TA 10 Petition PDF Tax Appeals Tribunal Nysdta Form

What is the TA 10 Petition PDF Tax Appeals Tribunal Nysdta?

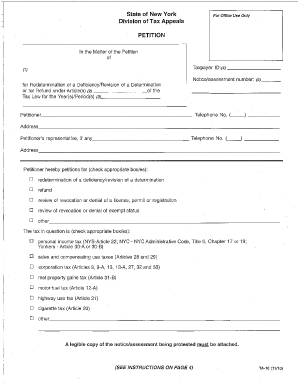

The TA 10 Petition PDF is a formal document used to appeal decisions made by the New York State Department of Taxation and Finance regarding tax assessments. This form is essential for taxpayers who wish to contest the findings of the department, providing a structured way to present their case to the Tax Appeals Tribunal. The form includes necessary details about the taxpayer, the specific tax issues being contested, and the grounds for the appeal. Understanding the purpose of this form is crucial for anyone looking to navigate the tax appeal process effectively.

Steps to Complete the TA 10 Petition PDF Tax Appeals Tribunal Nysdta

Completing the TA 10 Petition PDF involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including notices from the Department of Taxation and Finance. Next, fill out the petition form, providing detailed information about your case, including your personal details and the specific tax issues being appealed. Be sure to clearly state the reasons for your appeal. After completing the form, review it for any errors or omissions before submitting it to the Tax Appeals Tribunal. Finally, keep a copy of the submitted petition for your records.

How to Use the TA 10 Petition PDF Tax Appeals Tribunal Nysdta

Using the TA 10 Petition PDF effectively requires a clear understanding of its components and submission process. After filling out the form, you can submit it either electronically or via mail. If submitting electronically, ensure that you follow the guidelines provided by the Tax Appeals Tribunal for electronic submissions. If mailing the form, send it to the appropriate address listed on the form, and consider using certified mail to confirm delivery. Proper use of the form can significantly impact the outcome of your appeal.

Legal Use of the TA 10 Petition PDF Tax Appeals Tribunal Nysdta

The legal use of the TA 10 Petition PDF is governed by specific regulations set forth by the New York State Tax Appeals Tribunal. This form must be completed accurately and submitted within the designated time frame following the receipt of the tax assessment notice. It is important to include all necessary supporting documentation to substantiate your claims. Failure to adhere to these legal requirements may result in the dismissal of your appeal, making it crucial to understand the legal implications of your submission.

Required Documents for the TA 10 Petition PDF Tax Appeals Tribunal Nysdta

When filing the TA 10 Petition PDF, certain documents are required to support your appeal. These may include copies of the original tax assessment notice, any correspondence with the Department of Taxation and Finance, and any evidence that supports your case, such as financial records or receipts. Having these documents ready will help strengthen your petition and provide the tribunal with a comprehensive view of your situation.

Filing Deadlines / Important Dates for the TA 10 Petition PDF Tax Appeals Tribunal Nysdta

Filing deadlines for the TA 10 Petition PDF are critical to the success of your appeal. Typically, the petition must be filed within ninety days of the date of the notice of the tax assessment. It is essential to be aware of these deadlines to avoid missing the opportunity to contest the assessment. Keeping a calendar of important dates related to your tax appeal will help ensure that you meet all necessary timelines.

Quick guide on how to complete ta 10 petition pdf tax appeals tribunal nysdta

Effortlessly Create TA 10 Petition PDF Tax Appeals Tribunal Nysdta on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely keep it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage TA 10 Petition PDF Tax Appeals Tribunal Nysdta on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign TA 10 Petition PDF Tax Appeals Tribunal Nysdta with Ease

- Find TA 10 Petition PDF Tax Appeals Tribunal Nysdta and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign TA 10 Petition PDF Tax Appeals Tribunal Nysdta to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ta 10 petition pdf tax appeals tribunal nysdta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TA 10 Petition PDF for the Tax Appeals Tribunal NYSDTA?

The TA 10 Petition PDF is an official document used to file a tax appeal with the New York State Tax Appeals Tribunal (NYSDTA). It allows taxpayers to contest decisions made by the New York State Department of Taxation and Finance. Utilizing the TA 10 Petition PDF can help ensure that your appeal is filed correctly and efficiently.

-

How can airSlate SignNow help me with the TA 10 Petition PDF Tax Appeals Tribunal NYSDTA process?

airSlate SignNow streamlines the process of completing and signing the TA 10 Petition PDF for the Tax Appeals Tribunal NYSDTA. Our platform allows for easy document management, electronic signatures, and seamless filing, ensuring a hassle-free experience. By using airSlate SignNow, you can focus more on your appeal rather than paperwork.

-

What features does airSlate SignNow offer for the TA 10 Petition PDF?

airSlate SignNow provides advanced features for handling the TA 10 Petition PDF, such as electronic signatures, document tracking, and customizable templates. Our user-friendly interface makes it simple to fill out forms and obtain approvals promptly, which is crucial when dealing with tax appeals at the NYSDTA.

-

Is airSlate SignNow secure for submitting the TA 10 Petition PDF to the NYSDTA?

Yes, airSlate SignNow prioritizes security in handling your TA 10 Petition PDF submissions. Our platform employs industry-standard encryption and secure cloud storage to protect your sensitive information. You can trust us to keep your data safe while you navigate the tax appeals process.

-

What are the pricing options for using airSlate SignNow with the TA 10 Petition PDF?

airSlate SignNow offers affordable pricing plans suitable for individuals and businesses needing to file the TA 10 Petition PDF for the Tax Appeals Tribunal NYSDTA. With flexible subscription options, you can choose a plan that fits your budget and document needs. Sign up today to make your tax appeal process more efficient.

-

Can I integrate airSlate SignNow with other tools while managing the TA 10 Petition PDF?

Absolutely! airSlate SignNow integrates effortlessly with a wide range of tools, allowing you to handle your TA 10 Petition PDF alongside your favorite applications. Whether it’s CRM software or cloud storage platforms, our seamless integrations can enhance your workflow and save you time during the tax appeals process.

-

What benefits can I expect when using airSlate SignNow for my tax appeals?

Using airSlate SignNow for your TA 10 Petition PDF for the Tax Appeals Tribunal NYSDTA offers numerous benefits. You can achieve faster turnaround times with electronic signatures, improve accuracy with easy document editing, and access your files from anywhere. This ultimately leads to a more efficient tax appeal process for you.

Get more for TA 10 Petition PDF Tax Appeals Tribunal Nysdta

Find out other TA 10 Petition PDF Tax Appeals Tribunal Nysdta

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe