Authorization Template Rrsp Payroll Deduction Form

What is the Authorization Template Rrsp Payroll Deduction Form

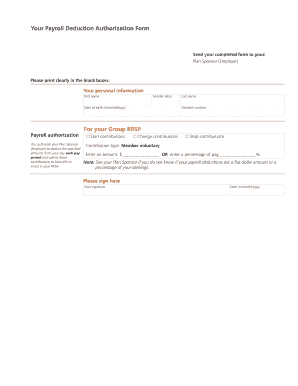

The Authorization Template Rrsp Payroll Deduction Form is a crucial document used by employees to authorize their employers to deduct specific amounts from their paychecks for contributions to a Registered Retirement Savings Plan (RRSP). This form ensures that employees can save for retirement while benefiting from potential tax advantages. By completing this form, employees provide clear instructions to their employers regarding the amount and frequency of deductions, facilitating a seamless payroll process.

How to use the Authorization Template Rrsp Payroll Deduction Form

Using the Authorization Template Rrsp Payroll Deduction Form involves a straightforward process. Employees should first obtain the form from their employer or a trusted source. Once in possession of the form, they need to fill in personal details, including their name, employee ID, and the amount they wish to contribute to their RRSP. After completing the form, it should be submitted to the payroll department for processing. Employers will then implement the deductions as specified, ensuring that contributions are made regularly to the employee's RRSP account.

Steps to complete the Authorization Template Rrsp Payroll Deduction Form

Completing the Authorization Template Rrsp Payroll Deduction Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from your employer or download it from a reliable source.

- Fill in your personal information, including your full name, address, and employee ID.

- Specify the amount you wish to contribute to your RRSP, along with the frequency of deductions (e.g., weekly, bi-weekly, monthly).

- Review the form for accuracy, ensuring all information is correct.

- Sign and date the form to authorize the deductions.

- Submit the completed form to your payroll department for processing.

Key elements of the Authorization Template Rrsp Payroll Deduction Form

The Authorization Template Rrsp Payroll Deduction Form contains several key elements that are essential for proper execution. These include:

- Employee Information: Personal details such as name, address, and employee ID.

- Contribution Amount: The specific dollar amount or percentage of salary to be deducted.

- Deduction Frequency: The schedule for deductions, whether it be weekly, bi-weekly, or monthly.

- Signature: The employee's signature is required to validate the authorization.

- Date: The date on which the form is signed, indicating when the authorization takes effect.

Legal use of the Authorization Template Rrsp Payroll Deduction Form

The Authorization Template Rrsp Payroll Deduction Form is legally binding when completed correctly. It serves as a formal agreement between the employee and employer regarding payroll deductions for RRSP contributions. To ensure its legal validity, the form must be signed by the employee, and the employer must adhere to the specified terms. Compliance with applicable laws and regulations, such as the Employee Retirement Income Security Act (ERISA), is essential to maintain the integrity of the deductions and protect both parties involved.

Form Submission Methods (Online / Mail / In-Person)

Employees can submit the Authorization Template Rrsp Payroll Deduction Form through various methods, depending on their employer's policies. Common submission methods include:

- In-Person: Handing the completed form directly to the payroll or HR department.

- Mail: Sending the form via postal service to the designated payroll address.

- Online: Some employers may offer digital submission options through employee portals or email.

Quick guide on how to complete authorization template rrsp payroll deduction form

Effortlessly prepare Authorization Template Rrsp Payroll Deduction Form on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without hassle. Manage Authorization Template Rrsp Payroll Deduction Form on any device using the airSlate SignNow apps available for Android and iOS, and streamline your document processes today.

The simplest way to modify and eSign Authorization Template Rrsp Payroll Deduction Form with ease

- Locate Authorization Template Rrsp Payroll Deduction Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Authorization Template Rrsp Payroll Deduction Form while ensuring clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization template rrsp payroll deduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Authorization Template Rrsp Payroll Deduction Form?

The Authorization Template Rrsp Payroll Deduction Form is a customizable document that allows employees to authorize their employer to deduct contributions for a Registered Retirement Savings Plan (RRSP) directly from their payroll. Using airSlate SignNow, this form can be easily created and electronically signed, streamlining the payroll deduction process.

-

How does the Authorization Template Rrsp Payroll Deduction Form benefit employers?

Employers benefit from using the Authorization Template Rrsp Payroll Deduction Form by simplifying the payroll process and ensuring compliance with RRSP regulations. This efficiency reduces administrative workload and minimizes errors in payroll deductions, allowing for a smoother operation of financial management.

-

Is the Authorization Template Rrsp Payroll Deduction Form customizable?

Yes, the Authorization Template Rrsp Payroll Deduction Form is fully customizable within airSlate SignNow. Employers can tailor the form to fit their specific RRSP deduction policies, making it a flexible solution that meets the unique needs of their workforce.

-

How secure is the Authorization Template Rrsp Payroll Deduction Form?

The Authorization Template Rrsp Payroll Deduction Form is handled securely through airSlate SignNow’s encryption features and secure storage solutions. This ensures that sensitive employee information remains protected during the signing and storage processes, adhering to industry-standard security protocols.

-

Can the Authorization Template Rrsp Payroll Deduction Form be integrated with other software?

Absolutely! The Authorization Template Rrsp Payroll Deduction Form can seamlessly integrate with various HR and payroll software, enhancing operational efficiency. This functionality allows for automated updates and minimizes the manual entry of data, ensuring accuracy and saving time.

-

What are the pricing options for using the Authorization Template Rrsp Payroll Deduction Form?

airSlate SignNow offers several pricing plans that include access to the Authorization Template Rrsp Payroll Deduction Form. These plans are designed to meet the needs of businesses of all sizes and provide options for additional features based on your organizational requirements.

-

How do I access the Authorization Template Rrsp Payroll Deduction Form?

You can easily access the Authorization Template Rrsp Payroll Deduction Form by signing up for an account on airSlate SignNow. Once registered, you can explore various templates, including the Authorization Template, and begin creating your forms for electronic signing.

Get more for Authorization Template Rrsp Payroll Deduction Form

- Enforcement of judgmentfullerton ampampamp knowles pc form

- By creditor form

- Utah property lien statutes utah mechanics lien lawlienitnow form

- National real estate ch 5 property ownership and the form

- The above space for recorders use only form

- Structuresthe offer is composed of compensation for loss of form

- Memorandum of agreement federal highway administration form

- Right of way by tenant form

Find out other Authorization Template Rrsp Payroll Deduction Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors