Form 8805

What is the Form 8805

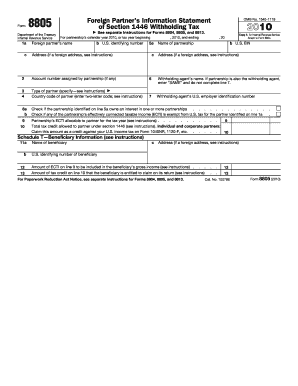

The Form 8805 is a tax document used by partnerships to report the income, deductions, and credits allocated to foreign partners. This form is essential for ensuring compliance with U.S. tax laws and is primarily utilized by partnerships that have non-resident alien partners. By accurately completing the Form 8805, partnerships can disclose the necessary information to the Internal Revenue Service (IRS) regarding the income earned by foreign partners and the associated tax obligations.

How to use the Form 8805

To effectively use the Form 8805, partnerships must first gather all relevant financial information regarding the income earned by foreign partners. This includes details about the partnership's income, deductions, and any applicable credits. Once the necessary information is collected, partnerships can fill out the form, ensuring that all sections are completed accurately. After completing the form, it must be filed with the IRS, along with any required schedules or attachments, by the designated deadline to avoid penalties.

Steps to complete the Form 8805

Completing the Form 8805 involves several key steps:

- Gather financial documents related to the partnership's income and deductions.

- Fill out the identifying information, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the total income earned by the partnership and allocate the appropriate amounts to each foreign partner.

- Include any deductions and credits that apply to the foreign partners.

- Review the completed form for accuracy and ensure all required signatures are included.

- File the form with the IRS by the due date, either electronically or via mail.

Legal use of the Form 8805

The legal use of the Form 8805 is governed by IRS regulations, which require partnerships to report income accurately for tax purposes. The form must be completed in compliance with the Internal Revenue Code, ensuring that all information disclosed is truthful and complete. Failure to comply with these regulations can result in penalties, including fines or additional tax liabilities for the partnership and its foreign partners.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the Form 8805 to ensure compliance. Typically, the form is due on the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by March 15. It is crucial to stay informed about any changes to these deadlines, as late submissions can incur penalties.

Required Documents

To complete the Form 8805, partnerships will need several supporting documents, including:

- Financial statements detailing the partnership's income and expenses.

- Records of distributions to foreign partners.

- Any relevant tax treaties that may affect the reporting of income.

- Previous year’s tax returns, if applicable.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 8805 can lead to significant penalties. Partnerships may face fines for failing to file the form on time or for providing inaccurate information. Additionally, foreign partners may be subject to withholding taxes if the form is not filed correctly. It is essential for partnerships to understand these potential penalties to ensure timely and accurate reporting.

Quick guide on how to complete form 8805

Prepare Form 8805 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8805 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 8805 with ease

- Find Form 8805 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8805 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8805

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8805 and why is it important?

Form 8805 is used by partners in partnerships to report each partner's share of income, deductions, credits, etc. from the partnership. Understanding Form 8805 is crucial for compliance with IRS regulations, as it ensures that all partners accurately report their income and fulfill their tax obligations.

-

How does airSlate SignNow streamline the completion of Form 8805?

airSlate SignNow streamlines the completion of Form 8805 by providing a user-friendly interface that allows for quick document preparation and e-signing. Our platform simplifies the process with templates and automated workflows, making it easier for businesses to manage their tax reporting efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8805?

Yes, there is a subscription cost for using airSlate SignNow, but it remains a cost-effective solution for businesses needing to manage Form 8805 and other documents. Pricing varies based on the plan chosen, which includes features tailored to meet diverse business needs.

-

Can airSlate SignNow integrate with other software for managing Form 8805?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing for seamless data transfer and document management. This can signNowly reduce the time spent on managing Form 8805 and enhance overall operational efficiency.

-

What security measures does airSlate SignNow implement for Form 8805?

airSlate SignNow prioritizes the security of your documents, including Form 8805, through robust security measures such as encryption and secure cloud storage. We ensure that your sensitive tax information is protected while allowing for convenient access and collaboration.

-

How can businesses benefit from using airSlate SignNow for Form 8805?

Businesses can benefit from using airSlate SignNow for Form 8805 by ensuring compliance, reducing errors, and saving time. Our platform's ease of use and automation features enable teams to focus on growth rather than paperwork.

-

Is there customer support available for questions about Form 8805?

Yes, airSlate SignNow provides excellent customer support to assist users with any questions or issues related to Form 8805. Our team is dedicated to ensuring you have all the resources you need for a smooth document management experience.

Get more for Form 8805

- Joint tenant tenancy form

- New york lien form

- New york assignment of lien by corporation or llc form

- Ny statement corporation form

- Ny waiver form

- Notice pay rent form

- New york notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- New york english notice of dishonored check civil keywords bad check bounced check form

Find out other Form 8805

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors