Form 4506 T Request for Transcript of Tax Return OMB No

What is the Form 4506 T Request For Transcript Of Tax Return

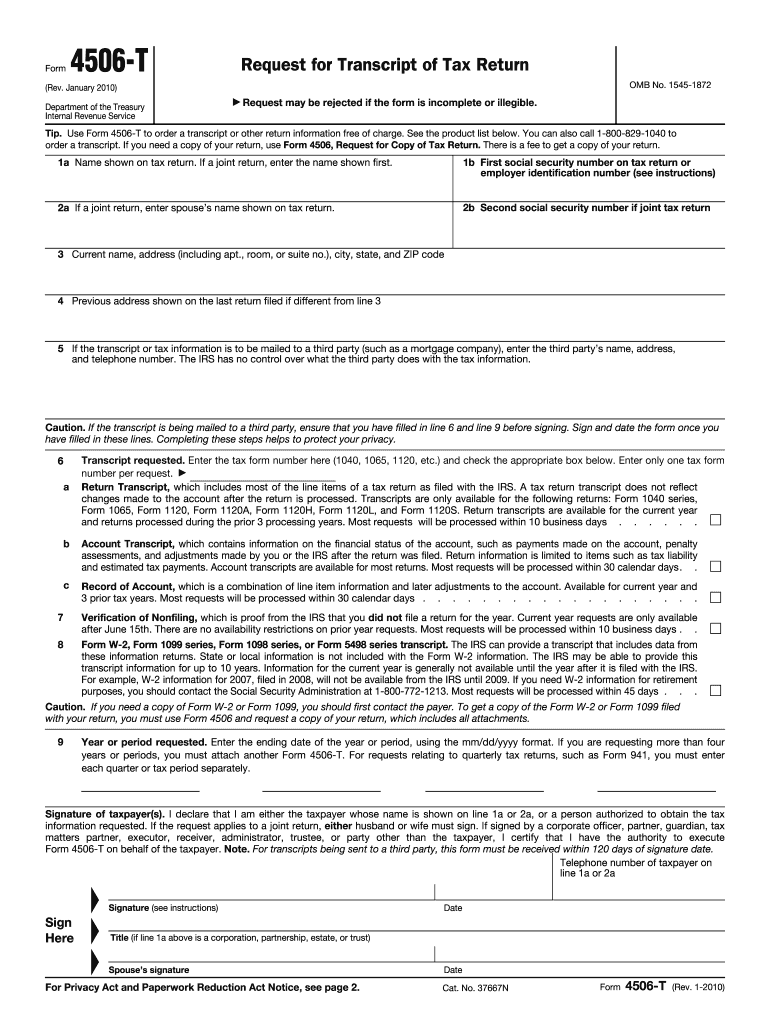

The Form 4506 T, officially known as the Request for Transcript of Tax Return, is a document used by taxpayers to request a transcript of their tax return from the Internal Revenue Service (IRS). This form allows individuals and businesses to obtain various types of tax return information, including tax account transcripts, return transcripts, and record of account transcripts. It is essential for those who need to verify their income for purposes such as applying for loans or financial aid.

Steps to Complete the Form 4506 T Request For Transcript Of Tax Return

Completing the Form 4506 T requires careful attention to detail. Here are the key steps:

- Provide personal information: Include your name, Social Security number, and address as they appear on your tax return.

- Specify the type of transcript: Indicate whether you want a tax return transcript, tax account transcript, or record of account transcript.

- Indicate the tax years: Clearly state the tax years for which you are requesting transcripts.

- Sign and date the form: Ensure that you sign the form to authorize the IRS to release your information.

How to Use the Form 4506 T Request For Transcript Of Tax Return

Once you have completed the Form 4506 T, you can use it to obtain your tax return transcripts. The form can be submitted to the IRS either by mail or electronically, depending on your preference. If you choose to mail the form, ensure that you send it to the correct address based on your state of residence. For electronic submissions, use a trusted eSignature platform to ensure compliance and security.

Legal Use of the Form 4506 T Request For Transcript Of Tax Return

The Form 4506 T is legally recognized and must be completed accurately to ensure that the IRS can process your request. It is crucial to understand that submitting false information on this form can lead to penalties or legal repercussions. The form is designed to protect taxpayer information while allowing access to necessary tax documents for legitimate purposes.

Required Documents for the Form 4506 T Request For Transcript Of Tax Return

When submitting the Form 4506 T, you typically do not need to provide additional documents. However, it is advisable to have your tax identification number, previous tax returns, and any relevant financial documents on hand to ensure that you can accurately complete the form. This preparation can help streamline the process and reduce potential delays in obtaining your transcripts.

Form Submission Methods

The Form 4506 T can be submitted to the IRS through various methods. You can mail the completed form to the appropriate address based on your state. Alternatively, if you are using an eSignature platform, you may be able to submit the form electronically. Ensure that you follow the submission guidelines provided by the IRS to avoid any issues with your request.

Quick guide on how to complete form 4506 t request for transcript of tax return omb no

Effortlessly Prepare Form 4506 T Request For Transcript Of Tax Return OMB No on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 4506 T Request For Transcript Of Tax Return OMB No on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 4506 T Request For Transcript Of Tax Return OMB No with Ease

- Obtain Form 4506 T Request For Transcript Of Tax Return OMB No and click on Obtain Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Complete button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, frustrating form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and electronically sign Form 4506 T Request For Transcript Of Tax Return OMB No to ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

If poker is your only profession and you have no other sources of income, how do you pay taxes for that in India? Which ITR forms should I fill out?

As per Section 115BB of the Income tax Act, 1961 any income of winnings from any lottery or crossword puzzle or race including horse race or card game and other game of any sort or from gambling or betting of any form or nature whatsoever (which includes income from poker) is taxable at 30% plus education cess of 3% (Total 30.9%). There is not benefit of basic exemption limit but Chapter VIA deductions are available i.e. section 80C, 80 D and other seciton 80- deductions. TDS is also deductible at 30%.

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t request for transcript of tax return omb no

How to generate an eSignature for the Form 4506 T Request For Transcript Of Tax Return Omb No in the online mode

How to generate an eSignature for the Form 4506 T Request For Transcript Of Tax Return Omb No in Google Chrome

How to make an electronic signature for putting it on the Form 4506 T Request For Transcript Of Tax Return Omb No in Gmail

How to generate an eSignature for the Form 4506 T Request For Transcript Of Tax Return Omb No straight from your smart phone

How to generate an electronic signature for the Form 4506 T Request For Transcript Of Tax Return Omb No on iOS devices

How to create an eSignature for the Form 4506 T Request For Transcript Of Tax Return Omb No on Android

People also ask

-

What does the signer need to complete on the 4506-T request for transcript of tax return document?

The signer needs to provide personal information such as their name, Social Security number, and address on the 4506-T request for transcript of tax return document. Additionally, they may need to specify the type of tax return requested and the year for which they are seeking transcripts. Ensuring all required fields are accurately filled out will expedite the processing of their request.

-

How can airSlate SignNow help with the 4506-T request?

airSlate SignNow simplifies the process of completing the 4506-T request by allowing signers to fill out and eSign the document electronically. This eliminates the need for printing and scanning, making it easier and quicker to submit requests. By using our platform, businesses can streamline their tax transcript requests without hassle.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans include options for individual users as well as teams, with features that enhance document management and eSigning capabilities. The cost-effective solutions ensure that all users can find a plan that fits their budget while helping them manage the 4506-T request for transcript of tax return document effectively.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with several business applications, enhancing its functionality and allowing for seamless workflow management. Users can connect with popular platforms like Google Drive, Dropbox, and CRM systems to streamline the process of managing documents such as the 4506-T request for transcript of tax return document. This ensures data coherence across different platforms.

-

What benefits does airSlate SignNow offer for tax document management?

airSlate SignNow provides numerous benefits for managing tax documents, including secure storage, easy access, and automated workflows. These features simplify the process of completing the 4506-T request for transcript of tax return document, ensuring that all documents are correctly filled out and securely stored. The platform's user-friendly interface also enhances overall efficiency.

-

Can multiple signers complete the 4506-T request on airSlate SignNow?

Absolutely, airSlate SignNow allows multiple signers to collaborate on documents, including the 4506-T request for transcript of tax return document. This feature is particularly beneficial for organizations where different individuals may need to provide inputs or approvals. The platform ensures all changes are tracked and documented effectively.

-

Is it secure to use airSlate SignNow for sensitive documents?

Yes, airSlate SignNow prioritizes security, employing top-tier encryption protocols to protect sensitive documents like the 4506-T request for transcript of tax return document. With advanced security measures, users can trust that their data is safe during transmission and storage. Compliance with regulations further ensures the integrity of the signing process.

Get more for Form 4506 T Request For Transcript Of Tax Return OMB No

- Chase paymatics bagreementb 01 25 16 pdf form

- Declaration of homestead secretary of the commonwealth sec state ma form

- Employee equipment checkout form

- Mdot form vr 210

- Obc ncl certificate format appendix 2

- Provider information sheet mclaren health care mclarenhealthplan

- Request to add terminate or change other insurance form

- Hipp direct deposit form

Find out other Form 4506 T Request For Transcript Of Tax Return OMB No

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure