Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, or Nonresident Alien Individual

What is the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

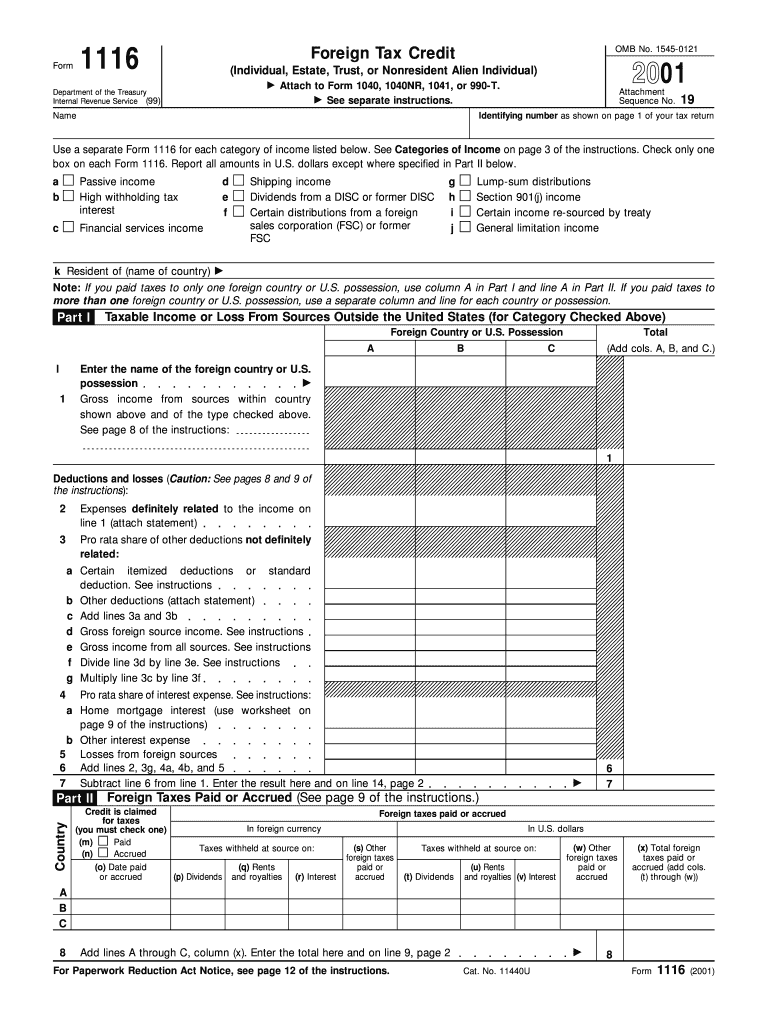

The Form 1116 Fill in Version is a tax form used by individuals, estates, trusts, or nonresident alien individuals to claim the Foreign Tax Credit. This credit allows taxpayers to reduce their U.S. tax liability based on the amount of foreign taxes paid or accrued during the tax year. The form is essential for those who have income from foreign sources, ensuring they do not face double taxation on the same income. By filing this form, taxpayers can report foreign taxes paid and calculate the allowable credit, which can significantly impact their overall tax obligation.

How to use the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

Using the Form 1116 Fill in Version involves several steps to ensure accurate completion and submission. First, gather all relevant documentation, including proof of foreign taxes paid and income earned abroad. Next, carefully fill out the form, providing detailed information about your foreign income, taxes, and any applicable deductions. It is crucial to follow the IRS guidelines to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or by mail, depending on your filing preferences and requirements.

Steps to complete the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

Completing the Form 1116 Fill in Version requires a systematic approach:

- Gather necessary documents, including foreign tax statements and income records.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Report your foreign income in the appropriate sections, ensuring accuracy in amounts and currencies.

- Detail the foreign taxes paid or accrued, providing documentation to support your claims.

- Calculate the allowable credit based on IRS guidelines, ensuring all calculations are precise.

- Review the completed form for errors before submission.

Legal use of the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

The legal use of the Form 1116 Fill in Version is governed by IRS regulations, which stipulate that the form must be completed accurately to claim the Foreign Tax Credit. This form is legally binding and must be submitted as part of your annual tax return. Failure to file correctly can result in penalties or disallowance of the claimed credit. It is important to maintain records of all foreign taxes paid and to keep copies of the submitted form for your records, as these may be required for future audits or inquiries by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1116 Fill in Version align with the annual tax return deadlines. Generally, individual taxpayers must file their returns by April 15 of the following year. If you require additional time, you can file for an extension, which typically extends the deadline by six months. However, any taxes owed must still be paid by the original due date to avoid penalties and interest. It is essential to stay informed about any changes in deadlines or requirements that may arise due to legislative updates or IRS announcements.

Examples of using the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

There are various scenarios where the Form 1116 Fill in Version is applicable. For instance, an individual who works abroad and pays foreign income taxes can use this form to claim a credit against their U.S. tax liability. Similarly, a trust that earns income from foreign investments may also file this form to reduce its tax burden. Nonresident aliens with U.S. source income and foreign taxes paid can benefit from this form as well. Each of these examples illustrates the importance of the Foreign Tax Credit in mitigating double taxation for U.S. taxpayers with international financial interests.

Quick guide on how to complete 2001 form 1116 fill in version foreign tax credit individual estate trust or nonresident alien individual

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about missing or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

Create this form in 5 minutes!

How to create an eSignature for the 2001 form 1116 fill in version foreign tax credit individual estate trust or nonresident alien individual

How to create an eSignature for the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual in the online mode

How to create an eSignature for the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual in Chrome

How to create an eSignature for signing the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual in Gmail

How to create an eSignature for the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual from your smartphone

How to make an eSignature for the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual on iOS devices

How to make an eSignature for the 2001 Form 1116 Fill In Version Foreign Tax Credit Individual Estate Trust Or Nonresident Alien Individual on Android

People also ask

-

What is the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual?

The Form 1116 Fill in Version for Foreign Tax Credit is designed to help individuals, estates, trusts, and nonresident alien individuals claim a credit for foreign taxes paid. This form allows taxpayers to reduce their U.S. tax liability by the amount of foreign taxes they have already paid. Using the eSignature capabilities of airSlate SignNow, you can easily fill and submit this form securely.

-

How can airSlate SignNow help with the Form 1116 process?

airSlate SignNow simplifies the process of completing the Form 1116 Fill in Version for Foreign Tax Credit. With our user-friendly platform, you can fill out the form digitally, eSign it, and share it seamlessly with your tax advisor or accountant. This efficiency saves you time and ensures your documents are processed quickly.

-

What are the pricing options for using airSlate SignNow for Form 1116?

airSlate SignNow offers flexible pricing options tailored to different needs, starting with a free trial. This allows users to explore the features available for completing the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual. Competitive subscription plans cater to individual users as well as businesses, ensuring everyone can find a suitable solution.

-

Is the airSlate SignNow platform secure for handling sensitive tax documents like Form 1116?

Yes, airSlate SignNow prioritizes the security of your sensitive documents, including the Form 1116 Fill in Version Foreign Tax Credit. We employ state-of-the-art encryption and security protocols to protect your data during transmission and storage. You can confidently sign and share your tax forms without fear of data bsignNowes.

-

Can I integrate airSlate SignNow with other tools for managing my tax documents?

Absolutely! airSlate SignNow offers seamless integrations with numerous tools and platforms, allowing you to manage all your tax-related documents, including the Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual. These integrations help streamline your workflow, ensuring that your documentation process is both efficient and organized.

-

What features does airSlate SignNow offer to assist with filling out Form 1116?

The platform includes an intuitive form builder and template library that helps users easily complete the Form 1116 Fill in Version Foreign Tax Credit. Features such as drag-and-drop document editing, customizable fields, and eSignature capabilities ensure that every aspect of the form is completed accurately. Additionally, you can track the status of your documents in real time.

-

How quickly can I complete and submit the Form 1116 using airSlate SignNow?

With airSlate SignNow, you can complete and submit the Form 1116 Fill in Version Foreign Tax Credit in a matter of minutes. The user-friendly interface accelerates the filling process, while the eSignature feature allows for immediate document signing and sharing. This efficiency means you can file your forms on time and avoid potential penalties.

Get more for Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

- Crs self certification form template

- Partnership application form american association of exporters

- Programming languages principles and practice 2nd edition pdf form

- Maryland divorce papers pdf form

- Income tax form vsi r

- Ga studies study guide answer key form

- Utility service request spotsylvania county form

- Pregnancy risk assessment template word 210567471 form

Find out other Form 1116 Fill in Version Foreign Tax Credit Individual, Estate, Trust, Or Nonresident Alien Individual

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document