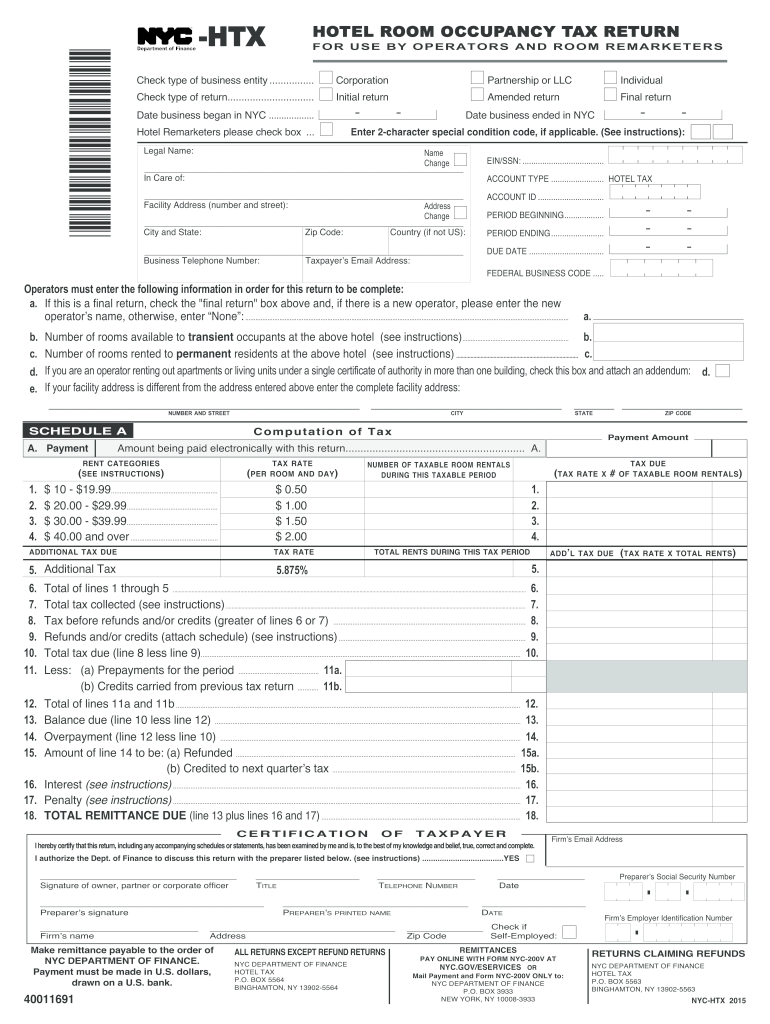

NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN 2015

What is the NYC HTX Hotel Room Occupancy Tax Return?

The NYC HTX Hotel Room Occupancy Tax Return is a tax form used by hotel operators in New York City to report and remit the hotel room occupancy tax. This tax is applicable to the rental of rooms in hotels, motels, and similar establishments. The revenue generated from this tax supports various city services and initiatives. Understanding this form is essential for compliance with local tax regulations and ensuring accurate reporting of occupancy taxes collected from guests.

Steps to Complete the NYC HTX Hotel Room Occupancy Tax Return

Completing the NYC HTX Hotel Room Occupancy Tax Return involves several key steps:

- Gather necessary information, including total room revenue and the number of occupied rooms.

- Access the official form, either online or in printed format.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax due based on the applicable tax rate.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, as per the guidelines provided.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the NYC HTX Hotel Room Occupancy Tax Return. Typically, returns are due on a quarterly basis, with specific dates set by the New York City Department of Finance. Missing these deadlines can result in penalties and interest on unpaid taxes. Keeping a calendar of these dates ensures timely compliance and helps avoid unnecessary fees.

Required Documents

When preparing to file the NYC HTX Hotel Room Occupancy Tax Return, certain documents are necessary to support the information provided. These may include:

- Records of total room revenue.

- Documentation of the number of rooms rented during the reporting period.

- Any previous tax returns filed for reference.

- Payment records for any taxes previously submitted.

Penalties for Non-Compliance

Failure to file the NYC HTX Hotel Room Occupancy Tax Return on time or inaccuracies in the submitted information can lead to significant penalties. These may include:

- Late filing fees based on the amount of tax due.

- Interest charges on unpaid taxes.

- Potential audits or further scrutiny from tax authorities.

Form Submission Methods

The NYC HTX Hotel Room Occupancy Tax Return can be submitted through various methods, providing flexibility for hotel operators. The options typically include:

- Online submission via the New York City Department of Finance website.

- Mailing a printed form to the designated tax office.

- In-person submission at specified tax office locations.

Quick guide on how to complete 2015 nyc htx hotel room occupancy tax return 2015 nyc htx hotel room occupancy tax return

Your assistance manual on how to prepare your NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN

If you’re eager to learn how to fill out and submit your NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN, here are a few quick suggestions to make tax submission signNowly simpler.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, draft, and complete your tax forms effortlessly. With its editor, you can easily switch between text, checkboxes, and eSignatures and return to amend answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to finish your NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Review your document and rectify any discrepancies.

- Save modifications, print your version, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please bear in mind that paper filing can lead to return mistakes and delay refunds. Of course, before electronically filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 nyc htx hotel room occupancy tax return 2015 nyc htx hotel room occupancy tax return

Create this form in 5 minutes!

How to create an eSignature for the 2015 nyc htx hotel room occupancy tax return 2015 nyc htx hotel room occupancy tax return

How to create an eSignature for your 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return in the online mode

How to create an electronic signature for your 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return in Chrome

How to generate an electronic signature for putting it on the 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return in Gmail

How to generate an eSignature for the 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return from your mobile device

How to make an eSignature for the 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return on iOS

How to create an electronic signature for the 2015 Nyc Htx Hotel Room Occupancy Tax Return 2015 Nyc Htx Hotel Room Occupancy Tax Return on Android OS

People also ask

-

What is the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN?

The NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN is a required document for hotels operating in New York City to report and remit taxes on room rentals. By effectively managing this process, businesses can ensure compliance with local regulations regarding hotel occupancy taxes.

-

How can airSlate SignNow help with the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN?

airSlate SignNow streamlines the process of preparing and submitting the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN. Our platform allows users to easily eSign necessary documents and manage records, ensuring a smooth and efficient process for compliance.

-

What are the key features of the airSlate SignNow platform for tax returns?

Key features of the airSlate SignNow platform for managing the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN include easy document creation, secure eSigning, and automated reminders for deadlines. These features help simplify the tax return process and keep your business organized.

-

Is there a cost associated with using airSlate SignNow for tax returns?

Yes, there is a cost associated with using airSlate SignNow for the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN, but it is designed to be cost-effective. Our pricing plans cater to businesses of all sizes, providing flexibility and value as you manage your compliance needs.

-

What are the benefits of using airSlate SignNow for my NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN?

Using airSlate SignNow for your NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN offers benefits like increased efficiency, reduced paperwork, and higher accuracy in document handling. These advantages allow your business to focus more on operations while ensuring compliance with tax regulations.

-

Can airSlate SignNow integrate with other tools for hotel management?

Yes, airSlate SignNow supports integrations with various hotel management and accounting tools, making it easier to handle the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN alongside your existing systems. These integrations help create a seamless workflow for your tax reporting and compliance.

-

What security measures does airSlate SignNow have for handling sensitive tax documents?

airSlate SignNow prioritizes security by employing advanced encryption and access controls to protect sensitive documents, including the NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN. Our commitment to data security helps safeguard your information from unauthorized access.

Get more for NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN

- Small employer uniform employee application for group health insurance wisconsin

- Credit reference request form

- Dentist w9 form

- Social history template 404210987 form

- Dss form 3353

- How to draft dv 130 restraining order after form

- Agreement for direct deposit form uib 1091a

- Business partnership buyout agreement template form

Find out other NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN NYC HTX HOTEL ROOM OCCUPANCY TAX RETURN

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy