Ohio Mortgage Form

What is the Ohio Mortgage Form

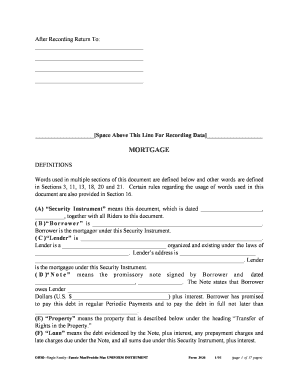

The Ohio mortgage form is a legal document used in the state of Ohio to secure a loan with real property as collateral. This form outlines the terms of the mortgage agreement between the borrower and the lender, detailing the rights and responsibilities of both parties. It serves to protect the lender's interest in the property while providing the borrower with the necessary funds to purchase or refinance real estate. Understanding the components of this form is essential for anyone involved in a mortgage transaction in Ohio.

How to use the Ohio Mortgage Form

Using the Ohio mortgage form involves several key steps to ensure that it is completed accurately and legally. First, gather all necessary information, including the borrower's and lender's details, property description, and loan terms. Next, fill out the form carefully, ensuring that all fields are completed and that the information is accurate. Once completed, both parties must sign the document in the presence of a notary public to validate the agreement. After notarization, the form should be filed with the county recorder's office to make it a matter of public record.

Steps to complete the Ohio Mortgage Form

Completing the Ohio mortgage form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documentation, including identification, property details, and financial information.

- Fill out the form with accurate information, ensuring all details are correct.

- Review the completed form for any errors or omissions.

- Sign the form in front of a notary public to ensure its legality.

- Submit the notarized form to the county recorder's office for official recording.

Legal use of the Ohio Mortgage Form

The legal use of the Ohio mortgage form is governed by state laws and regulations. To be considered valid, the form must meet specific requirements, such as being signed by both parties and notarized. Additionally, it must be filed with the appropriate county authority to provide public notice of the mortgage. Compliance with these legal standards ensures that the mortgage is enforceable in a court of law, protecting the interests of both the borrower and the lender.

Key elements of the Ohio Mortgage Form

Several key elements are essential to the Ohio mortgage form, including:

- Borrower Information: Names and addresses of the individuals or entities borrowing the funds.

- Lender Information: Details of the financial institution or individual providing the loan.

- Property Description: A detailed description of the property being mortgaged, including its legal description.

- Loan Amount: The total amount of money being borrowed.

- Terms of Repayment: Information about the interest rate, payment schedule, and any penalties for late payments.

Who Issues the Form

The Ohio mortgage form is typically issued by lenders, such as banks, credit unions, or mortgage companies. These institutions provide the necessary documentation to borrowers when they apply for a mortgage. While the form itself may be standardized, lenders may have their own specific requirements or additional documents that need to be completed as part of the mortgage application process.

Quick guide on how to complete ohio mortgage form 88774466

Complete Ohio Mortgage Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ohio Mortgage Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Ohio Mortgage Form with ease

- Obtain Ohio Mortgage Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Ohio Mortgage Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio mortgage form 88774466

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ohio mortgage form?

An Ohio mortgage form is a legal document used by lenders and borrowers in the state of Ohio to secure a loan with real property as collateral. This form outlines the terms of the mortgage, including the loan amount, repayment schedule, and interest rate. Using airSlate SignNow, you can easily create, edit, and eSign your Ohio mortgage form, streamlining the entire process.

-

How does airSlate SignNow simplify the Ohio mortgage form process?

airSlate SignNow simplifies the Ohio mortgage form process by allowing users to access templates and easily customize them to meet their specific needs. The platform's intuitive interface makes it easy to fill out all necessary fields and generate signatures quickly. Additionally, the ability to track document status ensures that you can stay updated throughout the signing process.

-

What are the pricing options for using airSlate SignNow for Ohio mortgage forms?

airSlate SignNow offers several pricing tiers to accommodate various needs, including a basic plan for individual users and more advanced plans for businesses. Each plan includes features that are beneficial for managing Ohio mortgage forms, such as unlimited document signing and storage. By choosing airSlate SignNow, you can find a cost-effective solution that fits your budget.

-

Can I integrate airSlate SignNow with other applications when working with Ohio mortgage forms?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, cloud storage services, and project management tools. This allows for a more streamlined workflow when handling Ohio mortgage forms. With these integrations, you can automate processes and improve efficiency within your business operations.

-

Is it secure to use airSlate SignNow for my Ohio mortgage form?

Absolutely! airSlate SignNow prioritizes the security of your documents and data. The platform employs robust encryption and security protocols to ensure that your Ohio mortgage form and any personal information remain confidential. You can confidently use airSlate SignNow knowing your documents are protected from unauthorized access.

-

Can I store my completed Ohio mortgage forms in airSlate SignNow?

Yes, airSlate SignNow offers secure storage for your completed Ohio mortgage forms and other important documents. You can access them anytime from anywhere with an internet connection. This feature ensures that all your important mortgage documents are organized and easily retrievable, enhancing your overall document management experience.

-

How do I eSign my Ohio mortgage form using airSlate SignNow?

eSigning your Ohio mortgage form with airSlate SignNow is quick and straightforward. After creating or uploading your document, simply add the necessary eSignature fields and send it out for signing. Recipients can sign the document electronically, ensuring a fast and legally binding agreement without the need for physical paperwork.

Get more for Ohio Mortgage Form

- Independent form

- 2018 2019 family size clarification form university of houston

- Please enclose your actual passport along with two 2 form

- D access center form

- Asmjc student activities ampamp benefits application modesto form

- 2019 2020 v 5 aggregate verification worksheet independent form

- Admission to the collegenmu college of business form

- Release of liability ampamp waiver of claim form

Find out other Ohio Mortgage Form

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document