One America Rollover Form

What is the One America Rollover Form

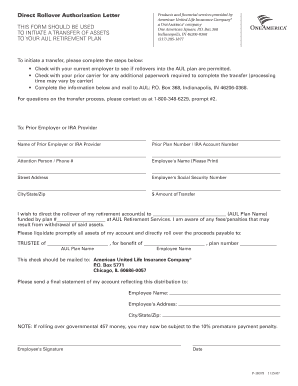

The One America Rollover Form is a crucial document used by individuals who wish to transfer their retirement savings from one account to another, typically from a 401(k) plan to an Individual Retirement Account (IRA) or another qualified retirement plan. This form facilitates the process of rolling over funds while ensuring compliance with IRS regulations. It is essential for maintaining the tax-deferred status of the retirement funds during the transfer process.

How to use the One America Rollover Form

Using the One America Rollover Form involves several straightforward steps. First, you need to obtain the form, which can often be downloaded from the One America website or requested through customer service. After obtaining the form, carefully fill out the required information, including your personal details and the specifics of the rollover. Ensure that you provide accurate account information for both the source and destination accounts. Once completed, review the form for any errors before submitting it according to the provided instructions.

Required Documents

When completing the One America Rollover Form, certain documents may be required to verify your identity and the accounts involved in the rollover. Commonly required documents include:

- A copy of your identification, such as a driver's license or passport.

- Statements from your current retirement account showing the balance and account details.

- Any additional forms or documentation requested by One America to process your rollover.

Having these documents ready can expedite the process and ensure compliance with all necessary requirements.

Form Submission Methods

The One America Rollover Form can be submitted through various methods, providing flexibility for users. The available submission methods typically include:

- Online Submission: Many users prefer to submit the form electronically through the One America website, ensuring a quicker processing time.

- Mail: If you choose to submit the form by mail, ensure that you send it to the correct address provided on the form to avoid delays.

- In-Person: Some individuals may opt to deliver the form in person at a One America office, which can also provide an opportunity to ask questions directly.

Eligibility Criteria

To utilize the One America Rollover Form, you must meet specific eligibility criteria. Generally, these criteria include:

- Being a participant in a qualified retirement plan, such as a 401(k) or similar employer-sponsored plan.

- Having a vested balance in your retirement account that you wish to roll over.

- Meeting any age or employment status requirements set by your current retirement plan and the receiving institution.

It is important to verify your eligibility before initiating the rollover process to ensure compliance with all applicable regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding rollovers to ensure that individuals do not incur unnecessary taxes or penalties. Key points include:

- Funds must be rolled over within sixty days of distribution to avoid tax implications.

- Direct rollovers, where funds are transferred directly between accounts, are generally tax-free.

- Consulting IRS publications or a tax advisor can provide additional clarity on rollover rules and implications.

Quick guide on how to complete one america rollover form

Complete One America Rollover Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without issues. Manage One America Rollover Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign One America Rollover Form effortlessly

- Find One America Rollover Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign One America Rollover Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the one america rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the one america 401k withdrawal form and why is it important?

The one america 401k withdrawal form is a document required to initiate the withdrawal process from your One America 401k plan. Completing this form is crucial, as it ensures that your request follows the proper guidelines and helps you access your funds efficiently.

-

How do I fill out the one america 401k withdrawal form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the one america 401k withdrawal form online. The platform allows you to enter your details, review the information for accuracy, and eSign the document, simplifying the submission process.

-

Are there any fees associated with using the one america 401k withdrawal form through airSlate SignNow?

While there may be fees associated with your 401k withdrawal itself, using airSlate SignNow to fill out and eSign the one america 401k withdrawal form is cost-effective. airSlate SignNow offers competitive pricing plans that can fit within your budget for document management.

-

What features does airSlate SignNow provide for the one america 401k withdrawal form?

airSlate SignNow equips users with features like templates, easy eSigning, and document storage specifically for forms like the one america 401k withdrawal form. These tools enhance user experience, ensuring a smooth document workflow.

-

Can airSlate SignNow help with other 401k forms aside from the one america 401k withdrawal form?

Yes, airSlate SignNow supports various 401k forms in addition to the one america 401k withdrawal form. This includes forms for contributions, loans, and beneficiary updates, making it a comprehensive solution for your retirement plan management.

-

Is it secure to use airSlate SignNow for the one america 401k withdrawal form?

Absolutely! airSlate SignNow employs advanced security measures to protect your information when completing the one america 401k withdrawal form. Your documents are encrypted, ensuring confidentiality and compliance with industry standards.

-

What integrations does airSlate SignNow offer for managing the one america 401k withdrawal form?

airSlate SignNow offers integrations with popular business applications to streamline your document management process, including for the one america 401k withdrawal form. These integrations enhance your ability to manage workflows and access important data across platforms.

Get more for One America Rollover Form

Find out other One America Rollover Form

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe