F1040se Form Irs

What is the F1040se Form IRS

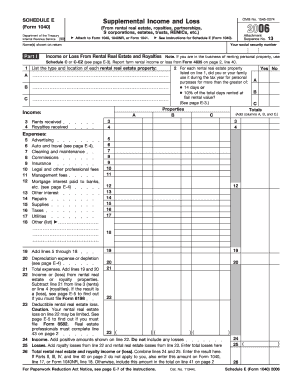

The F1040se form is a simplified tax return form used by self-employed individuals to report their income and calculate self-employment tax. This form is specifically designed for those who earn income from self-employment, allowing them to efficiently report their earnings to the IRS. The F1040se is part of the U.S. federal tax system and is crucial for ensuring compliance with tax obligations for self-employed individuals.

How to use the F1040se Form IRS

To use the F1040se form, individuals must first gather all necessary financial information related to their self-employment income. This includes records of earnings, expenses, and any other relevant financial documentation. Once the information is collected, the form can be filled out, detailing income sources and calculating the self-employment tax owed. It is essential to ensure accuracy in reporting to avoid potential issues with the IRS.

Steps to complete the F1040se Form IRS

Completing the F1040se form involves several key steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Fill out personal identification information at the top of the form.

- Report all self-employment income in the designated section.

- Calculate allowable deductions for business expenses.

- Determine the self-employment tax owed based on the reported income.

- Review the completed form for accuracy before submission.

Legal use of the F1040se Form IRS

The F1040se form is legally recognized by the IRS as a valid means for self-employed individuals to report their earnings and calculate taxes. To ensure legal compliance, it is important to adhere to IRS guidelines when filling out the form. This includes accurate reporting of income and expenses, as well as timely submission to avoid penalties. Utilizing electronic signing solutions can enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the F1040se form typically align with the general tax filing deadlines in the United States. Self-employed individuals are generally required to file their taxes by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The F1040se form can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using tax software, which often simplifies the process.

- Mail: The form can be printed and sent to the IRS via postal service. Ensure that it is sent to the correct address based on the state of residence.

- In-Person: Some individuals may opt to deliver their forms in person at local IRS offices, although this method is less common.

Quick guide on how to complete f1040se form irs

Complete F1040se Form Irs easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage F1040se Form Irs on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign F1040se Form Irs effortlessly

- Obtain F1040se Form Irs and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign F1040se Form Irs and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1040se form irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f1040se form and how does airSlate SignNow assist with it?

The f1040se form is used for reporting self-employment income in the United States. airSlate SignNow streamlines the eSigning process for f1040se forms, allowing you to collect signatures efficiently and securely online. This eliminates the need for paper forms and speeds up your filing process.

-

How much does airSlate SignNow cost for eSigning the f1040se?

airSlate SignNow offers pricing plans that are cost-effective and tailored to different business needs. Depending on the plan you choose, accessing features for eSigning the f1040se can be budget-friendly. You can check our website for detailed pricing options.

-

What features does airSlate SignNow provide for managing the f1040se?

With airSlate SignNow, you get features like document templates, automated workflows, and real-time tracking for your f1040se forms. These tools help you manage your documents efficiently and ensure that all signatures are collected in a timely manner.

-

Can I integrate airSlate SignNow with other applications for handling the f1040se?

Yes, airSlate SignNow offers integrations with various applications such as CRM systems, cloud storage, and accounting software that may be necessary for managing the f1040se form. These integrations help create a smooth workflow, allowing you to sync data and documents effortlessly.

-

What are the benefits of using airSlate SignNow for the f1040se form?

Using airSlate SignNow for your f1040se form enhances efficiency and reduces the time spent on paperwork. The platform ensures document security and compliance, allowing you to manage tax documents with peace of mind. Overall, it simplifies the eSigning process, making it user-friendly and accessible.

-

Is airSlate SignNow compliant with the regulations for the f1040se?

Absolutely! airSlate SignNow adheres to industry standards and regulations for eSigning, making it compliant with the requirements for the f1040se. This compliance ensures that your signed documents hold legal validity and are accepted by tax authorities.

-

How secure is my data when using airSlate SignNow for the f1040se?

airSlate SignNow prioritizes data security by implementing advanced encryption protocols to protect your information when eSigning the f1040se form. You can have confidence that your sensitive information is safeguarded against unauthorized access.

Get more for F1040se Form Irs

Find out other F1040se Form Irs

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form