Section 78 Form

What is the Section 78 Form

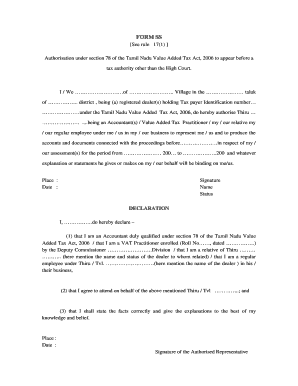

The Section 78 form is a legal document used primarily in the context of tax and financial reporting in the United States. It serves to provide essential information regarding specific transactions or activities that may have tax implications. Understanding the purpose of this form is crucial for individuals and businesses to ensure compliance with federal and state regulations.

How to use the Section 78 Form

Using the Section 78 form involves several steps to ensure accurate reporting. First, gather all necessary financial documents related to the transactions you need to report. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted according to the guidelines set forth by the relevant authorities, either online or by mail.

Steps to complete the Section 78 Form

Completing the Section 78 form requires attention to detail. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Collect all relevant financial documents and information needed to complete the form.

- Fill out the form accurately, ensuring all sections are completed as required.

- Double-check your entries for any errors or omissions.

- Submit the form according to the specified submission method, ensuring it is sent by the deadline.

Legal use of the Section 78 Form

The Section 78 form has specific legal implications. It must be filled out correctly to ensure that the information provided is valid and can be used for legal and tax purposes. Failure to comply with the requirements may result in penalties or legal issues. It is essential to understand the legal framework surrounding the use of this form to avoid potential complications.

Key elements of the Section 78 Form

Several key elements are crucial to the Section 78 form. These include:

- Identification of the taxpayer, including name and taxpayer identification number.

- Details of the transactions being reported, including dates and amounts.

- Signature of the taxpayer or authorized representative, affirming the accuracy of the information.

- Any additional documentation that may be required to support the information provided.

Form Submission Methods

The Section 78 form can be submitted through various methods. These typically include:

- Online submission through designated government portals.

- Mailing a physical copy of the form to the appropriate tax authority.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete section 78 form

Effortlessly Prepare Section 78 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Section 78 Form on any device with airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to Alter and Electronically Sign Section 78 Form with Ease

- Obtain Section 78 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Section 78 Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section 78 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is section 78 in the context of airSlate SignNow?

Section 78 refers to a specific feature within airSlate SignNow that allows users to efficiently manage and sign documents electronically. This section streamlines the workflow by ensuring that all parties can easily access and eSign documents, enhancing productivity and reducing turnaround time.

-

How does airSlate SignNow's pricing structure relate to section 78?

The pricing for airSlate SignNow is designed to be cost-effective, with various plans that cater to different business needs. Section 78 is included in all pricing tiers, ensuring that businesses of all sizes can leverage this feature without additional costs.

-

What are the key features of section 78 in airSlate SignNow?

Section 78 encompasses several key features including document tracking, customizable templates, and user-friendly interface for eSigning. These features enable businesses to optimize their document management processes and ensure compliance with signing requirements.

-

Can I integrate section 78 with other tools or platforms?

Yes, airSlate SignNow allows for seamless integration with various third-party applications and platforms. This means you can easily incorporate section 78 into your existing workflows, facilitating better collaboration across different software solutions.

-

What are the benefits of using section 78 for businesses?

Utilizing section 78 helps businesses save time and reduce paper usage by making the signing process entirely digital. Additionally, this feature enhances security and compliance, providing a reliable method for managing important documents.

-

Is section 78 suitable for all types of businesses?

Absolutely! Section 78 is designed to be versatile, making it suitable for businesses of all sizes and industries. Whether you're a small startup or a large enterprise, you can benefit from the efficiency and simplicity that section 78 provides.

-

How does section 78 enhance the customer experience?

By simplifying the document signing process, section 78 greatly enhances the overall customer experience. Clients receive timely updates and can sign documents quickly, which fosters trust and satisfaction with your business.

Get more for Section 78 Form

Find out other Section 78 Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament