Prepare Food and Beverage Sales Tax Monthly Remittance FormREVISED

What is the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

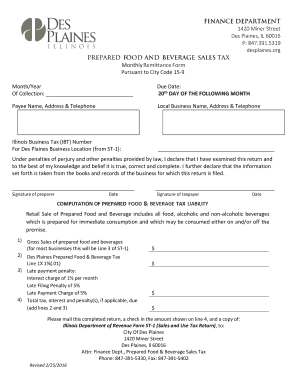

The Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED is a crucial document used by businesses in the food and beverage industry to report and remit sales tax collected from customers. This form is typically required on a monthly basis, ensuring that businesses comply with state tax regulations. By accurately completing this form, businesses can fulfill their tax obligations and avoid potential penalties. The form captures essential information such as total sales, taxable sales, and the amount of sales tax collected during the reporting period.

Steps to complete the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

Completing the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED involves several key steps:

- Gather necessary documentation: Collect all sales records, receipts, and any other relevant documents that detail your sales for the month.

- Calculate total sales: Sum up all sales made during the month, distinguishing between taxable and non-taxable sales.

- Determine sales tax collected: Calculate the total amount of sales tax collected from customers based on your taxable sales.

- Fill out the form: Enter the required information accurately in the designated fields of the form, ensuring all calculations are correct.

- Review for accuracy: Double-check all entries to ensure accuracy before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

The legal use of the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED is governed by state tax laws. To ensure the form is legally valid, it must be completed accurately and submitted within the specified deadlines. Electronic signatures are accepted, provided they comply with the ESIGN and UETA acts, which recognize eSignatures as legally binding. Keeping a copy of the submitted form and any supporting documentation is essential for record-keeping and potential audits.

Form Submission Methods

Businesses have several options for submitting the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED:

- Online: Many states offer online submission through their tax department websites, allowing for quicker processing.

- By Mail: The form can be printed, completed, and mailed to the appropriate tax authority address.

- In-Person: Some businesses may choose to deliver the form directly to their local tax office for immediate processing.

Filing Deadlines / Important Dates

Filing deadlines for the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED vary by state. Generally, businesses must submit the form by the end of the month following the reporting period. For example, sales from January must be reported by the end of February. It is important to check with your state’s tax authority for specific deadlines to avoid late fees or penalties.

Key elements of the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

Understanding the key elements of the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED is essential for accurate completion. The form typically includes:

- Business Information: Name, address, and tax identification number of the business.

- Sales Information: Total sales, taxable sales, and non-taxable sales for the reporting period.

- Sales Tax Calculation: The total amount of sales tax collected and owed to the state.

- Signature: A declaration that the information provided is accurate, often requiring a signature or electronic signature.

Quick guide on how to complete prepare food and beverage sales tax monthly remittance formrevised

Effortlessly Prepare Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, alter, and electronically sign your documents swiftly without hindrances. Manage Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related task today.

The Simplest Way to Edit and Electronically Sign Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED with Ease

- Obtain Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, the hassle of tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prepare food and beverage sales tax monthly remittance formrevised

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

The Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED is a specific document designed for businesses in the food and beverage industry to report and remit sales taxes monthly. It helps ensure compliance with state tax regulations while simplifying the filing process.

-

How can I use airSlate SignNow to prepare the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

With airSlate SignNow, you can easily create and customize the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED online. Our platform allows you to input necessary data, eSign, and send the document efficiently, saving you time and ensuring accuracy.

-

Are there any costs associated with using airSlate SignNow for the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

AirSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for businesses. You can choose a plan that suits your needs and budget, allowing you to prepare and manage the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED without breaking the bank.

-

What features does airSlate SignNow offer for preparing the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

Key features of airSlate SignNow include customizable templates, eSignature capabilities, document tracking, and secure cloud storage. These features ensure that you can efficiently prepare and manage the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED with ease and confidence.

-

Can I integrate airSlate SignNow with other tools for the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

Yes, airSlate SignNow offers robust integration options with various accounting and business management tools. This allows you to streamline your workflow and easily prepare the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED alongside your existing systems.

-

How does airSlate SignNow enhance the timeliness of submitting the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED?

By using airSlate SignNow, you can expedite the preparation and submission of your Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED. The platform's user-friendly interface allows for quick data entry and eSigning, helping you meet deadlines and maintain compliance.

-

Is the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED updated regularly on airSlate SignNow?

Yes, airSlate SignNow ensures that all templates, including the Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED, are kept up-to-date with the latest regulations. This commitment helps businesses stay compliant without worrying about outdated forms.

Get more for Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

Find out other Prepare Food And Beverage Sales Tax Monthly Remittance FormREVISED

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself