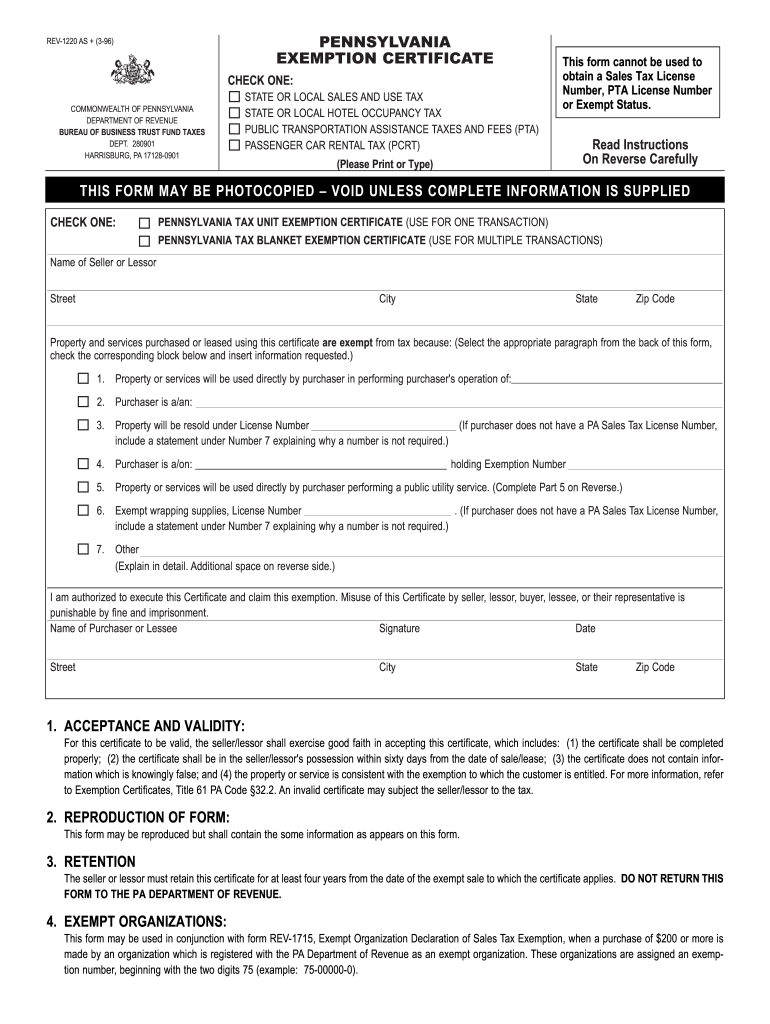

Pa Exemption Certificate Form 2020

What is the 1996 Revenue Rev 1220 Form?

The 1996 Revenue Rev 1220 form is a tax-related document used primarily for reporting certain types of income and expenses. This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It helps taxpayers accurately report their financial activities to the Internal Revenue Service (IRS), which is crucial for maintaining transparency and fulfilling tax obligations.

How to Use the 1996 Revenue Rev 1220 Form

Using the 1996 Revenue Rev 1220 form involves several steps. First, gather all necessary financial documents, such as income statements and receipts for deductible expenses. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the specific instructions provided by the IRS for this form, as errors can lead to delays or penalties. Once completed, submit the form to the appropriate IRS office by the required deadline.

Steps to Complete the 1996 Revenue Rev 1220 Form

Completing the 1996 Revenue Rev 1220 form requires attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Then, report your income sources, detailing amounts earned from various activities. Next, list any applicable deductions, ensuring you have documentation to support each claim. Review the form for accuracy before signing and dating it. Finally, submit the form through the designated method, whether electronically or via mail.

Legal Use of the 1996 Revenue Rev 1220 Form

The legal use of the 1996 Revenue Rev 1220 form is governed by IRS regulations. This form must be completed truthfully and accurately to avoid potential legal issues. Misrepresentation of information can lead to audits, fines, or other penalties. It is crucial to understand the legal implications of submitting this form and to maintain records that support the information reported.

Filing Deadlines / Important Dates

Filing deadlines for the 1996 Revenue Rev 1220 form are typically aligned with the annual tax filing schedule. Taxpayers should be aware of the specific dates set by the IRS, as late submissions may incur penalties. It is advisable to mark these deadlines on your calendar and plan to complete the form well in advance to avoid last-minute issues.

Required Documents

To accurately complete the 1996 Revenue Rev 1220 form, several documents are necessary. These include income statements, such as W-2s or 1099s, receipts for deductible expenses, and any other relevant financial records. Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Eligibility Criteria

Eligibility to use the 1996 Revenue Rev 1220 form typically depends on the type of income being reported and the taxpayer's filing status. Individuals and businesses that meet specific income thresholds or engage in particular activities may be required to use this form. It is important to review IRS guidelines to determine if you qualify for its use and to ensure accurate reporting of your financial information.

Quick guide on how to complete pa exemption certificate 1996 form

Handle Pa Exemption Certificate Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents seamlessly. Manage Pa Exemption Certificate Form on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related processes today.

How to modify and electronically sign Pa Exemption Certificate Form with ease

- Find Pa Exemption Certificate Form and click on Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Pa Exemption Certificate Form to ensure clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa exemption certificate 1996 form

Create this form in 5 minutes!

How to create an eSignature for the pa exemption certificate 1996 form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the importance of 1996 revenue rev 1220 for my business?

The 1996 revenue rev 1220 relates to tax compliance and revenue reporting, which is crucial for businesses to ensure they meet regulatory requirements. Understanding this revenue designation helps organizations accurately assess their financial standing and adhere to legal obligations.

-

How can airSlate SignNow assist with 1996 revenue rev 1220 documentation?

With airSlate SignNow, you can seamlessly prepare, send, and eSign documents related to the 1996 revenue rev 1220, enhancing your business's efficiency. Our platform simplifies the documentation process, making it easy to manage important tax-related documents.

-

Are there any costs associated with using airSlate SignNow for 1996 revenue rev 1220?

airSlate SignNow offers various pricing plans to suit different business needs. By exploring our pricing options, you can find a cost-effective solution to manage all 1996 revenue rev 1220 related documentation without breaking the bank.

-

What features does airSlate SignNow offer for handling 1996 revenue rev 1220 forms?

Our platform includes features such as customizable templates, secure cloud storage, and automated workflows specifically designed for managing 1996 revenue rev 1220 forms. These functionalities help streamline your documentation process while ensuring compliance and security.

-

Can I integrate airSlate SignNow with my existing software for 1996 revenue rev 1220 management?

Yes, airSlate SignNow supports integrations with various software applications, allowing you to manage your 1996 revenue rev 1220 documentation alongside your other business tools. This flexibility ensures a synchronized experience and increases productivity.

-

Is airSlate SignNow user-friendly for those unfamiliar with 1996 revenue rev 1220?

Absolutely! airSlate SignNow provides an intuitive interface designed for users of all levels, making it easy to handle 1996 revenue rev 1220 documentation. Our comprehensive support resources further assist users in navigating the platform efficiently.

-

What benefits does airSlate SignNow provide for managing 1996 revenue rev 1220?

By utilizing airSlate SignNow, businesses can save time, reduce errors, and enhance compliance when handling 1996 revenue rev 1220. Our eSigning solution accelerates your workflow, empowering you to focus on core business activities.

Get more for Pa Exemption Certificate Form

Find out other Pa Exemption Certificate Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple