Penfed Hardship Application Form

What is the Penfed Hardship Application

The Penfed hardship application is a formal request submitted to Pentagon Federal Credit Union (Penfed) for assistance during financial difficulties. This application allows members to seek relief options, such as deferment of payments or loan modifications. It is designed to help individuals manage their financial obligations when facing unexpected hardships, such as job loss, medical emergencies, or other significant life changes. Understanding the purpose and implications of this application is crucial for members seeking financial support.

Steps to Complete the Penfed Hardship Application

Completing the Penfed hardship application involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any relevant correspondence. Next, access the application form through the Penfed website or by contacting customer service. Fill out the form with accurate information, detailing your financial situation and the reasons for your hardship. After completing the application, review it for completeness and accuracy before submitting it online or via mail. Keeping a copy for your records is advisable.

Legal Use of the Penfed Hardship Application

The legal use of the Penfed hardship application is grounded in its compliance with federal and state regulations. When submitted correctly, the application serves as a binding document that can facilitate financial relief. It is essential to provide truthful and complete information, as any discrepancies may lead to denial of the request or potential legal consequences. Using a secure platform for submission, such as e-signature services, can enhance the legal standing of the application by ensuring that it meets electronic signature regulations.

Eligibility Criteria

Eligibility for the Penfed hardship application typically requires members to demonstrate a genuine financial need. This may include criteria such as loss of employment, significant medical expenses, or other unforeseen financial burdens. Members must provide documentation supporting their claims, including pay stubs, medical bills, or termination letters. It is crucial to check with Penfed for specific eligibility requirements, as they may vary based on individual circumstances and the type of assistance requested.

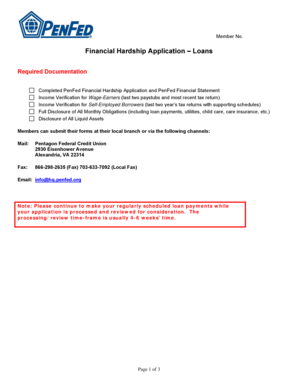

Required Documents

When applying for the Penfed hardship application, certain documents are generally required to substantiate your financial situation. These may include:

- Proof of income (recent pay stubs or tax returns)

- Documentation of expenses (bills, mortgage statements)

- Evidence of hardship (termination letters, medical records)

- Any other relevant financial information that supports your application

Gathering these documents in advance can streamline the application process and improve the chances of approval.

Form Submission Methods

The Penfed hardship application can be submitted through various methods to accommodate member preferences. Options typically include:

- Online submission via the Penfed website, which allows for a quick and secure process

- Mailing the completed application to the designated Penfed address

- In-person submission at a local Penfed branch for those who prefer face-to-face assistance

Choosing the right submission method can depend on individual circumstances and the urgency of the financial situation.

Quick guide on how to complete penfed hardship application

Prepare Penfed Hardship Application effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Penfed Hardship Application on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Penfed Hardship Application with ease

- Locate Penfed Hardship Application and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Edit and eSign Penfed Hardship Application to maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the penfed hardship application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PenFed hardship application?

The PenFed hardship application is a financial relief option that allows members to request assistance during difficult times. By submitting this application, you can gain access to financial support that may help reduce the burden of unexpected expenses.

-

How can airSlate SignNow assist with the PenFed hardship application process?

AirSlate SignNow streamlines the process of submitting your PenFed hardship application by allowing you to electronically sign and send documents with ease. This ensures that your application is submitted quickly and securely, making it more convenient for you.

-

Are there any fees associated with the PenFed hardship application?

There are no direct fees associated with submitting the PenFed hardship application itself. However, it's essential to review specific conditions and any applicable terms from PenFed regarding potential charges after approval.

-

What documents do I need to submit the PenFed hardship application?

To complete the PenFed hardship application, you typically need to provide personal identification and details outlining your financial situation. Using airSlate SignNow, you can easily upload and manage these documents to ensure your application is complete.

-

How long does the PenFed hardship application take to process?

The processing time for a PenFed hardship application can vary depending on the specifics of your situation. Generally, once submitted through airSlate SignNow, you can expect a response within a few business days regarding your application status.

-

Can I track the status of my PenFed hardship application?

Yes, once you submit your PenFed hardship application via airSlate SignNow, you’ll be able to track its status. This feature allows you to stay informed and manage any follow-up actions that may be necessary.

-

What benefits does the airSlate SignNow platform provide for the PenFed hardship application?

The airSlate SignNow platform offers a user-friendly interface for submitting the PenFed hardship application, ensuring a seamless experience. With electronic signing and document management tools, you can complete the process efficiently and securely.

Get more for Penfed Hardship Application

- How to download degree marks memo form

- Rsp form pdf download

- Premium receipt form

- Pmm sample background check authorization form doc 00312588 doc1 southside

- Bcivil caseb file bcover sheetb 9th judicial district court form

- Dr form 200 erie county public defender 220 columbus

- Al arm p erm i t app l ic a ti o n form

- Backflow prevention assembly test report doc form

Find out other Penfed Hardship Application

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile