Vat1tr Form

What is the vat1tr?

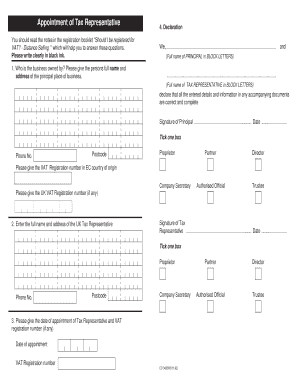

The vat1tr is a specific form used in the United States for various administrative and legal purposes. It is essential for businesses and individuals to understand its function and requirements. This form may be associated with tax filings, compliance documentation, or other regulatory submissions. Understanding the exact nature of the vat1tr is crucial for ensuring proper use and adherence to legal standards.

Steps to complete the vat1tr

Completing the vat1tr form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information: Collect all relevant data required for the form, including personal or business identification details.

- Fill out the form: Carefully input the information into the vat1tr, ensuring all fields are completed accurately.

- Review your entries: Double-check all information for errors or omissions to avoid complications.

- Sign the form: Ensure that the form is signed appropriately, adhering to any specific signature requirements.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the vat1tr

The vat1tr form is legally binding when completed according to specific regulations. To ensure its legal standing, it must meet certain criteria, including proper signatures and adherence to relevant laws. Understanding the legal implications of using the vat1tr is vital for both individuals and businesses, as improper use can lead to compliance issues or legal challenges.

How to obtain the vat1tr

Obtaining the vat1tr form is a straightforward process. It can typically be accessed through official government websites or relevant regulatory bodies. In some cases, businesses may need to request the form directly from specific agencies. Ensure you are using the most current version of the vat1tr to avoid any discrepancies during submission.

Required Documents

When filling out the vat1tr form, certain documents may be required to support your submission. These can include:

- Identification documents such as a driver's license or Social Security number.

- Business registration papers if applicable.

- Financial statements or tax documents that may be relevant to the information requested.

Having these documents ready will facilitate a smoother completion process.

Form Submission Methods

The vat1tr can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via designated government portals.

- Mailing a physical copy to the appropriate agency.

- In-person submission at local offices or designated locations.

Choosing the right method can affect processing times and compliance, so it is essential to follow the guidelines provided with the form.

Quick guide on how to complete vat1tr

Complete Vat1tr effortlessly on any device

Online document administration has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, since you can easily locate the correct form and safely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Vat1tr on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Vat1tr with ease

- Find Vat1tr and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your preference. Adjust and eSign Vat1tr and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat1tr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat1tr and how does airSlate SignNow utilize it?

Vat1tr is a powerful feature in airSlate SignNow that enables users to efficiently manage document workflows and electronic signatures. With vat1tr, businesses can automate signature requests, track document statuses, and enhance overall productivity. This streamlined approach allows teams to focus on their core tasks while ensuring compliance and security.

-

How does airSlate SignNow's pricing structure work for vat1tr?

airSlate SignNow offers a flexible pricing model that includes options tailored for users interested in vat1tr. You can choose from monthly or annual plans, allowing you to select a subscription that best fits your business needs. Each plan includes access to vat1tr features, ensuring you maximize your document signing experience.

-

What are the key features of vat1tr in airSlate SignNow?

The vat1tr feature in airSlate SignNow includes intuitive templates, real-time tracking, and automated reminders for document signing. Additionally, users can customize their workflows to match their unique business processes. These features ensure that you can manage your documents effectively and efficiently.

-

What benefits can businesses expect from using vat1tr?

Businesses that implement vat1tr within airSlate SignNow can expect reduced turnaround times for document signing, improved compliance, and increased operational efficiency. Lost documents and manual errors are minimized, allowing your organization to operate smoothly. Ultimately, vat1tr transforms how you handle important documents.

-

Does airSlate SignNow with vat1tr integrate with other software?

Yes, airSlate SignNow with vat1tr offers seamless integrations with popular business applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility enables users to enhance their workflows and maintain document consistency across platforms. Integrating vat1tr into your existing software ecosystem is straightforward and user-friendly.

-

Is the VAT1TR feature suitable for small businesses?

Absolutely! The vat1tr feature in airSlate SignNow is designed to cater to businesses of all sizes, making it especially beneficial for small businesses. The streamlined processes and cost-effective pricing help small teams manage their documents without the need for complex systems, ensuring that every business can maximize its potential.

-

How secure is the vat1tr feature in airSlate SignNow?

AirSlate SignNow prioritizes security for its vat1tr functionality by employing advanced encryption and compliance with industry standards. All documents signed through vat1tr are securely stored and accessible only to authorized users. You can have peace of mind knowing that your sensitive information is protected throughout the signing process.

Get more for Vat1tr

- Made by you under the contract or sale and any negotiable instrument executed by you will be returned form

- Within ten 10 business days following receipt by the seller of your cancellation notice form

- All said defects arising after form

- If you cancel you must make available to the seller at your residence in substantially as good condition form

- Material over tile form

- House to ice maker form

- Ac heat pump form

- Such as nail pops blisters and hairline cracks in excess of form

Find out other Vat1tr

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement