Rut 6 Form

What is the Rut 6

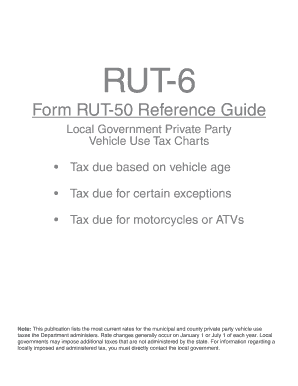

The Rut 6 is a specific form used in Illinois for reporting and documenting certain transactions. It is particularly relevant for individuals and businesses involved in private party transactions. The form helps ensure compliance with state regulations and facilitates accurate record-keeping. Understanding the Rut 6 is essential for those who engage in activities that require formal documentation, as it serves as a legal instrument in various contexts.

How to use the Rut 6

Using the Rut 6 involves several straightforward steps. First, gather all necessary information related to the transaction. This includes details about the parties involved, the nature of the transaction, and any relevant dates. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays or issues. Once completed, the Rut 6 can be submitted electronically or via traditional mail, depending on the requirements of the specific transaction.

Steps to complete the Rut 6

Completing the Rut 6 requires careful attention to detail. Follow these steps for successful submission:

- Collect all necessary documentation related to the transaction.

- Fill out the Rut 6 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form through the appropriate channel, whether online or by mail.

Legal use of the Rut 6

The Rut 6 is legally binding when completed correctly and submitted in accordance with state regulations. It is important to understand the legal implications of the form, as it serves as proof of the transaction and can be referenced in legal matters. Compliance with all relevant laws ensures that the Rut 6 holds up in court and protects the interests of all parties involved.

State-specific rules for the Rut 6

Each state may have specific rules governing the use of the Rut 6. In Illinois, it is crucial to understand the local regulations that apply to private party transactions. This includes knowing any deadlines for submission, required signatures, and additional documentation that may be necessary. Familiarizing oneself with these state-specific rules can prevent complications and ensure compliance.

Form Submission Methods

The Rut 6 can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via an approved electronic platform.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at designated locations, if applicable.

Examples of using the Rut 6

The Rut 6 is commonly used in various scenarios, such as:

- Documenting the sale of a vehicle between private parties.

- Recording the transfer of property ownership.

- Formalizing agreements in business transactions.

These examples illustrate the versatility of the Rut 6 in facilitating legal and transparent transactions in Illinois.

Quick guide on how to complete rut 6

Finalize Rut 6 seamlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Rut 6 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Rut 6 effortlessly

- Locate Rut 6 and click Get Form to initiate.

- Leverage the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Rut 6 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rut 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rut 6 in the context of airSlate SignNow?

Rut 6 refers to a specific functionality within airSlate SignNow that allows users to streamline document signing processes efficiently. Understanding rut 6 can help businesses optimize their workflow and enhance productivity.

-

How can airSlate SignNow with rut 6 improve my document workflow?

By implementing rut 6, airSlate SignNow enhances your document workflow through automated eSigning, real-time tracking, and easier collaboration. This leads to faster sign-off times and reduced administrative costs.

-

What are the pricing options for airSlate SignNow that includes rut 6 features?

AirSlate SignNow offers flexible pricing plans that incorporate rut 6 features to suit different business needs. These plans are designed to be cost-effective while providing access to all essential eSigning functionalities.

-

Does airSlate SignNow support integrations with other applications for rut 6?

Yes, airSlate SignNow supports various integrations with popular applications, enhancing the capabilities of rut 6. This ensures that your document management processes are seamlessly connected with your existing software solutions.

-

What are the key benefits of using rut 6 in airSlate SignNow?

The key benefits of using rut 6 in airSlate SignNow include increased efficiency, reduced paper usage, and enhanced security measures. These advantages help streamline business operations and improve overall productivity.

-

How secure is the eSigning process with rut 6 in airSlate SignNow?

Security is paramount in the eSigning process with rut 6 in airSlate SignNow. The platform employs advanced encryption protocols and complies with industry standards to protect your sensitive data during transactions.

-

Can I use rut 6 for mobile document signing?

Absolutely! Rut 6 in airSlate SignNow is optimized for mobile devices, allowing users to send and sign documents from anywhere. This flexibility increases accessibility and convenience for busy professionals.

Get more for Rut 6

Find out other Rut 6

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself