Form CT 590 CT Gov Trincoll

What is the Form CT 590 CT gov Trincoll

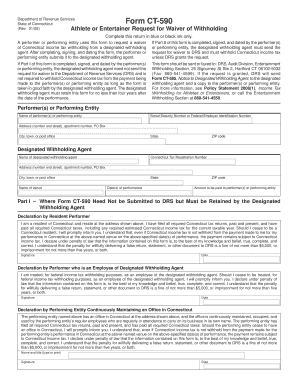

The Form CT 590 is a tax-related document used in Connecticut, primarily for reporting and claiming certain tax credits. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It serves as a declaration of eligibility for specific tax benefits and must be completed accurately to avoid penalties. Understanding the purpose of this form is crucial for taxpayers looking to optimize their tax filings in Connecticut.

How to use the Form CT 590 CT gov Trincoll

Using the Form CT 590 involves several steps to ensure proper completion. First, gather all necessary information, including personal identification details and financial records relevant to the tax year. Next, carefully read the instructions provided with the form to understand the required fields. Fill out the form with accurate data, ensuring that all calculations are correct. Once completed, the form can be submitted online or via mail, depending on the taxpayer's preference and the guidelines set by the Connecticut Department of Revenue Services.

Steps to complete the Form CT 590 CT gov Trincoll

Completing the Form CT 590 involves a systematic approach:

- Step 1: Download the form from the official Connecticut government website or obtain a physical copy.

- Step 2: Read the instructions thoroughly to understand all requirements and sections of the form.

- Step 3: Fill in your personal details, including name, address, and Social Security number.

- Step 4: Provide financial information relevant to the tax credits you are claiming.

- Step 5: Review the form for accuracy and completeness before submission.

- Step 6: Submit the form as per the guidelines—either electronically or by mail.

Legal use of the Form CT 590 CT gov Trincoll

The legal use of the Form CT 590 is governed by Connecticut tax laws. It must be completed and submitted in accordance with state regulations to be considered valid. The form serves as a declaration of eligibility for various tax credits, and improper use or submission of inaccurate information can lead to legal repercussions, including fines or audits. It is essential for taxpayers to ensure that they meet all eligibility criteria outlined in the form's instructions.

Who Issues the Form CT 590 CT gov Trincoll

The Form CT 590 is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide the necessary forms, guidelines, and support for individuals and businesses to navigate the tax filing process effectively. Taxpayers can access the form and related resources directly from the department's official website.

Form Submission Methods

Taxpayers can submit the Form CT 590 through various methods, depending on their preferences and the guidelines provided by the Connecticut Department of Revenue Services:

- Online Submission: Many taxpayers prefer to file electronically through the state's online portal, which offers a streamlined process.

- Mail Submission: Alternatively, the completed form can be printed and mailed to the designated address provided in the instructions.

- In-Person Submission: Some individuals may choose to submit their forms in person at local tax offices for assistance and confirmation.

Quick guide on how to complete form ct 590 ct gov trincoll

Prepare Form CT 590 CT gov Trincoll effortlessly on any device

Online document handling has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form CT 590 CT gov Trincoll on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign Form CT 590 CT gov Trincoll with ease

- Obtain Form CT 590 CT gov Trincoll and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Generate your eSignature using the Sign tool, a process that takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your delivery method for the form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form CT 590 CT gov Trincoll and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 590 ct gov trincoll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 590 and how is it used?

Form CT 590 is an essential tax document provided by the CT gov for specific tax reporting purposes at Trinity College. It is used by students, staff, or contributors related to federal taxation compliance. Understanding how to properly fill out Form CT 590 CT gov Trincoll ensures accuracy in tax filings.

-

How can I access Form CT 590 from CT gov?

You can access Form CT 590 directly from the CT gov website or the Trinity College resources page. Simply search for 'Form CT 590 CT gov Trincoll' on their site, and it will guide you to the downloadable format. This ensures that you have the latest version of the form for your requirements.

-

Are there any costs associated with using airSlate SignNow for Form CT 590?

Using airSlate SignNow for Form CT 590 CT gov Trincoll is a cost-effective solution. Our platform offers flexible pricing plans to suit different budgets, ensuring you get great value. There are no hidden fees, and you can sign and manage your forms at an affordable rate.

-

What features does airSlate SignNow provide for signing Form CT 590?

airSlate SignNow offers various features for efficiently signing Form CT 590 CT gov Trincoll. Our platform allows you to eSign documents, share them with others, and track their status in real-time. These features simplify the eSigning process and ensure compliance with tax requirements.

-

Can airSlate SignNow integrate with other tools for managing Form CT 590?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form CT 590 CT gov Trincoll effortlessly. You can connect with CRM systems, cloud storage services, and more. This interoperability enhances your workflow and ensures that your documents are always accessible.

-

What are the benefits of using airSlate SignNow for Form CT 590?

The benefits of using airSlate SignNow for Form CT 590 CT gov Trincoll are numerous. Our platform increases efficiency by streamlining the signing process, reduces paperwork, and allows for quick document turnaround. Additionally, our secure platform ensures that your sensitive data is well-protected.

-

Is it safe to sign Form CT 590 electronically using airSlate SignNow?

Yes, signing Form CT 590 CT gov Trincoll electronically using airSlate SignNow is completely safe. We prioritize data security with advanced encryption methods and compliance with industry standards. You can confidently manage your tax documents without worrying about unauthorized access.

Get more for Form CT 590 CT gov Trincoll

Find out other Form CT 590 CT gov Trincoll

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit