How to File a it 140 Form

What is the How To File A IT 140 Form

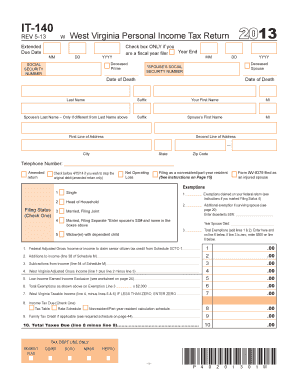

The IT 140 Form is a tax document used by residents of certain states to report income and calculate their state tax liability. This form is essential for ensuring compliance with state tax regulations and is typically required for individuals who earn income within the state. Understanding the purpose of the IT 140 Form is crucial for accurate tax filing and to avoid potential penalties.

Steps to complete the How To File A IT 140 Form

Completing the IT 140 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring you include all taxable earnings.

- Calculate your deductions and credits, which can reduce your taxable income.

- Determine your total tax liability based on the income reported and applicable tax rates.

- Review the form for accuracy before submission.

How to obtain the How To File A IT 140 Form

The IT 140 Form can be obtained through various channels. Most commonly, it is available on the official state tax department website. Alternatively, individuals can visit local tax offices or request a physical copy via mail. It's important to ensure that you are using the most current version of the form to comply with any recent tax law changes.

Legal use of the How To File A IT 140 Form

The IT 140 Form must be completed and submitted in accordance with state tax laws to be considered legally valid. This includes ensuring that all information provided is accurate and truthful. Falsifying information on the form can lead to severe penalties, including fines and potential criminal charges. Understanding the legal implications of filing this form is essential for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the IT 140 Form typically align with the federal tax filing dates. Most states require that the form be submitted by April fifteenth of each year. However, some states may have different deadlines or extensions available. It is crucial to check the specific deadlines for your state to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the IT 140 Form, each with its own advantages. Taxpayers can choose to file online through the state tax department’s website, which often provides a faster processing time. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has specific guidelines, so it is important to follow the instructions provided by the state tax authority.

Quick guide on how to complete how to file a it 140 form

Effortlessly prepare How To File A It 140 Form on any gadget

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle How To File A It 140 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign How To File A It 140 Form with ease

- Obtain How To File A It 140 Form and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details with functionalities that airSlate SignNow specifically provides for that purpose.

- Craft your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method to share your form, be it via email, SMS, or invite link, or download it to the computer.

Eliminate the stress of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in mere clicks from any device of your choice. Alter and eSign How To File A It 140 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file a it 140 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 140 Form?

The IT 140 Form is a tax form required by certain jurisdictions for the reporting of income and tax liabilities. Understanding how to file a IT 140 Form is crucial for compliance and accurate tax reporting. Users should ensure they have all relevant financial documents ready before starting the filing process.

-

How do I get started with airSlate SignNow for filing the IT 140 Form?

To get started with airSlate SignNow for filing the IT 140 Form, simply sign up for an account and navigate to our document creation section. Our intuitive platform walks you through the process, making it easy to upload and send your form for eSignature. With airSlate SignNow, you’ll find that learning how to file a IT 140 Form is straightforward and efficient.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. Each plan includes features essential for eSigning documents, including the IT 140 Form. Understanding how to file a IT 140 Form becomes even easier with our cost-effective subscriptions designed to maximize your productivity.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow boasts seamless integrations with many popular software solutions, including CRMs and cloud storage services. This functionality allows for greater flexibility when learning how to file a IT 140 Form, as you can manage your documents across various platforms. Integration enhances your workflow, making the filing process smoother and more efficient.

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow offers features like customizable templates, in-app notifications, and tracking capabilities to manage the signing process effectively. This makes it easier to understand how to file a IT 140 Form, as you can ensure all necessary parties review and sign the document promptly. Our features streamline your document management, saving you time and effort.

-

Is airSlate SignNow secure for filing sensitive forms like the IT 140 Form?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. When you learn how to file a IT 140 Form using our platform, you can be assured that your sensitive information is protected. We take your security seriously to provide peace of mind during the electronic signing process.

-

How can airSlate SignNow help speed up my document processing time?

airSlate SignNow enhances document processing time by enabling instant eSigning, automated workflows, and real-time notifications. This efficiency is particularly beneficial when you need to learn how to file a IT 140 Form quickly and without delays. With our solution, you can expedite your processes and reduce the time spent on paperwork.

Get more for How To File A It 140 Form

- Technical assessment ta summary form m00116 technical assessment ta summary form m00116

- J verification form

- Hit a thon pledge form

- Visiting my sponsored child world vision form

- Title transfer responsibility addendum to the ingramspark global print on demand agreement form

- Permission slip liability form archdiocese of galveston houston

- Incident report page 1 form

- Djsabam form

Find out other How To File A It 140 Form

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract