Pa 40 Form 2019

What is the Pa 40 Form

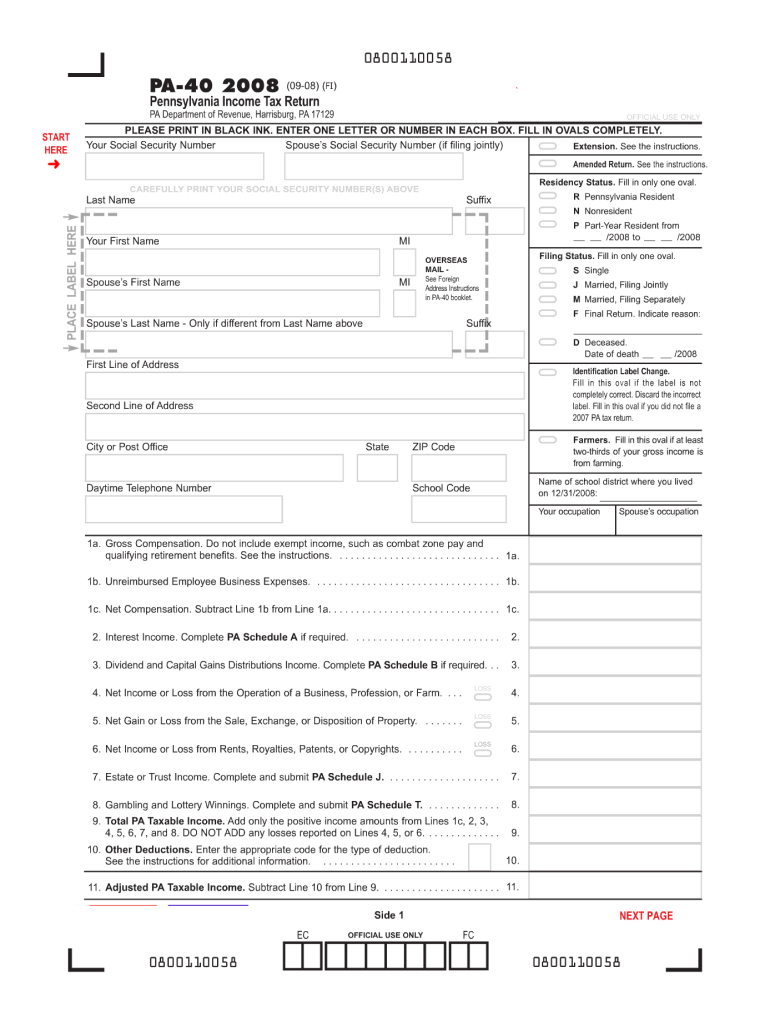

The Pa 40 Form is the Pennsylvania Personal Income Tax Return, used by residents of Pennsylvania to report their income and calculate their state tax obligations. This form is essential for individuals who earn income within the state, including wages, business income, and other sources of revenue. Filing the Pa 40 Form is a legal requirement for Pennsylvania residents, ensuring compliance with state tax laws.

How to use the Pa 40 Form

Using the Pa 40 Form involves several steps to accurately report your income and calculate your tax liability. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant deductions. Next, fill out the form with your personal information, income details, and any applicable credits or deductions. Once completed, you can submit the form either electronically or by mail, following the guidelines provided by the Pennsylvania Department of Revenue.

Steps to complete the Pa 40 Form

Completing the Pa 40 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents such as W-2 forms, 1099 forms, and receipts for deductions.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in the amounts listed.

- Calculate your total taxable income and apply any deductions or credits for which you qualify.

- Review the completed form for accuracy before submission.

- Submit the form electronically through the Pennsylvania Department of Revenue's online portal or by mailing a paper copy to the appropriate address.

Legal use of the Pa 40 Form

The legal use of the Pa 40 Form is governed by Pennsylvania tax law. It is crucial for individuals to file this form accurately and on time to avoid penalties. The form serves as a declaration of income and tax liability, and failure to comply with filing requirements can result in fines or legal action. Utilizing electronic filing options can enhance the security and efficiency of submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Pa 40 Form are typically aligned with federal tax deadlines. Generally, the form must be submitted by April 15 of each year for the previous tax year. If April 15 falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or specific extensions that may apply.

Required Documents

To complete the Pa 40 Form, several documents are required to ensure accurate reporting of income and deductions. These include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other relevant tax documents that reflect income or tax credits.

Form Submission Methods (Online / Mail / In-Person)

The Pa 40 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system, which is secure and efficient.

- Mailing a paper copy of the completed form to the designated address provided by the state.

- In-person submission at local tax offices, though this may require an appointment and adherence to local guidelines.

Quick guide on how to complete 2008 pa 40 form

Complete Pa 40 Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Pa 40 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Pa 40 Form with ease

- Obtain Pa 40 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign Pa 40 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 pa 40 form

Create this form in 5 minutes!

How to create an eSignature for the 2008 pa 40 form

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the Pa 40 Form used for?

The Pa 40 Form is a crucial document for Pennsylvania residents that serves as the state's income tax return. It is used to report an individual's income, calculate taxes owed, and apply for potential refunds. Understanding the Pa 40 Form is essential for accurate tax filing and compliance with state regulations.

-

How can airSlate SignNow help with the Pa 40 Form?

airSlate SignNow provides a streamlined solution for electronically signing and sending the Pa 40 Form. With our easy-to-use platform, users can quickly prepare and share their tax documents while ensuring a secure signing process. This feature not only saves time but also simplifies tax preparation and submission.

-

Is airSlate SignNow cost-effective for managing the Pa 40 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, making it a cost-effective solution for managing the Pa 40 Form. Our service eliminates additional costs associated with printing and mailing documents. With our competitive pricing, businesses can efficiently handle their tax forms without breaking the bank.

-

What features does airSlate SignNow offer for the Pa 40 Form?

airSlate SignNow includes features such as document templates, secure eSignatures, and cloud storage, all specifically designed to simplify the completion and submission of documents like the Pa 40 Form. Additionally, our platform allows for real-time tracking of document status, ensuring users stay informed throughout the process. These features enhance efficiency and reliability in handling important tax documents.

-

Can I integrate airSlate SignNow with other applications for the Pa 40 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when managing the Pa 40 Form. Whether you use accounting software, CRM systems, or other document management tools, our platform allows for easy data transfer and reduced manual entry. This integration helps streamline your overall tax preparation and filing process.

-

What benefits does using airSlate SignNow for the Pa 40 Form provide?

Using airSlate SignNow for the Pa 40 Form offers numerous benefits, including increased efficiency, reduced paper usage, and improved accuracy. Our eSignature technology minimizes the chances of errors and ensures compliance with legal requirements. These advantages contribute to a smoother, faster tax filing experience for individuals and businesses alike.

-

Is my data secure when using airSlate SignNow for the Pa 40 Form?

Yes, your data security is a top priority for airSlate SignNow. We implement advanced encryption and security protocols to protect your information when managing the Pa 40 Form. With our compliant practices, you can confidently handle sensitive documents knowing that your data is safe and secure.

Get more for Pa 40 Form

Find out other Pa 40 Form

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement