Form ETA 9035 Labor Condition U Foreignlaborcert Doleta

What is the Form ETA 9035?

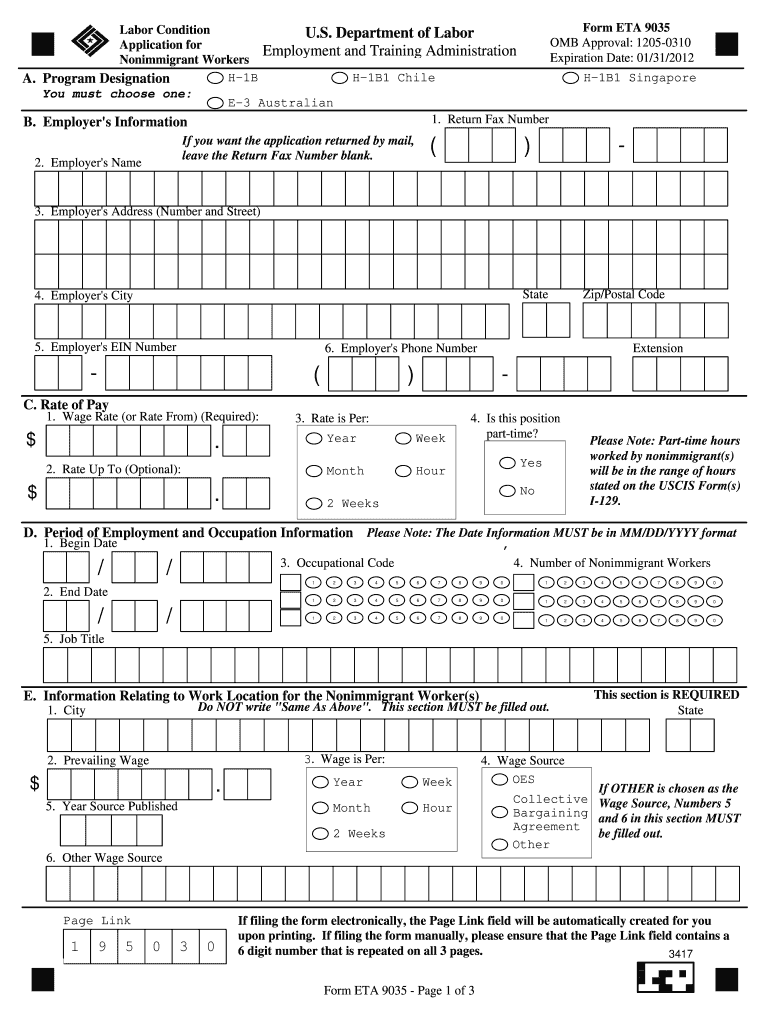

The Form ETA 9035, also known as the Labor Condition Application, is a document required by the U.S. Department of Labor (DOL) for employers seeking to hire foreign workers under the H-1B visa program. This form is essential for ensuring that the employment of foreign workers will not adversely affect the wages and working conditions of U.S. workers. The form must be submitted to the DOL and approved before an employer can file a petition with U.S. Citizenship and Immigration Services (USCIS) for an H-1B visa.

Steps to Complete the Form ETA 9035

Completing the Form ETA 9035 involves several key steps to ensure accuracy and compliance with legal requirements. First, employers must gather necessary information about the job position, including job title, duties, and salary. Next, they must provide details about the company, including its name, address, and employer identification number (EIN). After that, the employer should review the labor market information to confirm that hiring a foreign worker will not negatively impact local wages or job opportunities. Finally, the completed form must be submitted electronically through the DOL’s iCERT system, where it will be reviewed for approval.

Legal Use of the Form ETA 9035

The legal use of the Form ETA 9035 is crucial for employers to ensure compliance with immigration laws. This form is legally binding and must be filled out accurately to avoid penalties. Employers must attest that they will pay the foreign worker the prevailing wage and that the working conditions will not adversely affect U.S. workers. Misrepresentation or failure to comply with the terms outlined in the form can lead to significant legal consequences, including fines and disqualification from future immigration benefits.

Key Elements of the Form ETA 9035

The Form ETA 9035 includes several key elements that employers must address. These elements include the job title, job description, wage rate, and the work location. Additionally, employers must provide information about the recruitment process undertaken to ensure that no qualified U.S. workers are available for the position. The form also requires employers to confirm their understanding of the obligations under the H-1B program, including the maintenance of records and compliance with labor laws.

How to Use the Form ETA 9035

Using the Form ETA 9035 effectively requires understanding the process and requirements involved. Employers should begin by accessing the form through the DOL’s iCERT system. After filling out the required fields, they must ensure all information is accurate and complete. Once submitted, employers can track the status of their application through the iCERT system. It is important to retain a copy of the submitted form and any related documentation for future reference and compliance checks.

Filing Deadlines / Important Dates

Filing deadlines for the Form ETA 9035 are critical for employers planning to hire foreign workers. Typically, employers should submit the form at least 30 days before the intended start date of employment. It is advisable to submit the application as early as possible, as processing times can vary. Employers should also be aware of the annual cap on H-1B visas, which may affect their ability to hire foreign workers during certain periods.

Quick guide on how to complete doleta

Effortlessly Prepare doleta on Any Gadget

Digital document management has become increasingly favored by companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents rapidly without delays. Manage eta 9035 on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign eta form 9035e with ease

- Find form eta 9035 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or overlooked documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign form 9035 instructions and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs eta 9035 form

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Related searches to 9035 form

Create this form in 5 minutes!

How to create an eSignature for the 9035 instructions

How to generate an electronic signature for the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta in the online mode

How to create an eSignature for the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta in Google Chrome

How to make an eSignature for signing the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta in Gmail

How to generate an eSignature for the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta straight from your smart phone

How to make an eSignature for the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta on iOS

How to generate an eSignature for the Form Eta 9035 Labor Condition U Foreignlaborcert Doleta on Android OS

People also ask 9035

-

What is the eta 9035 and how does it benefit my business?

The eta 9035 is a robust electronic signature solution that streamlines document signing processes. With airSlate SignNow's eta 9035, businesses can enhance productivity by reducing turnaround times for contracts and agreements, ensuring a more efficient workflow. This solution is particularly beneficial for businesses looking to save time and resources while maintaining a high level of security.

-

How does the pricing for the eta 9035 compare with other eSignature solutions?

The eta 9035 offers competitive pricing, making it an economical choice for businesses of all sizes. Compared to other eSignature solutions, airSlate SignNow provides a cost-effective alternative without compromising on features or functionality. Explore our pricing plans to find the best fit for your organization's needs.

-

What features are included with the eta 9035?

The eta 9035 includes a range of features designed to optimize the document signing process. Key features include customizable templates, real-time tracking, and robust security measures to safeguard your sensitive information. These tools empower users to manage their workflows effortlessly and securely.

-

Can I integrate the eta 9035 with my existing software?

Yes, the eta 9035 is designed to seamlessly integrate with a variety of software platforms. Whether you use CRM systems, document management tools, or cloud storage solutions, airSlate SignNow's eta 9035 provides the flexibility needed to enhance your current workflows. This integration capability helps streamline your processes and improve overall efficiency.

-

Is the eta 9035 secure for sensitive documents?

Absolutely, the eta 9035 employs industry-standard encryption and security protocols to protect your sensitive documents. With airSlate SignNow, you can rest assured that your information is secure throughout the signing process. Our commitment to security ensures compliance with regulations such as GDPR and HIPAA.

-

How can the eta 9035 improve my team's productivity?

The eta 9035 is designed to signNowly improve team productivity by simplifying the document signing process. With features like bulk sending and automated reminders, your team can focus on their core tasks rather than getting bogged down by paperwork. By utilizing the eta 9035, businesses can achieve faster completion rates for contracts and agreements.

-

What types of documents can I sign using the eta 9035?

The eta 9035 allows you to sign a wide variety of document types, including contracts, agreements, and consent forms. With airSlate SignNow, businesses can easily manage all their documentation needs digitally. This versatility ensures that you can handle virtually any document that requires a signature with ease.

Get more for eta9035

Find out other eta 9035

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document