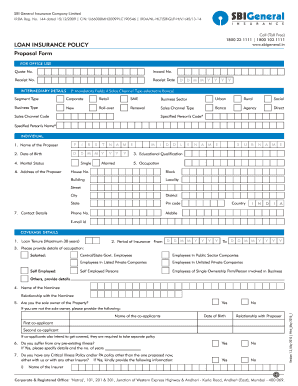

LOAN INSURANCE POLICY Form

What is the loan insurance policy?

A loan insurance policy is a financial product designed to protect both borrowers and lenders in the event of unforeseen circumstances that may affect the borrower's ability to repay a loan. This type of insurance typically covers scenarios such as job loss, disability, or death. By securing a loan insurance policy, borrowers can ensure that their loan payments are made even if they encounter financial difficulties, providing peace of mind for both parties involved.

How to obtain the loan insurance policy

Obtaining a loan insurance policy involves several straightforward steps. First, assess your insurance needs based on the type of loan and your financial situation. Next, research various insurance providers to compare coverage options and premiums. Once you have selected a provider, you will need to complete an application form, which may require personal and financial information. After submitting your application, the insurer will review it and may conduct a risk assessment. Upon approval, you will receive your policy documents outlining the terms and coverage details.

Steps to complete the loan insurance policy

Completing a loan insurance policy typically includes the following steps:

- Gather necessary personal and financial information.

- Review the terms and conditions of the policy.

- Fill out the application form accurately.

- Submit the application to the insurance provider.

- Await confirmation of your policy approval.

- Review your policy documents upon receipt.

Following these steps ensures that you have a comprehensive understanding of your coverage and obligations.

Legal use of the loan insurance policy

The legal use of a loan insurance policy is governed by various regulations that ensure its validity and enforceability. In the United States, policies must comply with state insurance laws, which dictate how insurance contracts are formed and executed. Additionally, for a loan insurance policy to be legally binding, it must include specific elements such as clear terms, the insured's consent, and compliance with consumer protection laws. Understanding these legal requirements is essential for both borrowers and lenders to ensure that the policy is enforceable in case of a claim.

Key elements of the loan insurance policy

Several key elements define a loan insurance policy, including:

- Coverage Amount: The total amount of loan payments covered by the policy.

- Premiums: The cost of the insurance, typically paid monthly or annually.

- Exclusions: Specific circumstances or events that are not covered by the policy.

- Claim Process: The steps required to file a claim and receive benefits.

- Policy Duration: The length of time the policy remains in effect.

Understanding these elements helps borrowers make informed decisions when selecting a loan insurance policy.

Examples of using the loan insurance policy

Loan insurance policies can be beneficial in various situations. For instance, a borrower who loses their job may rely on their policy to cover loan payments while they search for new employment. Similarly, if a borrower becomes disabled due to illness or injury, the insurance can help maintain their loan obligations during recovery. Additionally, in the unfortunate event of the borrower's death, the policy can ensure that the remaining loan balance is paid off, relieving financial burdens from family members.

Quick guide on how to complete loan insurance policy

Effortlessly Prepare LOAN INSURANCE POLICY on Any Device

Online document administration has gained signNow traction among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents promptly and without hindrances. Manage LOAN INSURANCE POLICY on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

Your Efficient Guide to Editing and eSigning LOAN INSURANCE POLICY with Ease

- Find LOAN INSURANCE POLICY and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you choose. Edit and eSign LOAN INSURANCE POLICY while ensuring outstanding communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan insurance policy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan insurance policy?

A loan insurance policy is designed to provide financial protection to borrowers and lenders in case of default, disability, or death. It ensures that the loan obligations are met, mitigating risks associated with borrowing. This can be particularly valuable for individuals taking out signNow loans.

-

How does a loan insurance policy benefit borrowers?

A loan insurance policy offers peace of mind to borrowers by ensuring that their loan payments are covered under unforeseen circumstances, such as job loss or illness. This not only protects the borrower's credit score but also ensures that their family isn’t burdened with debt. Choosing the right policy is essential to maximize these benefits.

-

What factors influence the cost of a loan insurance policy?

The cost of a loan insurance policy is influenced by several factors, including the amount of the loan, the borrower's age and health, and the type of policy chosen. Additionally, whether the coverage is for a single or multiple loans can also impact pricing. It's crucial to compare multiple options to find the best rates.

-

Can a loan insurance policy be bundled with other financial products?

Yes, many financial institutions offer the option to bundle a loan insurance policy with other products such as life insurance or health insurance. Bundling can often lead to discounts, providing a cost-effective solution for borrowers. It's advisable to inquire about such options when considering your loan insurance policy.

-

Are there any exclusions in a loan insurance policy?

Loan insurance policies may come with certain exclusions, such as pre-existing conditions or specific scenarios like suicide within the first few years of coverage. It’s important for prospective customers to read the fine print carefully. Understanding these exclusions will help in making informed decisions regarding your loan insurance policy.

-

How can I file a claim on a loan insurance policy?

Filing a claim on a loan insurance policy typically involves contacting your insurance provider and submitting the necessary documentation. This generally includes proof of the event that triggered the claim, such as medical records for disability. Prompt action and proper documentation can streamline this process.

-

Is a loan insurance policy worth it for everyone?

Not all borrowers may require a loan insurance policy; however, it can be beneficial for those with dependents or signNow financial responsibilities. Evaluating your financial situation and future liabilities can help determine if a loan insurance policy is a wise investment. Consulting with a financial advisor may provide additional clarity.

Get more for LOAN INSURANCE POLICY

- Vehicle services titling division of motor vehicles form

- Delaware motor vehicle bill of sale form templates fillable

- County delaware form

- Pennsylvania property bill of sale form templates fillable

- New mexico quitclaim deed from individual to corporation form

- Hereafter form

- Surfaces to be painted prior to commencing work form

- Type of heat form

Find out other LOAN INSURANCE POLICY

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document