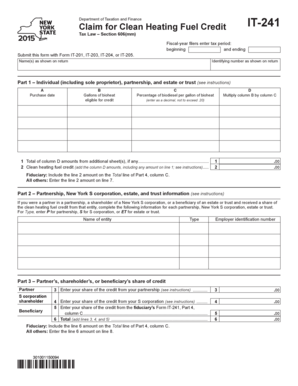

Form it 241Claim for Clean Heating Fuel Creditit241 Tax Ny

What is the Form IT-241 Claim for Clean Heating Fuel Credit?

The Form IT-241 is a tax form used in New York State to claim a credit for clean heating fuel. This credit is designed to encourage the use of environmentally friendly heating fuels, which can help reduce greenhouse gas emissions. Eligible taxpayers can benefit from this credit, making it an important document for those who utilize clean heating sources in their homes or businesses.

How to Obtain the Form IT-241

To obtain the Form IT-241, taxpayers can visit the New York State Department of Taxation and Finance website. The form is available for download in a printable format. Additionally, taxpayers may request a physical copy by contacting the department directly. It is essential to ensure that you have the most current version of the form to avoid any issues during the filing process.

Steps to Complete the Form IT-241

Completing the Form IT-241 involves several key steps:

- Gather all necessary documentation related to your clean heating fuel usage.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the type and amount of clean heating fuel used during the tax year.

- Calculate the credit based on the guidelines provided in the form instructions.

- Review your completed form for accuracy before submission.

Legal Use of the Form IT-241

The Form IT-241 is legally binding when completed and submitted according to New York State tax regulations. It is crucial to provide accurate information to avoid penalties. The form must be signed and dated by the taxpayer, and it should be submitted within the designated filing period to ensure compliance with state tax laws.

Eligibility Criteria for the Form IT-241

To qualify for the clean heating fuel credit on the Form IT-241, taxpayers must meet specific eligibility criteria:

- Must be a resident of New York State.

- Must have used clean heating fuel in a residential or commercial property.

- Must provide proof of fuel purchase and usage.

Filing Deadlines for the Form IT-241

Taxpayers must be aware of the filing deadlines for the Form IT-241 to ensure timely submission. Generally, the form must be filed with your New York State income tax return by the same deadline as your federal tax return. It is advisable to check the New York State Department of Taxation and Finance website for any specific deadlines or changes that may apply.

Quick guide on how to complete form it 241claim for clean heating fuel creditit241 tax ny

Effortlessly complete Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without holdups. Manage Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny with minimal effort

- Locate Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize relevant sections of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which is quick and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and eSign Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny to ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 241claim for clean heating fuel creditit241 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

Form IT 241 is a tax form used in New York that allows individuals and businesses to claim a credit for clean heating fuel. This credit helps offset the costs of using clean heating sources, promoting environmentally friendly practices. Understanding how to properly fill out Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with completing Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

airSlate SignNow provides an efficient platform for eSigning and managing documents, including the Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny. Our user-friendly interface guides you through the document signing process, ensuring that you complete your forms accurately and promptly. This helps streamline your tax filing process and minimize errors.

-

Is there a cost associated with using airSlate SignNow for Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

While airSlate SignNow offers various pricing plans, users can take advantage of our cost-effective solutions tailored for businesses. You can choose a plan that fits your needs, whether you’re signing a few documents or many. Investing in our platform can save you time and resources when preparing your Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny.

-

What features does airSlate SignNow offer for managing Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

Our platform offers several features, including eSigning, document templates, and real-time tracking to help manage your Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny. Additionally, collaborative tools allow multiple parties to review and sign the document seamlessly. These features ensure a streamlined workflow for tax preparation.

-

Can airSlate SignNow integrate with other software to assist with Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

Yes, airSlate SignNow integrates with various applications to enhance your document management process. This includes popular accounting and tax software, allowing for a seamless workflow when handling Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny. Integrations help synchronize your data, reducing manual entry and potential errors.

-

What are the benefits of using airSlate SignNow for tax documents like Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

Using airSlate SignNow for Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny ensures quick and secure handling of your tax documents. Our electronic signature feature speeds up the signing process and enhances security. This modern solution promotes efficiency, allowing you to submit your tax claims on time with confidence.

-

Is airSlate SignNow easy to use for completing Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny?

Absolutely! airSlate SignNow is designed with usability in mind, making it easy for anyone to navigate. Whether you're tech-savvy or not, you can effortlessly complete your Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny with our intuitive interface and helpful guides.

Get more for Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny

- Business law assignment 8 questionsbusiness ampamp finance form

- Friend when you are not sure what youve done form

- Board actions by written consent ampampamp interested director form

- Of church nonprofit corporation form

- Application for employment ward medical services form

- Sam user guide office of the under secretary of defense for form

- Did you know that labor day was created by the labor movement to form

- Incorporation of n a m e o f c o m p a n y inc form

Find out other Form IT 241Claim For Clean Heating Fuel Creditit241 Tax Ny

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy