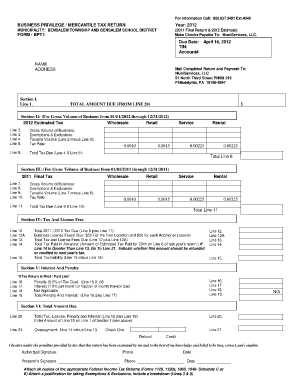

Bensalem Township Business Privilege Tax Form

What is the Bensalem Township Business Privilege Tax

The Bensalem Township Business Privilege Tax (BPT) is a local tax levied on businesses operating within the township. This tax is based on the gross receipts of a business, meaning that the amount owed is directly related to the revenue generated by the business activities conducted in the area. The BPT is designed to fund local services and infrastructure, ensuring that businesses contribute to the community in which they operate.

Steps to complete the Bensalem Township Business Privilege Tax

Completing the Bensalem Township Business Privilege Tax involves several key steps to ensure compliance and accuracy. First, businesses must gather all relevant financial information, including total gross receipts for the reporting period. Next, they should obtain the appropriate tax form, which can typically be found on the Bensalem Township website or through local government offices. After filling out the form, businesses must calculate the tax owed based on the established rates. Finally, the completed form, along with any payment, should be submitted to the township by the specified deadline.

Required Documents

To successfully file the Bensalem Township Business Privilege Tax, businesses need to prepare several documents. These typically include:

- Gross receipts statements for the reporting period.

- Completed BPT tax form.

- Payment method details, such as a check or electronic payment confirmation.

Having these documents ready will streamline the filing process and help ensure compliance with local regulations.

Penalties for Non-Compliance

Failure to comply with the Bensalem Township Business Privilege Tax requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to filing deadlines and ensure accurate reporting to avoid these consequences. Understanding the implications of non-compliance can help businesses maintain good standing within the community.

Form Submission Methods

Businesses can submit their Bensalem Township Business Privilege Tax forms through various methods. Options typically include:

- Online submission via the township's official website.

- Mailing the completed form to the designated tax office.

- In-person submission at local government offices.

Each method has its own set of guidelines and deadlines, so it is important for businesses to choose the one that best fits their needs and ensures timely compliance.

Eligibility Criteria

To be subject to the Bensalem Township Business Privilege Tax, businesses must meet specific eligibility criteria. Generally, any business entity operating within the township and generating gross receipts is required to file and pay the tax. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Understanding these criteria is essential for businesses to determine their tax obligations accurately.

Quick guide on how to complete bensalem business privilege tax

Complete bensalem business privilege tax effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle bensalem business privilege tax on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign bensalem bpt with ease

- Find bensalem business privilege and mercantile tax return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal value as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign bensalem township business privilege tax and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to bensalem business privilege tax

Create this form in 5 minutes!

How to create an eSignature for the bensalem bpt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask bensalem township business privilege tax

-

What is Bensalem BPT and how can airSlate SignNow help my business?

Bensalem BPT refers to Business Process Transformation initiatives specific to the Bensalem area. airSlate SignNow enhances this transformation by providing a seamless platform for electronic signatures and document management, enabling businesses in Bensalem to streamline their operations efficiently.

-

How much does airSlate SignNow cost for businesses in Bensalem?

The pricing for airSlate SignNow varies based on the features you need. For businesses in Bensalem BPT, we offer competitive pricing tiers that cater to small and large organizations alike, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for Bensalem BPT users?

airSlate SignNow offers various features like customizable templates, advanced security options, and automated workflow capabilities specifically designed for Bensalem BPT initiatives. These tools help businesses to efficiently collect signatures and manage documents with ease.

-

Can airSlate SignNow integrate with other tools commonly used in Bensalem?

Yes, airSlate SignNow can integrate seamlessly with various software tools that businesses in Bensalem BPT frequently use, such as CRMs, project management software, and more, allowing for a streamlined workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for my business in Bensalem?

Utilizing airSlate SignNow offers numerous benefits, including faster turnaround times for document signing and increased security. For businesses engaged in Bensalem BPT, these advantages facilitate smoother transactions and enhance customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents in Bensalem?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents. This is especially critical for businesses in Bensalem BPT, where sensitive information needs to be safeguarded during the signing process.

-

How can I get started with airSlate SignNow for my Bensalem BPT project?

Getting started with airSlate SignNow for your Bensalem BPT project is straightforward. You can sign up for a free trial on our website, where you’ll find resources and support to help you implement the solution effectively in no time.

Get more for bensalem business privilege tax

- Know all men by these presents that i for and in consideration form

- Before the mississippi workers compensation commission form

- Mississippi wc law anderson crawley ampamp burke pllc form

- Compilation of the rules of the mississippi workers form

- General rule 1 mississippi workers compensation commission form

- Mwcc no mississippi workers compensation commission form

- Mississippi workers compensation commission form

- Child and spousal support liens placed upon workers form

Find out other bensalem bpt

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney