1041v Form

What is the 1041v

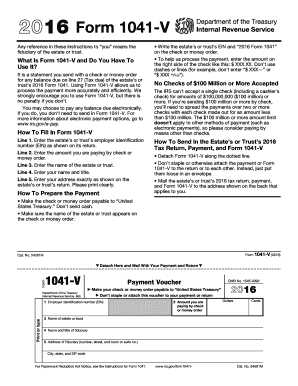

The 1041v form is a tax document used by estates and trusts to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for fiduciaries managing estates or trusts, ensuring that the income generated is accurately reported and taxed accordingly. The 1041v is specifically designed to facilitate the reporting process, making it easier for trustees and executors to fulfill their tax obligations.

How to use the 1041v

Using the 1041v form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to the estate or trust, including income sources, deductions, and credits. Next, fill out the form by entering the relevant data in the designated fields. It is crucial to review the completed form for accuracy before submission. Once verified, the form can be submitted electronically or by mail, depending on the preference of the filer and the requirements of the IRS.

Steps to complete the 1041v

Completing the 1041v form requires careful attention to detail. Here are the essential steps:

- Gather all financial records related to the estate or trust, including income statements and expense reports.

- Fill in the identifying information, such as the name and taxpayer identification number of the estate or trust.

- Report all income generated during the tax year, including interest, dividends, and rental income.

- List any deductions, such as administrative expenses or distributions to beneficiaries.

- Calculate the total taxable income and determine the tax liability.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Legal use of the 1041v

The 1041v form must be used in compliance with IRS regulations to ensure its legal validity. This includes accurately reporting all income and deductions associated with the estate or trust. Failure to comply with tax laws can result in penalties or legal issues. It is essential for fiduciaries to understand their responsibilities and ensure that the form is completed correctly to avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1041v form are crucial for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts operating on a calendar year, this typically means April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates helps avoid late filing penalties.

Required Documents

To complete the 1041v form, several documents are required to provide accurate information. These include:

- Financial statements detailing income and expenses for the estate or trust.

- Tax identification number for the estate or trust.

- Records of distributions made to beneficiaries.

- Documentation supporting any deductions claimed, such as receipts or invoices.

Quick guide on how to complete 1041v

Easily Prepare 1041v on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the required form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle 1041v on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to Modify and Electronically Sign 1041v Effortlessly

- Locate 1041v and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Select your preferred method for delivering your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from a device of your choice. Modify and electronically sign 1041v and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1041v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1041v form and how can airSlate SignNow help?

The 1041v form is used for filing income tax returns for estates and trusts. With airSlate SignNow, you can easily prepare, sign, and send your 1041v documents electronically, ensuring fast processing and compliance with tax regulations.

-

Is airSlate SignNow a cost-effective solution for managing 1041v forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your 1041v forms. Our pricing plans are designed to accommodate businesses of all sizes, providing you with essential features at an affordable rate.

-

What features does airSlate SignNow offer for enhancing the 1041v signing experience?

airSlate SignNow includes features like document templates, customizable workflows, and secure storage to enhance the signing experience for your 1041v forms. These features ensure that you streamline your document management while keeping it secure.

-

Can I integrate airSlate SignNow with other tools for automating 1041v processes?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to automate your 1041v processes. This integration helps you save time and reduces manual errors while managing your estate and trust filings.

-

What are the benefits of using airSlate SignNow for 1041v document management?

Using airSlate SignNow for your 1041v documents offers numerous benefits, including improved efficiency, reduced processing time, and enhanced security. You'll also have access to electronic signatures that conform to legal standards, making your filing process smoother.

-

Is it easy to use airSlate SignNow for completing the 1041v form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete their 1041v form. The intuitive interface guides you through the process, allowing you to focus on what matters – accurate and timely filings.

-

What support options are available for users managing 1041v forms on airSlate SignNow?

airSlate SignNow provides robust customer support, including live chat, email assistance, and a comprehensive knowledge base to help you manage your 1041v forms. Our team is dedicated to ensuring you have the resources needed to utilize our platform effectively.

Get more for 1041v

- Nevada affidavit document form

- Nevada trust form

- New york final notice of forfeiture and request to vacate property under contract for deed form

- Home inspection checklist form 481374085

- Ny corporation form

- New york new york articles of incorporation certificate nonprofit corporation tax exempt form

- New york application for default judgment in the state of new york civil case form

- New york revocation of postnuptial property agreement new york form

Find out other 1041v

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document