Form 8911 Instructions

What is the Form 8911 Instructions

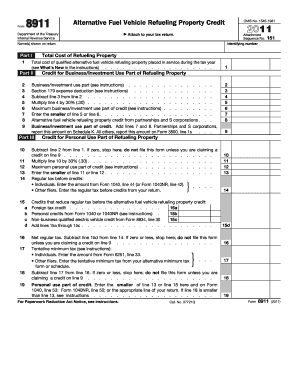

The Form 8911 instructions provide detailed guidance on how to complete the IRS Form 8911, which is used to claim a credit for the alternative fuel vehicle refueling property. This form is essential for businesses and individuals who have invested in alternative fuel infrastructure and wish to benefit from tax credits. Understanding these instructions is crucial for ensuring accurate completion and compliance with IRS regulations.

Steps to complete the Form 8911 Instructions

Completing the Form 8911 involves several key steps that ensure accurate reporting and compliance. The process typically includes:

- Gathering necessary documentation, such as purchase receipts and installation costs.

- Filling out the form with accurate information regarding the property and the credit being claimed.

- Reviewing the completed form for errors or omissions.

- Submitting the form along with your tax return to the IRS.

Each step is important to avoid delays or issues with your tax credit claim.

Legal use of the Form 8911 Instructions

The legal use of the Form 8911 instructions ensures that taxpayers comply with IRS regulations while claiming tax credits. It is important to follow the guidelines precisely, as improper use could lead to penalties or denial of the credit. The instructions outline the eligibility criteria, required documentation, and the correct method of submission to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8911 are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the tax return due date, which is usually April fifteenth for individuals. However, if you are filing for an extension, it is essential to ensure that the form is included in your extended return. Staying aware of these dates helps avoid late penalties and ensures timely processing of your tax credits.

Required Documents

To complete the Form 8911 accurately, several documents are necessary. These may include:

- Receipts for the purchase and installation of alternative fuel vehicle refueling property.

- Documentation proving the property meets IRS requirements for the credit.

- Any prior tax returns if adjustments are being made.

Having these documents ready can streamline the completion process and support your claims.

Form Submission Methods (Online / Mail / In-Person)

The Form 8911 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through tax software that supports electronic filing.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may be limited.

Choosing the right submission method can affect processing times and the overall efficiency of your tax filing experience.

Quick guide on how to complete form 8911 instructions

Prepare Form 8911 Instructions effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form 8911 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Form 8911 Instructions with ease

- Obtain Form 8911 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Modify and eSign Form 8911 Instructions and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8911 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are form 8911 instructions?

Form 8911 instructions provide guidance on how to complete the IRS Form 8911, which is used to claim the alternative fuel vehicle refueling property credit. It's crucial to follow these instructions carefully to ensure that you fill out the form correctly and claim your credits effectively.

-

How can airSlate SignNow help with form 8911 instructions?

airSlate SignNow offers tools that allow users to electronically sign and send documents, including those with form 8911 instructions. This helps streamline the process and ensures that all documents are securely handled and accessible whenever needed.

-

Are there any costs associated with using airSlate SignNow for form 8911 instructions?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Each plan provides access to essential features, including templates for form 8911 instructions, making it a cost-effective solution for managing your documents.

-

What features does airSlate SignNow offer for handling form 8911 instructions?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and easy document sharing that help users efficiently manage their form 8911 instructions. These features ensure that you have everything you need to complete your forms accurately.

-

Can I integrate airSlate SignNow with other software for form 8911 instructions?

Absolutely! airSlate SignNow integrates seamlessly with popular software like Google Drive, Salesforce, and more, allowing you to access and share your form 8911 instructions easily. This ensures that your workflow remains efficient across all platforms.

-

Is there customer support available for questions about form 8911 instructions?

Yes, airSlate SignNow provides excellent customer support to assist users with questions regarding form 8911 instructions. Whether you have inquiries about the software or need help with specific questions, their team is ready to help.

-

Can I use airSlate SignNow for filing form 8911 with the IRS?

While airSlate SignNow streamlines the signing and sending of documents, it does not file form 8911 directly with the IRS. However, you can prepare your form 8911 instructions, obtain necessary signatures, and then file it through the IRS website.

Get more for Form 8911 Instructions

- Va form 21 4192 request for employment information in connection with claim for disability benefits

- Va form 26 6681 application for fee or roster

- Fillable online 02 3virginia tax fax email print pdffiller form

- 2021 form 763 virginia nonresident income tax return 2021 virginia nonresident income tax return

- Agency information collection activity under omb review

- Va form 10 10hs request for hardship determination

- To the regional loan center form

- 2021 form 763s virginia special nonresident claim for individual income tax withheld

Find out other Form 8911 Instructions

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer