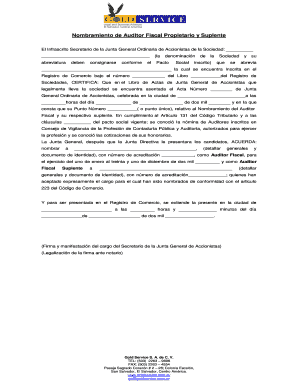

Nombramiento De Auditor Fiscal Propietario Y Suplente Elsalvador Law Form

Understanding the nombramiento de auditor fiscal

The nombramiento de auditor fiscal is a formal designation that authorizes an individual to act as a tax auditor for a specific entity. This process is crucial for ensuring that financial statements and tax obligations are accurately reviewed and reported. In the context of U.S. businesses, having a designated auditor can help maintain compliance with federal and state tax regulations. This designation typically includes both a primary auditor and an alternate, ensuring continuity in the auditing process.

Steps to complete the nombramiento de auditor fiscal

Completing the nombramiento de auditor fiscal involves several key steps:

- Identify the individual(s) to be appointed as the primary and alternate auditors.

- Gather necessary documentation, including identification and qualifications of the auditors.

- Fill out the required form, ensuring all information is accurate and complete.

- Obtain signatures from all relevant parties, including the entity's representatives.

- Submit the completed form to the appropriate tax authority or governing body.

Each of these steps is essential to ensure that the appointment is legally recognized and effective.

Legal use of the nombramiento de auditor fiscal

The nombramiento de auditor fiscal serves a legal purpose by formally designating the auditor's authority to review and report on financial matters. This designation must comply with relevant tax laws and regulations to be considered valid. In the U.S., it is essential to ensure that the appointed auditor meets all qualifications and is recognized by the appropriate regulatory bodies. Failure to comply with these legal requirements can result in penalties or challenges to the validity of the audit.

Required documents for the nombramiento de auditor fiscal

To successfully complete the nombramiento de auditor fiscal, specific documents are typically required:

- Identification documents for the appointed auditors.

- Proof of qualifications or certifications relevant to auditing.

- Any previous audit reports, if applicable.

- Internal resolutions or approvals from the entity's governing body.

Having these documents ready can streamline the appointment process and ensure compliance with legal standards.

Examples of using the nombramiento de auditor fiscal

In practice, the nombramiento de auditor fiscal can be utilized in various scenarios, such as:

- Designating an auditor for an annual financial review of a corporation.

- Appointing an auditor for a non-profit organization to ensure transparency in financial reporting.

- Establishing an auditing framework for a partnership to meet regulatory compliance.

These examples illustrate the versatility and importance of this designation in maintaining financial integrity.

Who issues the nombramiento de auditor fiscal

The nombramiento de auditor fiscal is typically issued by the entity that requires the audit, such as a corporation, partnership, or non-profit organization. The governing body of the entity, such as the board of directors or a similar authority, is responsible for formally appointing the auditors. This process ensures that the auditors have the necessary authority and support to carry out their duties effectively.

Quick guide on how to complete nombramiento de auditor fiscal

Effortlessly Complete nombramiento de auditor fiscal on Any Device

Managing documents online has gained popularity among both organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly, without unnecessary delays. Handle nombramiento de auditor fiscal on any device using airSlate SignNow’s Android or iOS applications and simplify your document-driven processes today.

Easily Modify and Electrically Sign nombramiento de auditor fiscal

- Locate nombramiento de auditor fiscal and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign nombramiento de auditor fiscal to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nombramiento de auditor fiscal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask nombramiento de auditor fiscal

-

What is the process for obtaining a nombramiento de auditor fiscal?

To obtain a nombramiento de auditor fiscal, businesses must ensure they comply with local regulations and standards. This typically involves formally appointing an auditor through a signed document, which can be seamlessly executed using airSlate SignNow. Our platform simplifies the process, ensuring that all parties can eSign the nombramiento de auditor fiscal efficiently.

-

How can airSlate SignNow help in managing a nombramiento de auditor fiscal?

airSlate SignNow offers a user-friendly interface for sending and managing your nombramiento de auditor fiscal. With our solution, you can track document status, send reminders, and store all necessary files securely. This ensures that your auditor's appointment is organized and meets compliance requirements.

-

Is there a cost associated with using airSlate SignNow for a nombramiento de auditor fiscal?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is designed to be cost-effective for businesses of all sizes. Depending on your needs, we offer different subscription tiers that include features suitable for executing documents like a nombramiento de auditor fiscal. You can easily compare plans on our website.

-

What features does airSlate SignNow offer for the nombramiento de auditor fiscal?

Our platform includes several features essential for the nombramiento de auditor fiscal, such as customizable templates and the ability to set signing orders. Additionally, airSlate SignNow provides secure storage, audit trails, and integration with popular software tools, making document management more efficient.

-

Can I track the status of my nombramiento de auditor fiscal with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including a nombramiento de auditor fiscal. You’ll receive notifications when the document is viewed and signed, allowing you to stay informed throughout the process and ensuring timely execution.

-

What are the benefits of using airSlate SignNow for a nombramiento de auditor fiscal?

Utilizing airSlate SignNow for a nombramiento de auditor fiscal streamlines the signing process, promotes efficiency, and minimizes errors. The electronic signature feature helps expedite the formal appointment, ensuring compliance while enhancing your company’s productivity. Additionally, it helps maintain a professional image through timely processing.

-

Does airSlate SignNow integrate with other software for managing a nombramiento de auditor fiscal?

Yes, airSlate SignNow integrates with various software applications, enhancing your ability to manage a nombramiento de auditor fiscal. It works well with CRM systems, document management tools, and accounting software, allowing you to keep all your important documents organized and easily accessible.

Get more for nombramiento de auditor fiscal

- Notice default form 497304818

- Assignment of contract for deed by seller iowa form

- Notice of assignment of contract for deed iowa form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement iowa form

- Buyers home inspection checklist iowa form

- Sellers information for appraiser provided to buyer iowa

- Legallife multistate guide and handbook for selling or buying real estate iowa form

- Subcontractors agreement iowa form

Find out other nombramiento de auditor fiscal

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free