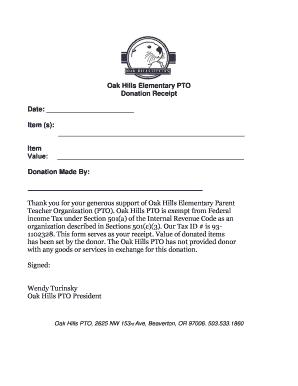

General Tax Donation Receipt Oak Hills PTO Oakhillspto Form

What is a tax donation letter?

A tax donation letter serves as a formal acknowledgment from a charitable organization to a donor, confirming the receipt of a donation. This document is essential for the donor's tax records, as it provides proof of the contribution made, which may be necessary when filing taxes. The letter typically includes details such as the name of the organization, the date of the donation, the amount donated, and a statement regarding whether any goods or services were provided in exchange for the donation. This information is crucial for donors who wish to claim tax deductions for their contributions.

Key elements of a tax donation letter

When creating a tax donation letter, certain key elements must be included to ensure its validity and usefulness for tax purposes. These elements typically consist of:

- Organization's Name and Address: Clearly state the name and contact information of the charitable organization.

- Donor's Name and Address: Include the full name and address of the donor to establish their identity.

- Date of Donation: Specify the exact date when the donation was made.

- Amount of Donation: Clearly indicate the monetary value of the donation or a description of the donated items.

- Statement of No Goods or Services: Include a statement confirming whether the donor received any goods or services in return for the donation.

- Signature of an Authorized Representative: The letter should be signed by someone authorized within the organization, adding legitimacy to the document.

Steps to complete a tax donation letter

Completing a tax donation letter involves several straightforward steps to ensure it meets all necessary requirements. Follow these steps to create an effective letter:

- Gather Information: Collect all relevant details about the donor and the donation, including names, addresses, and amounts.

- Draft the Letter: Use a clear and professional format to draft the letter, incorporating all key elements mentioned earlier.

- Review for Accuracy: Double-check all information for accuracy to avoid any potential issues during tax filing.

- Obtain Signature: Have an authorized representative of the organization sign the letter to validate it.

- Distribute the Letter: Provide a copy of the signed letter to the donor for their records.

IRS guidelines for tax donation letters

The Internal Revenue Service (IRS) provides specific guidelines regarding the documentation required for charitable contributions. According to IRS regulations, a tax donation letter is necessary for any donation exceeding a certain amount, which is currently set at $250. The letter must include all key elements to ensure compliance with IRS requirements. Donors should retain this documentation for their records, as it may be requested during an audit or when filing taxes. Familiarizing oneself with these guidelines can help ensure that both the donor and the organization meet their obligations.

Legal use of a tax donation letter

A tax donation letter is legally recognized as proof of a charitable contribution, provided it meets the IRS requirements. This document can be used by donors to substantiate their claims for tax deductions. It is essential that the letter is accurate and complete, as any discrepancies could lead to complications during tax filing. Organizations must ensure that they issue these letters promptly and maintain proper records of all donations received, as this practice supports transparency and accountability.

Examples of tax donation letters

Providing examples of tax donation letters can help organizations understand how to format and structure their own letters. Here are a few common scenarios:

- Monetary Donation: A letter acknowledging a cash donation, including the amount and a statement confirming that no goods or services were provided in exchange.

- In-Kind Donation: A letter recognizing a donation of goods, detailing the items donated and their estimated value.

- Recurring Donations: A letter summarizing multiple donations made over a specific period, with total amounts and dates included.

Quick guide on how to complete general tax donation receipt oak hills pto oakhillspto

Effortlessly Prepare General Tax Donation Receipt Oak Hills PTO Oakhillspto on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle General Tax Donation Receipt Oak Hills PTO Oakhillspto on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow right now.

The Easiest Way to Edit and Electronically Sign General Tax Donation Receipt Oak Hills PTO Oakhillspto

- Locate General Tax Donation Receipt Oak Hills PTO Oakhillspto and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information using functionality specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign General Tax Donation Receipt Oak Hills PTO Oakhillspto to ensure efficient communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the general tax donation receipt oak hills pto oakhillspto

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax donation letter template?

A tax donation letter template is a pre-designed document that helps individuals or organizations create a formal acknowledgment of donations made to them. This template typically includes essential information such as the donor's name, donation amount, and a statement regarding the tax-deductibility of the donation, making it a valuable resource for tax purposes.

-

How can I customize a tax donation letter template using airSlate SignNow?

With airSlate SignNow, you can easily customize a tax donation letter template by adding your logo, changing text fields, and adjusting the layout. The platform offers a user-friendly editor that allows you to make these changes quickly, ensuring the template aligns with your organization's branding and specific requirements.

-

Is the tax donation letter template free to use?

airSlate SignNow offers various pricing plans, and while the platform provides a range of features for generating a tax donation letter template, costs may vary based on your needs. You can sign up for a free trial to explore the features and determine which plan best fits your budget and requirements.

-

What are the benefits of using a tax donation letter template?

Using a tax donation letter template can save you time and ensure accuracy in documenting donations for both donors and recipients. It also helps in maintaining compliance with IRS regulations, providing a professional appearance, and enhancing donor relationships through timely and personalized communication.

-

Can I integrate the tax donation letter template with other software?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, allowing you to incorporate your tax donation letter template into your existing workflow. This can streamline the document management process, enhance collaboration, and increase overall efficiency in handling donations.

-

Are there any limitations on the number of tax donation letter templates I can create?

While airSlate SignNow provides flexibility in creating tax donation letter templates, limits may depend on your chosen pricing plan. Higher-tier plans typically allow for more templates and features, giving you the freedom to customize documents as needed without worrying about limits.

-

How do I ensure compliance when using a tax donation letter template?

To ensure compliance when using a tax donation letter template, include all required information such as the donor’s details, donation amount, and a disclaimer confirming the tax-deductible status of the contribution. airSlate SignNow guides you through best practices, helping maintain compliance with IRS rules and regulations.

Get more for General Tax Donation Receipt Oak Hills PTO Oakhillspto

Find out other General Tax Donation Receipt Oak Hills PTO Oakhillspto

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer