of New York S Corporations 2021

What is the Of New York S Corporations

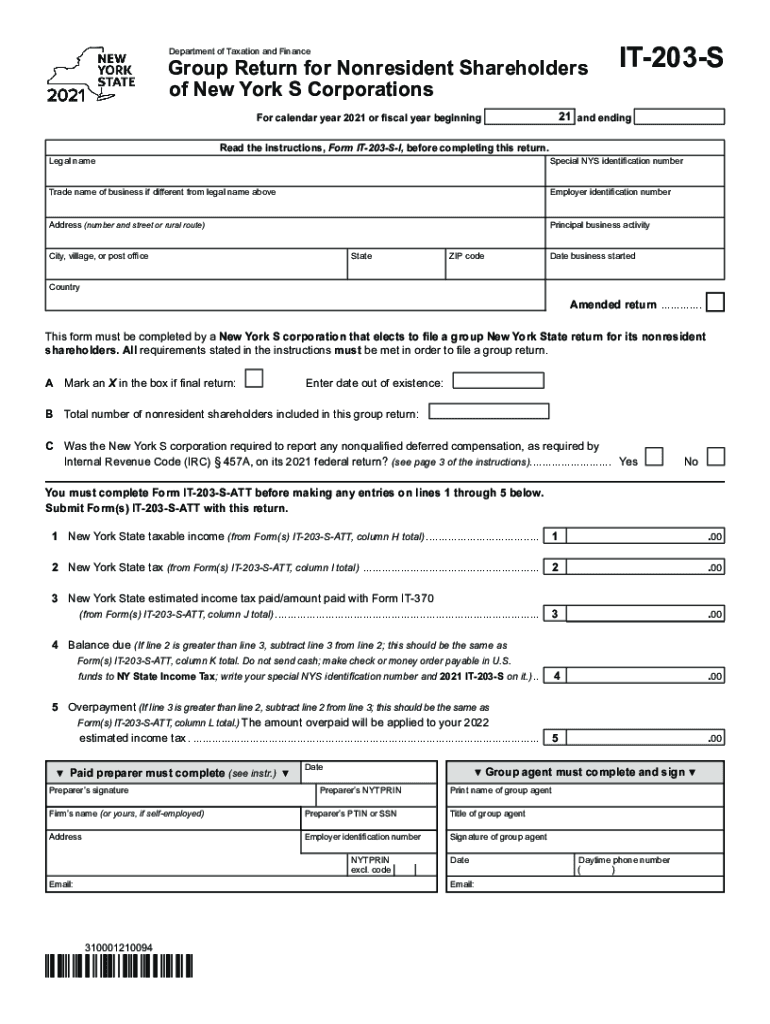

The Of New York S Corporations form is a legal document used by businesses in New York to elect S Corporation status for tax purposes. This designation allows corporations to pass income, losses, deductions, and credits through to shareholders for federal tax purposes, avoiding double taxation. It is essential for businesses seeking to optimize their tax liabilities while maintaining the benefits of corporate structure.

Steps to complete the Of New York S Corporations

Completing the Of New York S Corporations form involves several key steps:

- Gather necessary information, including your business's legal name, address, and federal employer identification number (EIN).

- Ensure that your corporation meets the eligibility criteria for S Corporation status, such as having a limited number of shareholders and only one class of stock.

- Fill out the form accurately, paying close attention to sections that require detailed information about the corporation's structure and ownership.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate state agency, ensuring you comply with any filing deadlines.

Legal use of the Of New York S Corporations

The legal use of the Of New York S Corporations form is crucial for businesses that want to benefit from S Corporation taxation. This form must be filed with the New York State Department of Taxation and Finance to officially elect S Corporation status. Proper completion and submission ensure that the corporation can enjoy the tax benefits associated with this designation while adhering to state regulations.

Required Documents

To successfully file the Of New York S Corporations form, several documents may be required, including:

- Articles of Incorporation or Certificate of Incorporation.

- Federal Employer Identification Number (EIN) confirmation.

- Shareholder agreements or records of ownership.

- Any prior tax returns, if applicable.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines when submitting the Of New York S Corporations form. Generally, the form must be filed within two months and 15 days after the beginning of the tax year in which the election is to take effect. Missing this deadline can result in the loss of S Corporation status for the current tax year.

Who Issues the Form

The Of New York S Corporations form is issued by the New York State Department of Taxation and Finance. This agency oversees the collection of taxes and ensures compliance with state tax laws, making it the authoritative body for processing S Corporation elections in New York.

Quick guide on how to complete of new york s corporations

Prepare Of New York S Corporations effortlessly on any device

Digital document administration has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct template and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Of New York S Corporations on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to update and electronically sign Of New York S Corporations with ease

- Locate Of New York S Corporations and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Of New York S Corporations and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct of new york s corporations

Create this form in 5 minutes!

How to create an eSignature for the of new york s corporations

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF document on Android

People also ask

-

What are the benefits of using airSlate SignNow for managing documents of New York S Corporations?

airSlate SignNow offers an intuitive interface that simplifies document management for New York S Corporations. With features like eSigning, cloud storage, and automated workflows, businesses can streamline their processes, reduce turnaround times, and minimize paperwork. This helps corporations save time and resources, allowing them to focus on growth.

-

How does pricing work for airSlate SignNow for New York S Corporations?

airSlate SignNow provides flexible pricing plans designed to accommodate the needs of New York S Corporations. Businesses can choose from various subscription options based on their size and requirements, ensuring they only pay for the features they use. This cost-effective solution is ideal for corporations looking to optimize their document management without breaking the bank.

-

Can airSlate SignNow integrate with other tools used by New York S Corporations?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that New York S Corporations may already be using. This includes tools for CRM, project management, and cloud storage, among others. Such integrations enhance productivity and ensure a smooth flow of information across platforms.

-

Is airSlate SignNow compliant with regulations for New York S Corporations?

Absolutely! airSlate SignNow prioritizes compliance with industry regulations essential for New York S Corporations. Our platform adheres to electronic signature laws and data protection standards to ensure that all documents signed and stored are secure and legally binding.

-

How does airSlate SignNow ensure the security of documents for New York S Corporations?

airSlate SignNow incorporates advanced security measures to protect documents for New York S Corporations. Features include encryption, secure data centers, and user authentication protocols. This multi-layered security framework helps safeguard sensitive information from unauthorized access.

-

What features does airSlate SignNow offer specifically for New York S Corporations?

airSlate SignNow provides tailored features that cater to the specific needs of New York S Corporations, such as customizable document templates and audit trails. These tools facilitate compliance and enhance accountability within the document-signing process. This allows businesses to maintain clear records and reduce error risks.

-

How can New York S Corporations get started with airSlate SignNow?

New York S Corporations can easily get started with airSlate SignNow by signing up for a free trial. This allows businesses to explore the platform’s features and understand how it fits their document management needs. Once satisfied, they can select a subscription plan that meets their requirements.

Get more for Of New York S Corporations

- Delaware letter tenant landlord form

- Letter from tenant to landlord about sexual harassment delaware form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children delaware form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure delaware form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497302078 form

- Delaware failure form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497302080 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497302081 form

Find out other Of New York S Corporations

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online