Form 80 105 12 8 1 000

What is the Form 80 105 12 8 1 000

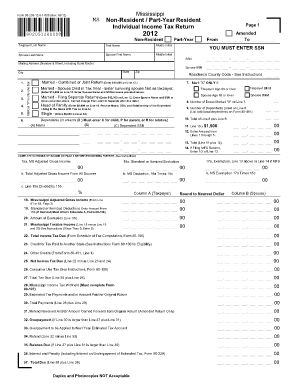

The Form 80 105 12 8 1 000 is a specific document used for various administrative purposes, often related to legal or governmental processes. It is essential for individuals or businesses to understand its function and requirements to ensure compliance with relevant regulations. This form may be required for applications, disclosures, or other formal submissions, depending on the context in which it is used.

How to use the Form 80 105 12 8 1 000

Using the Form 80 105 12 8 1 000 involves several steps to ensure that all necessary information is accurately provided. Begin by reviewing the form to understand the required fields. Fill out the form carefully, ensuring all information is complete and accurate. Once filled, the form can be submitted according to the guidelines specified for its use, which may include online submission or mailing to a designated address.

Steps to complete the Form 80 105 12 8 1 000

Completing the Form 80 105 12 8 1 000 involves a systematic approach:

- Read the instructions carefully to understand the requirements.

- Gather all necessary information and documents needed to fill out the form.

- Complete each section of the form, double-checking for accuracy.

- Sign and date the form as required.

- Submit the form through the appropriate channel, whether online or by mail.

Legal use of the Form 80 105 12 8 1 000

The legal use of the Form 80 105 12 8 1 000 is governed by specific regulations that dictate how it should be completed and submitted. Ensuring compliance with these regulations is crucial for the form to be considered valid. This includes adhering to signature requirements, submission deadlines, and any associated documentation that may be required to accompany the form.

Key elements of the Form 80 105 12 8 1 000

Key elements of the Form 80 105 12 8 1 000 typically include:

- Identification information, such as name and address.

- Specific details relevant to the purpose of the form.

- Signature section to validate the information provided.

- Date of submission to track compliance with deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form 80 105 12 8 1 000 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal, if available.

- Mailing the completed form to the specified address.

- In-person submission at an authorized location, if applicable.

Quick guide on how to complete form 80 105 12 8 1 000

Complete Form 80 105 12 8 1 000 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without complications. Manage Form 80 105 12 8 1 000 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Form 80 105 12 8 1 000 without any hassle

- Find Form 80 105 12 8 1 000 and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that require printing additional document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 80 105 12 8 1 000 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 80 105 12 8 1 000

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 80 105 12 8 1 000?

Form 80 105 12 8 1 000 is a specific document format utilized for various administrative purposes. airSlate SignNow allows users to seamlessly create, edit, and eSign this form, ensuring compliance and efficiency. Utilizing our platform simplifies managing this document type.

-

How can I use airSlate SignNow to manage Form 80 105 12 8 1 000?

You can use airSlate SignNow to upload, modify, and eSign Form 80 105 12 8 1 000 easily. Our platform provides templates and tools to ensure you can handle this form effortlessly. This streamlines the entire signing process and enhances collaboration.

-

Is there a cost associated with using airSlate SignNow for Form 80 105 12 8 1 000?

Yes, there are different pricing plans available that cater to various business needs for managing Form 80 105 12 8 1 000. These plans are designed to be cost-effective, ensuring you can effectively eSign documents without breaking the bank. You can choose the plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for Form 80 105 12 8 1 000?

airSlate SignNow provides numerous features tailored for Form 80 105 12 8 1 000, including customizable templates, secure cloud storage, and real-time tracking. Our eSigning solutions enhance document management, making it easier to obtain signatures and manage compliance. You will find the platform intuitive and user-friendly.

-

Can airSlate SignNow integrate with other applications for Form 80 105 12 8 1 000?

Yes, airSlate SignNow offers integration options with various applications to help manage Form 80 105 12 8 1 000. This ensures that your workflow remains uninterrupted and streamlined across multiple platforms. By integrating your essential tools, your document management process becomes much more efficient.

-

What are the benefits of using airSlate SignNow for Form 80 105 12 8 1 000?

Using airSlate SignNow for Form 80 105 12 8 1 000 leads to improved efficiency and reduced paperwork. The ability to eSign documents quickly and securely enhances your productivity. Additionally, our platform's compliance features ensure that your documents meet necessary standards.

-

How secure is the process of eSigning Form 80 105 12 8 1 000 with airSlate SignNow?

The security of your documents, including Form 80 105 12 8 1 000, is our top priority at airSlate SignNow. Our platform implements advanced encryption and security protocols to protect your data. You can eSign documents with confidence knowing they remain confidential and safe.

Get more for Form 80 105 12 8 1 000

- Checklist partnership agreement form

- Full text of ampquotannual report of the state engineer and form

- Generic samples of church articles of incorporation and form

- How to write personal statements may 2017 form

- Department of justice ada title iii regulation 28 cfr part form

- Share purchase agreement template form

- 14 form checklist for software license agreement

- Sample nonprofit bylaws template to start a form 1023

Find out other Form 80 105 12 8 1 000

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile