Il 1120 Form

What is the Il 1120 Form

The Il 1120 Form is a tax document used by corporations in the United States to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for corporations to calculate their federal tax liability and ensure compliance with tax regulations. It provides a comprehensive overview of a corporation's financial activities for the tax year, allowing the IRS to assess the corporation's tax obligations accurately.

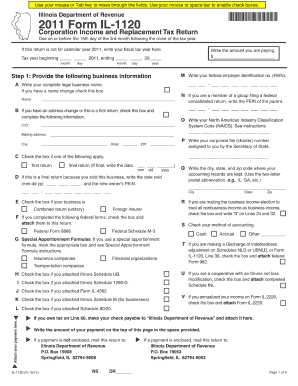

Steps to complete the Il 1120 Form

Completing the Il 1120 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by providing detailed information about the corporation's income, expenses, and tax credits. It is crucial to double-check all entries for accuracy before submitting the form. Finally, sign and date the form, ensuring that it is filed by the appropriate deadline to avoid penalties.

How to obtain the Il 1120 Form

The Il 1120 Form can be obtained directly from the IRS website or through various tax preparation software. Corporations may also request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to ensure that you have the most current version of the form, as tax regulations and requirements may change from year to year.

Legal use of the Il 1120 Form

The legal use of the Il 1120 Form is governed by IRS regulations. Corporations must file this form annually to report their financial activities and tax obligations. Failure to file the form correctly or on time can result in penalties, including fines and interest on unpaid taxes. It is essential for corporations to maintain accurate records and ensure that the form is completed in accordance with IRS guidelines to avoid legal issues.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Il 1120 Form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for corporations to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the Il 1120 Form accurately, corporations must gather several required documents. These include financial statements, such as income statements and balance sheets, records of all income received, documentation of deductions and credits claimed, and any relevant tax forms from prior years. Having these documents organized and readily available can streamline the completion process and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Il 1120 Form can result in significant penalties for corporations. These penalties may include fines for late filing, interest on unpaid taxes, and potential audits by the IRS. In severe cases, failure to file can lead to legal action against the corporation. To mitigate these risks, it is essential for corporations to file the form accurately and on time, ensuring all necessary information is included.

Quick guide on how to complete il 1120 form

Easily prepare Il 1120 Form on any device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate forms and securely keep them online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your papers swiftly without delays. Handle Il 1120 Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Il 1120 Form effortlessly

- Locate Il 1120 Form and click on Obtain Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that reason.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Finish button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Il 1120 Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1120 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Il 1120 Form, and why is it important for businesses?

The Il 1120 Form is a key tax form used by corporations in the U.S. to report their income, gains, losses, and tax liabilities. It's essential for ensuring compliance with federal tax regulations and can affect a business's financial health. Understanding how to correctly file the Il 1120 Form can help you avoid penalties and audits.

-

How can airSlate SignNow assist with preparing the Il 1120 Form?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and share the Il 1120 Form securely. With our streamlined process, you can manage document workflows efficiently and ensure that all necessary signatures are obtained in a timely manner. This increases your productivity and helps you focus on your business instead of paperwork.

-

What features does airSlate SignNow offer for managing the Il 1120 Form?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and real-time tracking for the Il 1120 Form. These tools are designed to simplify your document management process, making it easier to prepare and submit your forms accurately. Additionally, you can integrate your existing systems to maintain workflow efficiency.

-

Is airSlate SignNow's solution cost-effective for managing multiple Il 1120 Forms?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit various business needs, making it cost-effective for managing multiple Il 1120 Forms. Whether you're a small business or a large corporation, our pricing ensures you get the best value for your document management solutions. Plus, you can save time and resources that can be better spent on growing your business.

-

Can I track the status of my Il 1120 Form in airSlate SignNow?

Absolutely! airSlate SignNow enables you to track the status of your Il 1120 Form in real-time. You can monitor who has viewed and signed the document, ensuring accountability at every stage. This feature minimizes follow-up efforts and helps you stay organized during the filing process.

-

Does airSlate SignNow integrate with existing accounting software for the Il 1120 Form?

Yes, airSlate SignNow offers integrations with popular accounting software that facilitate easier management of the Il 1120 Form. This allows for seamless data transfer, reducing the chances of errors and streamlining your preparation process. With these integrations, you can efficiently handle tax documentation without the hassle of manual entry.

-

How secure is the information submitted through airSlate SignNow for the Il 1120 Form?

Security is a top priority at airSlate SignNow. All information submitted through our platform, including the Il 1120 Form, is encrypted and protected according to industry standards. We take every measure to ensure that your sensitive data remains confidential and secure during the eSigning process.

Get more for Il 1120 Form

- California regulations form

- California fictitious business name statement form

- California spousal partner or family support order attachment form

- California notice of motion and motion for simplified modification of order for child spousal or family support form

- California california installments fixed rate promissory note secured by personal property form

- 3 day cancel form

- Sc 140 form

- Conditional waiver release payment form

Find out other Il 1120 Form

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement