Et 2815 Form 2010

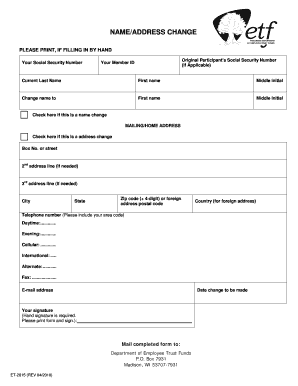

What is the Et 2815 Form

The Et 2815 Form is a specific document used for tax-related purposes in the United States. It is primarily utilized by individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and is often required for accurate tax filing. Understanding the purpose and requirements of the Et 2815 Form is crucial for taxpayers to avoid potential penalties and ensure their tax obligations are met.

How to use the Et 2815 Form

Using the Et 2815 Form involves several steps to ensure that all necessary information is accurately reported. First, gather all required financial documents, such as income statements and deductions. Next, fill out the form with the relevant details, ensuring that all information is complete and accurate. After completing the form, review it for any errors before submission. It is important to follow the specific guidelines provided by the IRS to ensure that the form is used correctly and effectively.

Steps to complete the Et 2815 Form

Completing the Et 2815 Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and previous tax returns.

- Access the Et 2815 Form, either online or in print.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income and any applicable deductions accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Et 2815 Form

The legal use of the Et 2815 Form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the specified deadlines. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is essential to understand the legal implications of using the form, as improper use can lead to serious consequences for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Et 2815 Form are crucial for compliance with tax laws. Typically, the form must be submitted by April 15 of each year, aligning with the standard tax filing deadline in the United States. However, specific circumstances, such as extensions or changes in tax law, may affect these dates. It is important to stay informed about any updates to filing deadlines to avoid late submissions and potential penalties.

Who Issues the Form

The Et 2815 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to fulfill their tax obligations. Understanding the role of the IRS in the issuance of the Et 2815 Form helps taxpayers navigate the complexities of tax compliance.

Quick guide on how to complete et 2815 form

Effortlessly Prepare Et 2815 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Et 2815 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Et 2815 Form with Ease

- Find Et 2815 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Et 2815 Form and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 2815 form

Create this form in 5 minutes!

How to create an eSignature for the et 2815 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Et 2815 Form and why is it important?

The Et 2815 Form is a tax form used for specific financial disclosures. Utilizing the Et 2815 Form is crucial for accurately reporting financial activities to comply with regulations and avoid penalties.

-

How can airSlate SignNow help me with the Et 2815 Form?

airSlate SignNow allows you to easily send, sign, and manage the Et 2815 Form digitally. This streamlined process ensures you can handle your tax documents securely and efficiently, reducing the risk of errors.

-

Is there a pricing plan for using airSlate SignNow for the Et 2815 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. You can choose a plan that suits your business requirements for managing and eSigning the Et 2815 Form and other documents.

-

What features does airSlate SignNow offer for the Et 2815 Form?

airSlate SignNow provides features like customizable templates, secure signing, and document tracking specifically for the Et 2815 Form. These features enhance efficiency and keep your data secure.

-

Can I integrate airSlate SignNow with other applications for the Et 2815 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, making it easy to manage the Et 2815 Form within your existing workflows.

-

What are the benefits of eSigning the Et 2815 Form with airSlate SignNow?

eSigning the Et 2815 Form with airSlate SignNow is convenient and saves time. It allows you to finalize documents quickly and securely, ensuring compliance and reducing the need for physical paperwork.

-

Is airSlate SignNow user-friendly for managing documents like the Et 2815 Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage documents like the Et 2815 Form. The intuitive interface allows users to navigate the process without extensive training.

Get more for Et 2815 Form

- Physiotherapy certificate of attendance form

- Extended stay third party authorization form

- Tcz registration form

- Neuro checks flowsheet form

- Mathematics grade 11 textbook pdf download form

- Ga dept of corrections visitation form

- Medi cal choice form for los angeles health care options

- City of north adams massachusetts inspection serv form

Find out other Et 2815 Form

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free