Form Department of the Treasury Internal Revenue Service 98 1040A Label L a B E L H E R E U

What is the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

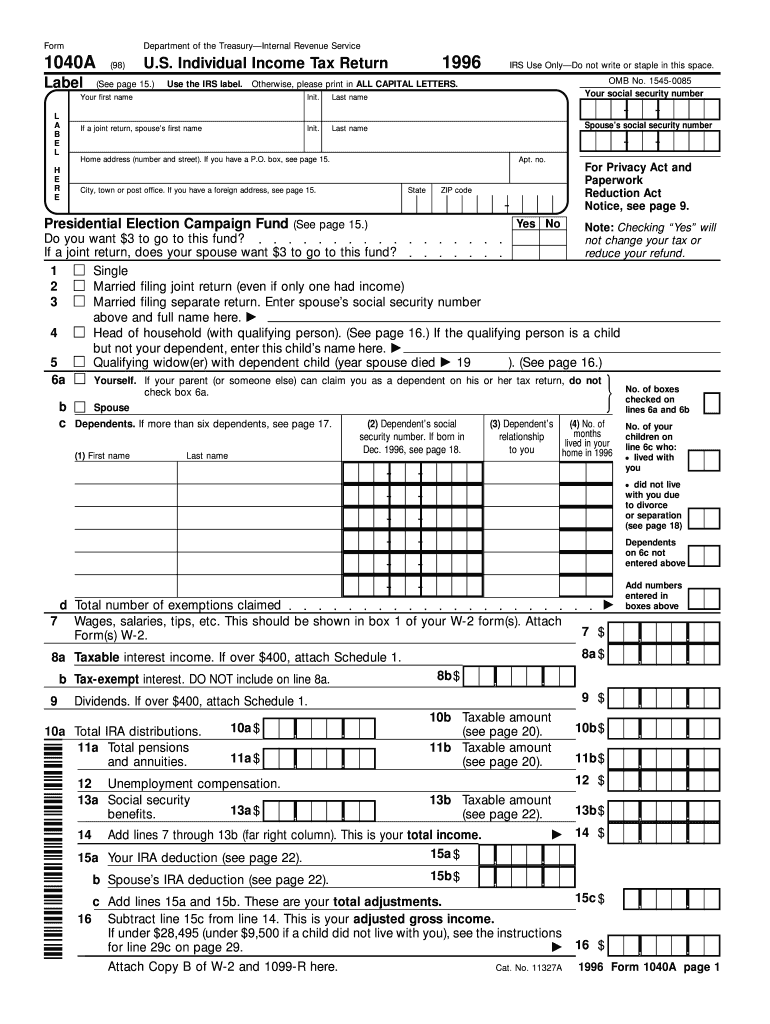

The Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U is a tax form used by individuals in the United States for filing their income tax returns. This form is a simplified version of the standard Form 1040 and is specifically designed for taxpayers with straightforward tax situations. It allows for the reporting of income, deductions, and credits, making it easier for eligible individuals to complete their tax filings efficiently.

Steps to complete the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

Completing the Form 98 1040A involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any records of deductions or credits.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from various sources as indicated on your documents.

- Claim deductions and credits: Utilize the appropriate sections of the form to claim any eligible deductions and credits.

- Calculate tax liability: Follow the instructions to determine your total tax owed or refund due.

- Sign and date the form: Ensure that you sign and date the form before submission to validate it.

Legal use of the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

The Form 98 1040A is legally binding when completed and signed correctly. It must comply with IRS regulations and guidelines to ensure its validity. Electronic signatures are accepted, provided that they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that the form holds the same legal weight as a traditional paper form when submitted electronically.

How to obtain the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

The Form 98 1040A can be obtained through various channels:

- IRS website: Download the form directly from the official IRS website, where it is available in PDF format.

- Tax preparation software: Many tax preparation programs include this form as part of their services, allowing for easy completion and filing.

- Local IRS offices: Visit a local IRS office to request a physical copy of the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 98 1040A to avoid penalties. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their returns, which can be requested through the IRS.

Examples of using the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

The Form 98 1040A is commonly used in various taxpayer scenarios, including:

- Wage earners: Individuals who receive wages from a single employer and have straightforward tax situations.

- Students: Taxpayers who may have limited income and qualify for education-related credits.

- Retirees: Seniors who receive pension income and Social Security benefits.

Quick guide on how to complete form department of the treasury internal revenue service 98 1040a label l a b e l h e r e u

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z . Which letter in this alphabet is the eighth letter to the right of the letter and which is tenth letter to the left of the last but one letter of the alphabet?

G,G is the letter in this alphabet is the eighth letter to the right of the letter 'O' and which is the tenth letter to the left of the last but one letter ('Y') of the alphabet.

-

Which letter amongst the following alphabet is the 8th letter to the right of 17th letter from right? A B C D E F G H I J K L M N O P Q R S T U V W X Y Z?

R

Related searches to Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

Create this form in 5 minutes!

How to create an eSignature for the form department of the treasury internal revenue service 98 1040a label l a b e l h e r e u

How to generate an electronic signature for your Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U in the online mode

How to make an eSignature for your Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U in Chrome

How to create an electronic signature for putting it on the Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U in Gmail

How to generate an eSignature for the Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U right from your smartphone

How to make an electronic signature for the Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U on iOS devices

How to generate an electronic signature for the Form Department Of The Treasury Internal Revenue Service 98 1040a Label L A B E L H E R E U on Android OS

People also ask

-

What is the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

The Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U is a specialized tax form used for specific purposes by the IRS. It allows taxpayers to label their submissions correctly and ensures compliance with federal tax regulations. Utilizing airSlate SignNow, you can easily complete and eSign this form digitally.

-

How can airSlate SignNow simplify the process of filling out the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

airSlate SignNow streamlines the completion of the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U by providing intuitive tools for document creation and editing. You can quickly fill in the required fields and add your signatures, ensuring a hassle-free process. This efficiency helps you focus on what really matters—your finances.

-

What pricing options are available for airSlate SignNow's services related to the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you're an individual or a larger organization, you can find an option that fits your budget while still providing access to capabilities that support the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U. Pricing details can be found directly on our website.

-

Are there any features specific to the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U in airSlate SignNow?

Yes, airSlate SignNow offers features designed specifically for managing the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U. These features include customizable templates, digital signatures, and secure storage options, which enhance the user experience and provide peace of mind regarding document security.

-

How can airSlate SignNow help with compliance regarding the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

Using airSlate SignNow ensures that your use of the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U adheres to compliance standards. Our platform provides tools that automate document tracking and secure archiving, which help maintain a compliant workflow. This feature is especially beneficial during audits or reviews.

-

Can I integrate airSlate SignNow with other software for managing the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications that you might already be using. This capability allows for easy management and transition of the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U data across platforms, enhancing your overall productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U?

Using airSlate SignNow for the Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U provides numerous benefits, including time savings, improved accuracy, and easier collaboration. You can manage your tax documents more efficiently, ensuring that all your submissions are completed correctly and on time.

Get more for Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

Find out other Form Department Of The Treasury Internal Revenue Service 98 1040A Label L A B E L H E R E U

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document