St3 Form Nj

What is the St3 Form Nj

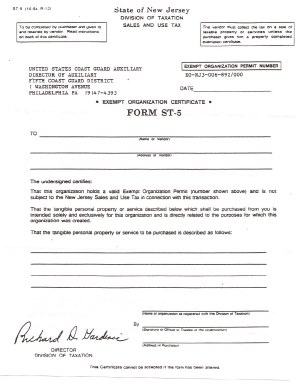

The St3 form, officially known as the Sales Tax Exempt Use Certificate, is utilized in New Jersey to document exempt purchases made by certain organizations. This form is essential for entities that qualify for sales tax exemptions, such as non-profit organizations, government agencies, and educational institutions. By completing the St3 form, these organizations can purchase goods without incurring sales tax, which can lead to significant savings on operational costs.

How to use the St3 Form Nj

To effectively use the St3 form, the exempt organization must fill it out accurately and present it to the seller at the time of purchase. The form requires specific information, including the name and address of the purchaser, the type of exempt organization, and a description of the items being purchased. It is crucial to ensure that the seller retains a copy of the completed form for their records, as this serves as proof of the tax-exempt status during audits.

Steps to complete the St3 Form Nj

Completing the St3 form involves several straightforward steps:

- Obtain a blank St3 form, which can be downloaded from the New Jersey Division of Taxation website.

- Fill in the name and address of the organization claiming the exemption.

- Indicate the type of exempt organization, such as a non-profit or government entity.

- Provide a detailed description of the items being purchased.

- Sign and date the form to validate the information provided.

Once completed, present the form to the seller to complete the tax-exempt purchase.

Legal use of the St3 Form Nj

The legal use of the St3 form is governed by New Jersey tax laws, which outline the eligibility criteria for sales tax exemptions. Organizations must ensure they meet these criteria to avoid penalties. Misuse of the form, such as using it for non-exempt purchases, can lead to legal repercussions, including fines and back taxes owed. Therefore, it is vital to understand the legal implications and use the form correctly.

Who Issues the St3 Form Nj

The St3 form is issued by the New Jersey Division of Taxation. This state agency is responsible for overseeing tax compliance and providing necessary forms for tax-related processes. Organizations seeking to use the St3 form should ensure they are registered with the Division of Taxation to confirm their eligibility for sales tax exemptions.

Required Documents

When preparing to use the St3 form, organizations must have certain documents ready to support their tax-exempt status. These documents may include:

- Proof of tax-exempt status, such as a determination letter from the IRS.

- State registration documents for non-profit organizations.

- Any relevant organizational bylaws or operating agreements.

Having these documents on hand can facilitate a smoother process when completing the St3 form.

Quick guide on how to complete st3 form nj

Complete St3 Form Nj effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and eSign your documents quickly without delays. Manage St3 Form Nj on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to adjust and eSign St3 Form Nj without hassle

- Locate St3 Form Nj and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign St3 Form Nj and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st3 form nj

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 3 sample feature of airSlate SignNow?

The st 3 sample feature of airSlate SignNow allows users to create and manage standardized document templates efficiently. This feature is essential for businesses looking to streamline their document workflows and ensure consistent branding across all signed documents.

-

How does airSlate SignNow's st 3 sample pricing work?

airSlate SignNow offers competitive pricing plans that include access to the st 3 sample functionality. Customers can choose a plan that best fits their needs, whether it be for a small team or a large organization, with options for monthly or annual billing.

-

Can I integrate airSlate SignNow with other applications using the st 3 sample?

Yes, airSlate SignNow supports integrations with various applications, and the st 3 sample can be easily incorporated into your existing workflows. This means you can connect with popular CRM and project management tools to enhance your document management process.

-

What are the benefits of using the st 3 sample feature?

The st 3 sample feature in airSlate SignNow enables users to save time and reduce errors by utilizing pre-made templates for recurring documents. It enhances productivity by ensuring that documents are uniformly formatted, which is essential for maintaining professionalism in business communications.

-

Is the st 3 sample feature user-friendly for new users?

Absolutely! The st 3 sample feature is designed with user-friendliness in mind, making it accessible for all users, regardless of their technical expertise. With an intuitive interface, new users can quickly adopt airSlate SignNow and start utilizing the st 3 sample effectively.

-

What types of documents can I create with the st 3 sample in airSlate SignNow?

With the st 3 sample in airSlate SignNow, you can create a variety of documents, including contracts, agreements, and forms. This flexibility allows businesses to address various needs while ensuring that all documents are crafted with the same quality standards.

-

Can the st 3 sample assist with compliance and security?

Yes, the st 3 sample feature in airSlate SignNow includes compliance and security measures to protect sensitive information. This aspect is crucial for businesses that must adhere to regulatory standards, ensuring that all signed documents remain secure and legally binding.

Get more for St3 Form Nj

Find out other St3 Form Nj

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors