows and sync their data easily to enhance productivity.

-

What benefits does using airSlate SignNow with ar941pt provide for businesses?

Businesses that utilize airSlate SignNow with ar941pt experience improved workflow efficiency and reduced turnaround times for document signing. This solution minimizes the need for physical document processing, saving both time and resources. Moreover, it enhances compliance and security measures while maintaining user-friendly access.

-

Is airSlate SignNow secure when using it for ar941pt signing?

Absolutely, airSlate SignNow prioritizes security with its ar941pt functionality. The platform employs advanced encryption protocols to ensure that your documents and signatures are protected. Additionally, it adheres to industry standards and regulations, providing peace of mind for businesses.

-

How can I get support for airSlate SignNow related to ar941pt?

Support for airSlate SignNow users utilizing ar941pt is readily available through multiple channels. You can access comprehensive online documentation, FAQs, and tutorials directly on the website. For personalized assistance, the support team is signNowable via email, chat, or phone during business hours.

Get more for Ar941pt

- Form bcal 3704 afc download fillable pdf or fill online

- Medical clearance request child care licensing form

- Reg 44 report of adoption form

- Self declaration form spicejet

- Child care certificate care 4 kids form

- Care4kids form

- Youth football registration form

- I believe that i am entitled to exemption from form

Find out other Ar941pt

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF