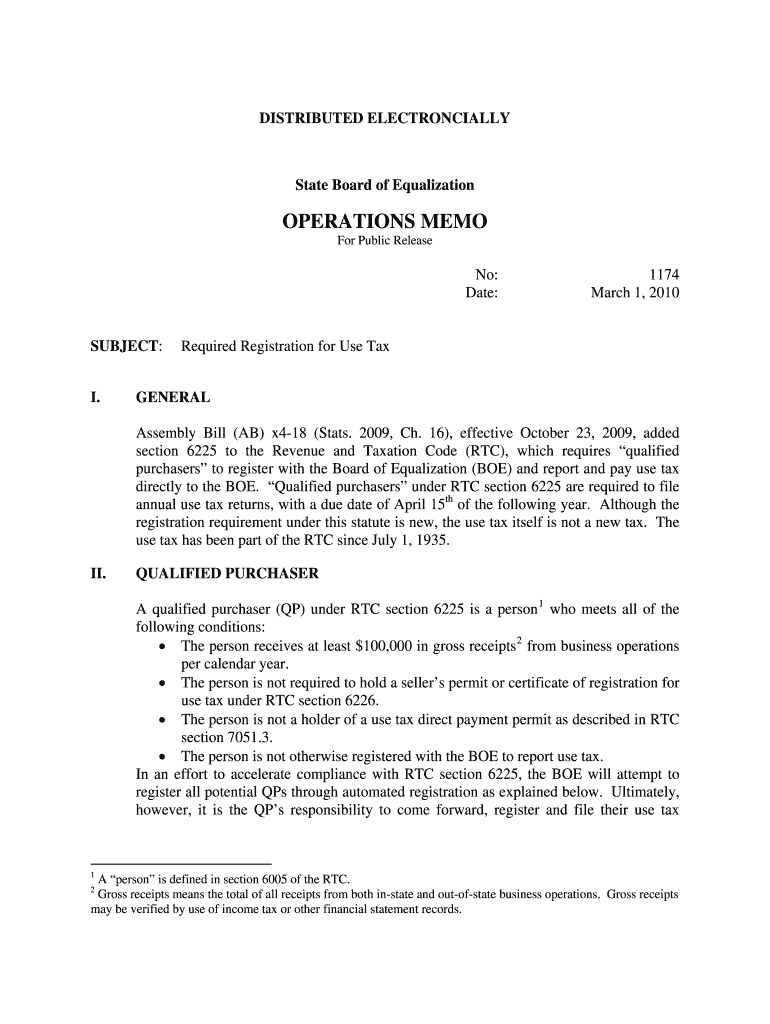

OM 1174 Required Registration for Use Tax Boe Ca Form

What is the OM 1174 Required Registration for Use Tax boe ca?

The OM 1174 Required Registration for Use Tax boe ca is a form used by businesses in California to register for use tax purposes. Use tax is a tax imposed on the storage, use, or consumption of tangible personal property in California when sales tax has not been paid. This form is essential for ensuring compliance with California tax regulations, allowing businesses to report and remit the appropriate taxes to the state. Completing this form accurately helps prevent potential penalties and ensures that businesses fulfill their tax obligations.

Steps to Complete the OM 1174 Required Registration for Use Tax boe ca

Completing the OM 1174 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your business name, address, and federal employer identification number (FEIN).

- Provide details about the types of tangible personal property your business uses or consumes in California.

- Indicate the estimated amount of use tax you expect to owe for the reporting period.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the California Department of Tax and Fee Administration (CDTFA) either online or by mail.

Legal Use of the OM 1174 Required Registration for Use Tax boe ca

The legal use of the OM 1174 form is governed by California tax laws, which require businesses to register for use tax if they purchase tangible personal property from out-of-state vendors without paying sales tax. This registration is crucial for maintaining compliance with the state's tax regulations. By accurately completing and submitting the form, businesses can avoid legal issues and potential penalties associated with non-compliance.

How to Obtain the OM 1174 Required Registration for Use Tax boe ca

Obtaining the OM 1174 form is straightforward. Businesses can access the form through the California Department of Tax and Fee Administration (CDTFA) website. It is available for download in a printable format. Additionally, businesses can request a physical copy of the form by contacting the CDTFA directly. Ensuring you have the latest version of the form is important, as tax regulations may change.

State-Specific Rules for the OM 1174 Required Registration for Use Tax boe ca

California has specific rules regarding the use tax that businesses must adhere to when completing the OM 1174 form. These rules include:

- Businesses must register for use tax if they purchase items for use in California without paying sales tax.

- The form must be submitted within a specified time frame after the purchase to avoid penalties.

- Businesses are required to keep accurate records of all purchases and use tax owed.

Filing Deadlines / Important Dates

Filing deadlines for the OM 1174 form are crucial for compliance. Businesses should be aware of the following important dates:

- Registration must occur before the end of the reporting period in which the purchases were made.

- Quarterly and annual filing deadlines vary, so it is important to check the CDTFA calendar for specific dates.

Quick guide on how to complete boe ca

Finalize boe ca effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage boe ca on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign boeca with ease

- Find boe ca and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign boeca to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs boeca

-

Which documents are required to fill out the CA foundation exam form for the second attempt?

Just fill examination form only…. no documents require.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Related searches to boe ca

Create this form in 5 minutes!

How to create an eSignature for the boeca

How to generate an electronic signature for your Om 1174 Required Registration For Use Tax Boe Ca online

How to create an eSignature for the Om 1174 Required Registration For Use Tax Boe Ca in Google Chrome

How to create an eSignature for signing the Om 1174 Required Registration For Use Tax Boe Ca in Gmail

How to make an eSignature for the Om 1174 Required Registration For Use Tax Boe Ca right from your mobile device

How to make an eSignature for the Om 1174 Required Registration For Use Tax Boe Ca on iOS devices

How to create an electronic signature for the Om 1174 Required Registration For Use Tax Boe Ca on Android

People also ask boeca

-

What is boe ca and how can it benefit my business?

Boe ca refers to the business-oriented electronic communications that airSlate SignNow enables for efficient document management. By utilizing boe ca, your business can streamline the signing process, reduce turnaround times, and improve overall productivity. This solution also enhances security, ensuring that sensitive information in your documents is well-protected.

-

How much does the boe ca pricing plan cost?

The boe ca pricing plan from airSlate SignNow offers competitive rates that cater to businesses of all sizes. You can choose from various subscription tiers, depending on your needs and the number of users you have. Additionally, there are options for discounts on annual plans, making it a cost-effective choice for your document management requirements.

-

What features does airSlate SignNow offer for boe ca users?

For users focused on boe ca, airSlate SignNow provides a wide array of features including customizable templates, automatic reminders, and integration with popular business applications. The platform's intuitive interface simplifies the signing process for both senders and recipients. Furthermore, you can track document status in real-time, providing visibility throughout your workflows.

-

Can I integrate boe ca with other business software?

Absolutely! AirSlate SignNow supports seamless integrations with a variety of business software including CRM systems, cloud storage, and project management tools to enhance the functionality of boe ca. This allows your team to maintain a unified workflow, ensuring that all your documents are easily accessible and ready for signing without switching platforms.

-

Is there a free trial available for the boe ca solution?

Yes, airSlate SignNow offers a free trial for businesses interested in exploring the boe ca capabilities. This trial allows you to test the features and functionality, so you can see first-hand how it can benefit your operations. During the trial, you'll have access to most premium features, enabling you to evaluate the solution effectively.

-

What types of documents can I send and eSign using boe ca?

With boe ca, you can send and eSign a variety of document types including contracts, agreements, proposals, and much more. AirSlate SignNow supports multiple file formats, giving you the flexibility to work with documents that best suit your business needs. This versatility makes it an ideal solution for diverse industries.

-

How does airSlate SignNow ensure the security of boe ca documents?

AirSlate SignNow takes security seriously, especially for boe ca documents. The platform uses advanced encryption methods for data in transit and at rest, along with secure audit trails for compliance and accountability. Additionally, identity verification options are available to further authenticate users before they can access or sign documents.

Get more for boe ca

Find out other boeca

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy