Uniform Residential Loan Application Interactive Spanish Form

What is the Uniform Residential Loan Application Interactive Spanish Form

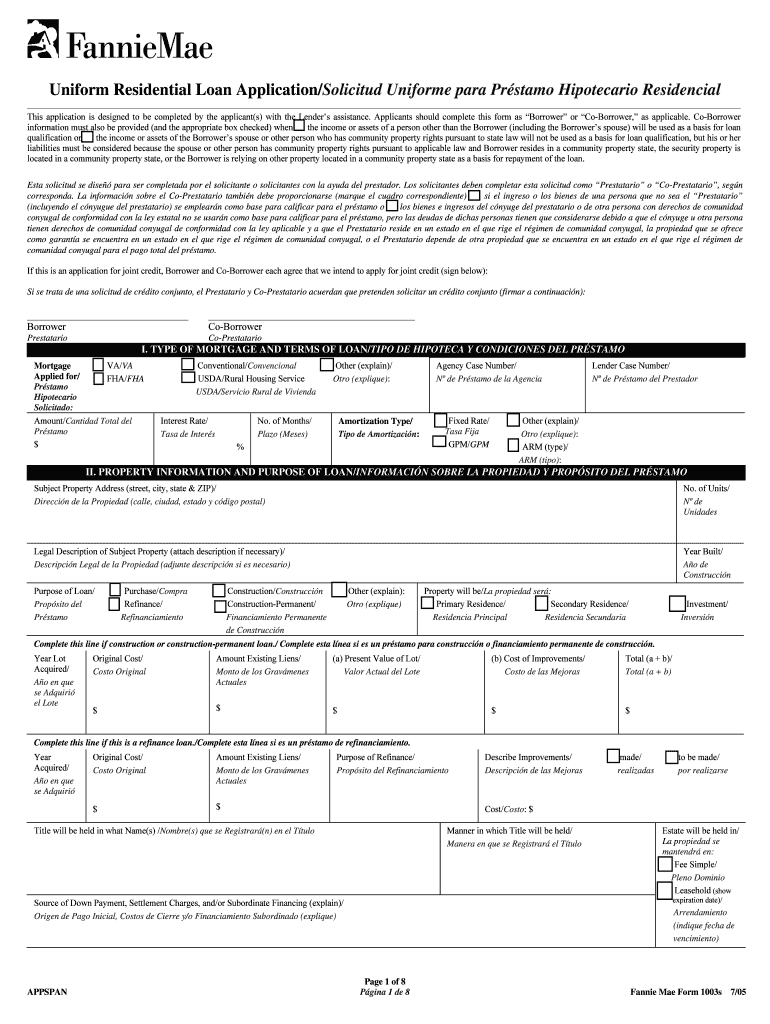

The Uniform Residential Loan Application Interactive Spanish Form is a standardized document used by individuals applying for a residential mortgage. This form is designed to gather essential information about the borrower, including personal details, employment history, and financial status. It is particularly beneficial for Spanish-speaking applicants, as it provides a user-friendly interface in their native language, ensuring clarity and ease of understanding throughout the application process.

How to use the Uniform Residential Loan Application Interactive Spanish Form

To effectively use the Uniform Residential Loan Application Interactive Spanish Form, applicants should first ensure they have all necessary documentation ready. This includes identification, income verification, and details of assets and liabilities. Once prepared, users can access the form online, fill it out step-by-step, and submit it electronically. The interactive features allow for easy navigation and real-time validation of information, minimizing errors and enhancing the overall experience.

Steps to complete the Uniform Residential Loan Application Interactive Spanish Form

Completing the Uniform Residential Loan Application Interactive Spanish Form involves several key steps:

- Gather necessary documents, such as proof of income and identification.

- Access the form online and select the Spanish language option.

- Fill out personal information, including name, address, and contact details.

- Provide employment history and income information.

- Detail assets and liabilities to give a comprehensive financial picture.

- Review all entries for accuracy before submission.

- Submit the form electronically and save a copy for personal records.

Legal use of the Uniform Residential Loan Application Interactive Spanish Form

The legal use of the Uniform Residential Loan Application Interactive Spanish Form is governed by U.S. regulations concerning electronic signatures and documentation. For the form to be considered legally binding, it must comply with the ESIGN Act and UETA, which establish the validity of electronic signatures. By using a secure platform for submission, applicants can ensure their information is protected and that the form meets all legal requirements.

Key elements of the Uniform Residential Loan Application Interactive Spanish Form

Key elements of the Uniform Residential Loan Application Interactive Spanish Form include:

- Borrower Information: Personal details such as name, address, and social security number.

- Employment History: Information regarding current and previous employment.

- Financial Information: Details about income, assets, and liabilities.

- Loan Information: Requested loan amount and property details.

- Declarations: Questions regarding financial history and obligations.

Who Issues the Form

The Uniform Residential Loan Application Interactive Spanish Form is issued by the Federal Housing Finance Agency (FHFA) and is utilized by various lenders across the United States. This standardized application ensures that all necessary information is collected uniformly, facilitating the mortgage approval process for both lenders and borrowers.

Quick guide on how to complete uniform residential loan application interactive spanish form

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the exact same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Uniform Residential Loan Application Interactive Spanish Form

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application interactive spanish form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Uniform Residential Loan Application Interactive Spanish Form?

The Uniform Residential Loan Application Interactive Spanish Form is a comprehensive tool designed for Spanish-speaking individuals to apply for a mortgage. This form simplifies the loan application process, allowing users to fill it out electronically with ease, ensuring compliance with industry standards.

-

How does the Uniform Residential Loan Application Interactive Spanish Form enhance my loan application process?

By utilizing the Uniform Residential Loan Application Interactive Spanish Form, users can streamline their application process with an easy-to-navigate interface. This interactive form reduces errors and facilitates faster submissions, improving overall efficiency in obtaining mortgage approvals.

-

Is the Uniform Residential Loan Application Interactive Spanish Form cost-effective?

Yes, the Uniform Residential Loan Application Interactive Spanish Form is designed to be an affordable solution for both lenders and borrowers. Its cost-effective nature allows businesses to save time and resources while ensuring a smooth loan application process in Spanish.

-

What features are included in the Uniform Residential Loan Application Interactive Spanish Form?

This form includes features such as electronic signatures, real-time collaboration, and customizable fields. These functionalities make it easy for users to complete the loan application in Spanish while ensuring all necessary information is captured correctly.

-

Are there integrations available with the Uniform Residential Loan Application Interactive Spanish Form?

Absolutely! The Uniform Residential Loan Application Interactive Spanish Form integrates seamlessly with various CRMs and financial software, making it easier for users to manage their application data. These integrations enhance workflow efficiency and ensure a smooth transition from application to approval.

-

Can multiple users work on the Uniform Residential Loan Application Interactive Spanish Form simultaneously?

Yes, the Uniform Residential Loan Application Interactive Spanish Form supports real-time collaboration, allowing multiple users to work together on the application. This feature ensures that all stakeholders can contribute essential information, enhancing communication and speeding up the process.

-

How secure is the Uniform Residential Loan Application Interactive Spanish Form?

Security is a priority with the Uniform Residential Loan Application Interactive Spanish Form. The platform utilizes advanced encryption methods to protect sensitive information, ensuring that all personal and financial data remains confidential and secure throughout the application process.

Get more for Uniform Residential Loan Application Interactive Spanish Form

- Alberta health information update

- Form 16b affidavit service

- Nikah nama form in english bangladesh pdf

- Reference form for physicisns

- Wsib workers report form

- Application for a permit to construct or demolish city of london london form

- Letter of authorization for temporary operation permit mv1803 letter of authorization for temporary operation permit mv1803 form

- Nwt teacher salary evaluation form

Find out other Uniform Residential Loan Application Interactive Spanish Form

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online