770es Form

What is the 770es

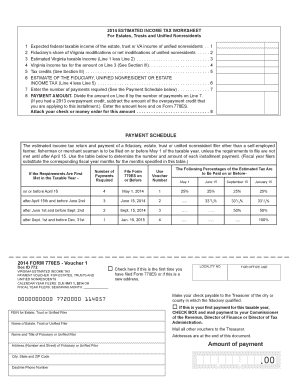

The 770es form is a specific document used in various legal and administrative contexts. It serves as a formal request or declaration that may be required by certain institutions or government agencies. Understanding its purpose is essential for ensuring compliance with relevant regulations. This form typically requires detailed information about the individual or entity submitting it, including identification details and the nature of the request being made.

How to use the 770es

Using the 770es form involves several key steps to ensure that it is completed correctly. First, gather all necessary information, including personal identification and any relevant documentation. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the 770es

Completing the 770es form requires careful attention to detail. Follow these steps for successful submission:

- Collect necessary documents, such as identification and supporting materials.

- Access the 770es form online or obtain a physical copy.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check your entries for correctness and completeness.

- Submit the form as instructed, keeping a copy for your records.

Legal use of the 770es

The legal use of the 770es form is critical for ensuring that submissions are recognized and accepted by relevant authorities. Compliance with applicable laws and regulations is essential. This includes understanding any specific requirements related to signatures, documentation, and submission methods. Utilizing a trusted platform for electronic signatures can enhance the legal standing of the completed form, ensuring it meets all necessary legal criteria.

Key elements of the 770es

Several key elements must be included in the 770es form for it to be valid. These elements typically consist of:

- Personal or business identification details.

- A clear description of the purpose of the form.

- Any required signatures or certifications.

- Supporting documentation, if applicable.

Ensuring that these elements are correctly addressed will facilitate the processing of the form and help avoid potential delays or rejections.

Filing Deadlines / Important Dates

Filing deadlines for the 770es form can vary depending on the specific context in which it is used. It is important to be aware of any relevant dates to ensure timely submission. Missing a deadline may result in penalties or complications with the request being processed. Always check for the most current information regarding deadlines and plan accordingly to avoid any issues.

Quick guide on how to complete 770es

Prepare 770es effortlessly on any gadget

Web-based document administration has gained popularity among businesses and individuals. It offers a seamless eco-friendly substitute to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and sign your documents quickly without delays. Manage 770es on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and sign 770es effortlessly

- Locate 770es and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and sign 770es and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 770es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 770es and how does it relate to airSlate SignNow?

770es is a powerful feature within airSlate SignNow that streamlines the eSigning process. It allows users to effortlessly send and sign documents, ensuring a smooth workflow for businesses of all sizes. Leveraging 770es can signNowly enhance document management efficiency.

-

How much does the 770es feature cost?

The 770es feature is included in the airSlate SignNow pricing plans, which are designed to be budget-friendly. Various subscription tiers cater to different business needs, making it easy to find an option that suits your budget. Explore our pricing page for detailed information.

-

What are the key benefits of using 770es?

770es offers numerous benefits including increased productivity, reduced turnaround time for document signing, and enhanced security. By simplifying the eSigning process, it helps businesses save time and reduces the need for physical paperwork. This leads to greater efficiency and a more streamlined workflow.

-

What features does the 770es system include?

The 770es system includes features such as document templates, custom branding, and advanced authentication options. These functionalities ensure that you can customize your signing experience to fit your unique business requirements. airSlate SignNow's 770es empowers organizations to manage their documents with precision.

-

How can I integrate airSlate SignNow's 770es with other tools?

airSlate SignNow's 770es can be easily integrated with various third-party applications including CRM systems, cloud storage, and project management tools. These integrations enable a seamless workflow, allowing users to automate document sending and tracking. To learn more about integrations, check our API documentation.

-

Is 770es secure for eSigning sensitive documents?

Yes, 770es is designed with security in mind, using encryption and compliance with industry standards to protect sensitive documents. airSlate SignNow ensures that all data is stored securely, providing peace of mind for businesses handling confidential information. Trust in 770es for secure and efficient eSigning.

-

Can I customize the 770es signing workflow?

Absolutely! The 770es signing workflow can be tailored to meet your specific needs, allowing you to set custom fields, add signers, and establish signing order. This flexibility makes it ideal for businesses with varied document processes. Customize your workflow within airSlate SignNow to enhance operational efficiency.

Get more for 770es

- Clean seed capital usa patent office approves smart form

- Proposal to approve the material terms of the form

- Sec info renaissance cosmetics incde 10 k405 for 3 form

- Def14a secgov form

- Proxy statementsstrategy amp f form

- Sec info dfa investment dimensions group inc n 30d form

- Form s 8 pos sec

- 6 k deswell industries inc secgov form

Find out other 770es

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document