January Department of the Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate Form

What is the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

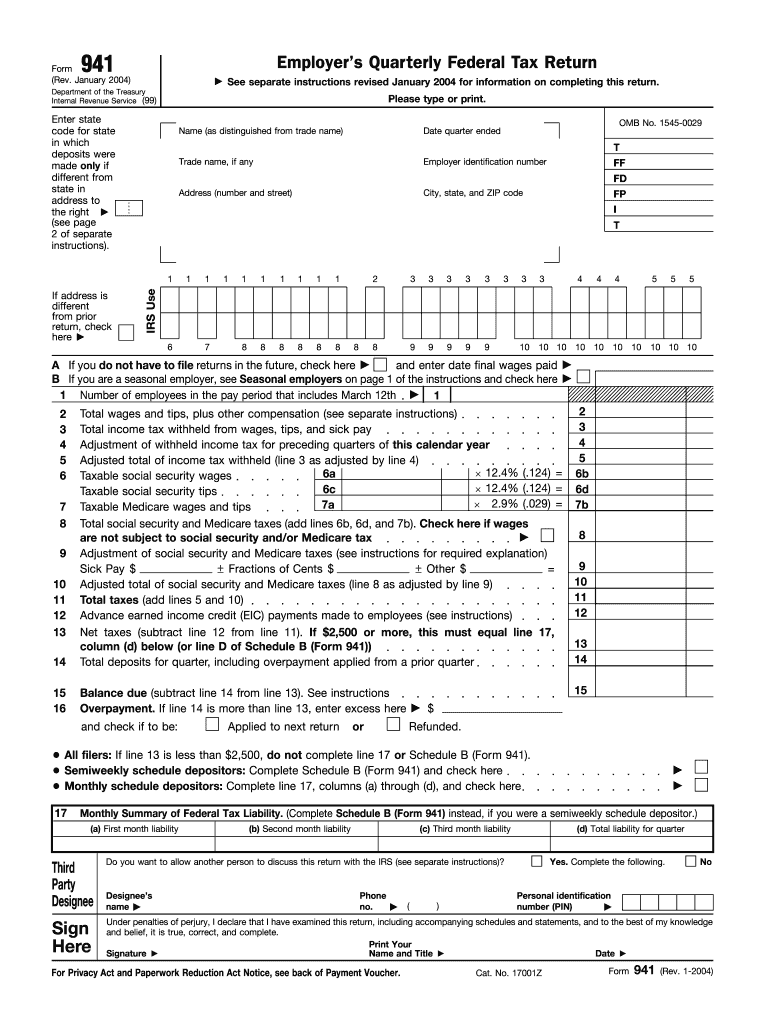

The January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return, commonly referred to as the 941 form, is a crucial document used by employers in the United States to report payroll taxes. This form provides the IRS with information regarding the wages paid to employees, the taxes withheld from those wages, and the employer's share of Social Security and Medicare taxes. It is essential for compliance with federal tax regulations and helps ensure that the correct amount of taxes is remitted to the government.

Steps to complete the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

Completing the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return involves several key steps:

- Gather necessary information, including total wages paid, tips reported, and taxes withheld.

- Fill out the form accurately, ensuring all sections are completed, including the employer identification number (EIN) and the quarter being reported.

- Calculate the total taxes due, including the employer's portion of Social Security and Medicare taxes.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Legal use of the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

The January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return is legally binding when completed and submitted correctly. Employers must ensure that the information reported is accurate and reflects true payroll practices. Failure to comply with IRS regulations can result in penalties, including fines and interest on unpaid taxes. Using digital tools for form completion and submission can enhance security and compliance, as long as they meet the legal requirements set forth by the IRS.

Filing Deadlines / Important Dates

It is vital for employers to be aware of the filing deadlines associated with the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return. The form is due on the last day of the month following the end of each quarter. Specifically, for the first quarter (January to March), the due date is April 30. For the second quarter (April to June), the deadline is July 31. The third quarter (July to September) is due on October 31, and the fourth quarter (October to December) must be filed by January 31 of the following year. Timely submission helps avoid penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return. The form can be filed electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, employers may choose to mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available for this form, making electronic filing or mailing the primary methods for compliance.

Penalties for Non-Compliance

Failure to file the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return on time can result in significant penalties for employers. The IRS imposes a failure-to-file penalty, which can be a percentage of the unpaid tax amount for each month the return is late. Additionally, employers may face interest charges on any unpaid taxes. It is crucial for businesses to stay informed about their filing obligations to avoid these penalties and maintain compliance with federal tax laws.

Quick guide on how to complete january 2004 department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate

Complete [SKS] effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

Create this form in 5 minutes!

How to create an eSignature for the january 2004 department of the treasury internal revenue service 99 941 employers quarterly federal tax return see separate

How to make an electronic signature for your January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate in the online mode

How to generate an electronic signature for your January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate in Google Chrome

How to create an electronic signature for putting it on the January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate in Gmail

How to make an electronic signature for the January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate right from your smart phone

How to make an eSignature for the January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate on iOS

How to generate an electronic signature for the January 2004 Department Of The Treasury Internal Revenue Service 99 941 Employers Quarterly Federal Tax Return See Separate on Android

People also ask

-

What is the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

The January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate is a form that employers use to report payroll taxes to the IRS. This form helps ensure compliance with federal tax regulations and provides important information about employee wages, tips, and withheld taxes for the quarter.

-

How can airSlate SignNow help with the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

airSlate SignNow can simplify the process of completing and submitting the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate by enabling users to fill out, sign, and securely send the form electronically. This digital solution enhances efficiency and accuracy, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for my January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the features and level of service you require. However, the cost is often offset by the time savings and increased accuracy when preparing the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate.

-

What features does airSlate SignNow offer for managing the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

airSlate SignNow offers several features to assist with the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate, including customizable templates, electronic signatures, and automated reminders. These tools streamline the filing process and ensure timely submission.

-

Can I integrate airSlate SignNow with other accounting software for my taxes?

Yes, airSlate SignNow can integrate with various accounting and tax software, allowing for seamless data transfer when preparing the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. This integration enhances productivity and ensures that all data remains consistent across platforms.

-

How secure is my information when using airSlate SignNow for tax returns?

airSlate SignNow prioritizes security and utilizes top-notch encryption to protect all user data, including information related to the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate. Compliance with industry standards ensures your sensitive information remains confidential and secure.

-

What are the benefits of digital signatures for the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate?

Digital signatures make it easier to sign and send the January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate quickly, without the need for printing or physical methods. This not only saves time but also enhances the authenticity and integrity of your document.

Get more for January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

Find out other January Department Of The Treasury Internal Revenue Service 99 941 Employer's Quarterly Federal Tax Return See Separate

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template