Form Gst Drc 14 Word Format

What is the Form Gst Drc 14 Word Format

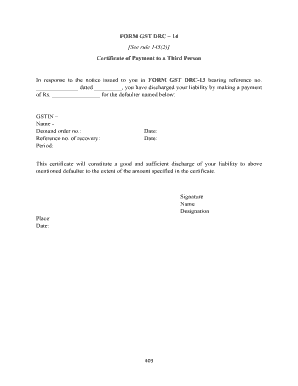

The Form Gst Drc 14 is a crucial document used in the context of Goods and Services Tax (GST) compliance. This form is primarily utilized by businesses to report and reconcile their GST transactions. The Word format of the form allows for easy editing and filling out of necessary information, ensuring that users can complete it efficiently. Understanding the structure and purpose of the gst drc 14 is essential for accurate GST reporting.

Steps to Complete the Form Gst Drc 14 Word Format

Completing the Form Gst Drc 14 in Word format involves several key steps:

- Download the form in Word format from a reliable source.

- Open the document and review the sections that require your information.

- Fill in the necessary details, including your business name, GST number, and transaction specifics.

- Ensure all calculations are accurate and comply with GST regulations.

- Save the completed form securely for your records.

Legal Use of the Form Gst Drc 14 Word Format

The legal validity of the Form Gst Drc 14 hinges on its proper completion and submission. When filled out electronically, the form must meet specific legal standards to be considered binding. Utilizing a reliable eSigning platform can enhance the legitimacy of your submission. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is vital for ensuring that your electronically signed document holds up in legal contexts.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form Gst Drc 14 can be done through various methods, depending on your preference and the requirements of your local tax authority:

- Online Submission: Many jurisdictions allow for electronic submission through official tax portals.

- Mail: You can print the completed form and send it via postal service to the relevant tax office.

- In-Person: Some businesses may prefer to submit the form directly at a local tax office.

Key Elements of the Form Gst Drc 14 Word Format

The Form Gst Drc 14 includes several critical elements that users must pay attention to:

- Business Information: Clear identification of the business entity, including name and GST registration number.

- Transaction Details: Accurate reporting of sales, purchases, and any adjustments related to GST.

- Signature Section: A designated area for the authorized signatory to confirm the accuracy of the information provided.

How to Obtain the Form Gst Drc 14 Word Format

The Form Gst Drc 14 in Word format can typically be obtained from official government websites or tax authority portals. It is important to ensure that you are downloading the most current version of the form to comply with the latest regulations. Additionally, some accounting software may offer the form as part of their template library, allowing for easier access and completion.

Quick guide on how to complete form gst drc 14 word format

Effortlessly prepare Form Gst Drc 14 Word Format on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without complications. Manage Form Gst Drc 14 Word Format on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form Gst Drc 14 Word Format effortlessly

- Locate Form Gst Drc 14 Word Format and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to record your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Gst Drc 14 Word Format and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form gst drc 14 word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DRC 14 in GST?

DRC 14 in GST refers to a specific form used for applying for a refund or re-credit of input tax credit under the Goods and Services Tax system in India. This form is essential for businesses that have excess input tax credit and seek financial adjustments. Understanding DRC 14 in GST can help streamline your tax processes and improve cash flow.

-

How can airSlate SignNow help with DRC 14 in GST?

airSlate SignNow simplifies the process of preparing and sending documents related to DRC 14 in GST. Our platform allows you to securely e-sign financial documents and ensure compliance with GST regulations easily. This reduces the time spent on paperwork, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for DRC 14 in GST documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for managing DRC 14 in GST-related paperwork. Our pricing is designed to be cost-effective while providing comprehensive solutions for document management and e-signatures. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for managing DRC 14 in GST documents?

airSlate SignNow offers features tailored for managing DRC 14 in GST documents, including secure e-signatures, document templates, and audit trails. These tools ensure that your documents are legally compliant and easily accessible. Moreover, the user-friendly interface simplifies the document preparation process, making it efficient.

-

Can airSlate SignNow integrate with existing accounting software for DRC 14 in GST?

Yes, airSlate SignNow supports integrations with various accounting software, which can facilitate smoother processing of DRC 14 in GST documents. By connecting your accounting systems, you can automatically manage input tax credits and refunds more effectively. This integration ensures that your financial data remains coordinated and accurate.

-

What are the benefits of using airSlate SignNow for DRC 14 in GST?

Using airSlate SignNow for DRC 14 in GST provides several benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our solution reduces the time spent on preparing and signing documents, enabling faster processing of refunds. This results in better cash flow management for your business.

-

Is airSlate SignNow secure for handling DRC 14 in GST documents?

Absolutely, airSlate SignNow prioritizes security and compliance while handling DRC 14 in GST documents. Our platform uses encryption and secure cloud storage to protect your sensitive information. You can trust us to provide a secure environment for managing your important tax-related documents.

Get more for Form Gst Drc 14 Word Format

Find out other Form Gst Drc 14 Word Format

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template