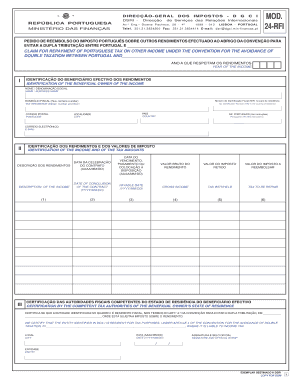

MOD 24 RFI Steuerliches Info Center Form

What is the MOD 24 RFI Steuerliches info center

The MOD 24 RFI Steuerliches info center is a specific form used primarily for tax-related inquiries and information requests within the United States. This form is essential for individuals and businesses seeking clarification on their tax obligations, eligibility for deductions, or other tax-related matters. It serves as a formal request to the relevant tax authorities, ensuring that the submitter receives accurate and timely information regarding their tax status or specific queries.

How to use the MOD 24 RFI Steuerliches info center

Using the MOD 24 RFI Steuerliches info center involves a straightforward process. First, ensure you have all necessary information regarding your tax situation. This includes your personal identification details, tax identification number, and any specific questions you may have. Next, fill out the form accurately, providing clear and concise information. Once completed, submit the form through the designated channels, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the MOD 24 RFI Steuerliches info center

Completing the MOD 24 RFI Steuerliches info center requires careful attention to detail. Follow these steps:

- Gather necessary documents, including identification and any relevant tax forms.

- Fill out the form with accurate information, ensuring clarity in your questions or requests.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, ensuring it reaches the correct tax authority.

Legal use of the MOD 24 RFI Steuerliches info center

The legal use of the MOD 24 RFI Steuerliches info center is governed by federal and state tax laws. It is crucial to ensure that all information provided is truthful and accurate, as any misrepresentation could lead to penalties or legal repercussions. The form is designed to facilitate communication with tax authorities, allowing individuals and businesses to seek necessary clarifications without fear of legal consequences, provided they adhere to the guidelines and requirements set forth by the IRS.

Key elements of the MOD 24 RFI Steuerliches info center

Key elements of the MOD 24 RFI Steuerliches info center include the following:

- Identification Information: Personal details and tax identification number of the requester.

- Specific Queries: Clear articulation of the questions or information requested.

- Submission Method: Options for submitting the form, such as online or by mail.

- Compliance Acknowledgment: A statement confirming adherence to legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the MOD 24 RFI Steuerliches info center can vary based on the nature of the inquiry and the specific tax year involved. It is essential to submit the form in a timely manner to ensure that you receive the necessary information before critical tax deadlines. Typically, forms should be filed well in advance of tax return due dates to allow sufficient time for processing and response from tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The MOD 24 RFI Steuerliches info center can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many tax authorities offer an online portal for direct submission of forms.

- Mail: Forms can be printed and mailed to the appropriate tax office, ensuring proper postage and addressing.

- In-Person: Individuals may also choose to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete mod 24 rfi steuerliches info center

Complete MOD 24 RFI Steuerliches info center seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage MOD 24 RFI Steuerliches info center on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to alter and eSign MOD 24 RFI Steuerliches info center with ease

- Find MOD 24 RFI Steuerliches info center and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign MOD 24 RFI Steuerliches info center and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mod 24 rfi steuerliches info center

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MOD 24 RFI Steuerliches info center?

The MOD 24 RFI Steuerliches info center is a centralized platform designed to streamline your tax-related documentation processes. It offers efficient management of requests for information (RFIs) while ensuring compliance with tax regulations. This helps businesses save time and reduce errors in their documentation.

-

How does airSlate SignNow integrate with the MOD 24 RFI Steuerliches info center?

airSlate SignNow seamlessly integrates with the MOD 24 RFI Steuerliches info center, allowing users to eSign and manage documents directly from the platform. This integration enhances workflow efficiency by providing a single solution for document management and compliance. You can automate repetitive tasks and improve collaboration with your team.

-

What are the pricing plans for using the MOD 24 RFI Steuerliches info center?

The pricing for the MOD 24 RFI Steuerliches info center varies based on the features and level of service you choose. airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring you get value for your investment. Contact us for a tailored quote that meets your specific requirements.

-

What features does the MOD 24 RFI Steuerliches info center offer?

The MOD 24 RFI Steuerliches info center includes features such as document tracking, customizable templates, and automated workflows. These functionalities enhance the user experience and ensure compliance with tax documentation practices. It helps businesses manage their RFIs more effectively and reduces the risk of delays.

-

How can the MOD 24 RFI Steuerliches info center benefit my business?

By utilizing the MOD 24 RFI Steuerliches info center, your business can signNowly streamline its tax documentation processes. This leads to improved accuracy, reduced time spent on paperwork, and enhanced compliance with tax regulations. Overall, it helps businesses operate more efficiently and focus on their core activities.

-

Is the MOD 24 RFI Steuerliches info center suitable for small businesses?

Yes, the MOD 24 RFI Steuerliches info center is designed to be scalable and user-friendly, making it suitable for small businesses as well as larger organizations. With its affordable pricing and essential features, it provides a cost-effective solution for managing tax-related documents. Small businesses can benefit from improved efficiency without overwhelming complexity.

-

What kind of support is available for users of the MOD 24 RFI Steuerliches info center?

Users of the MOD 24 RFI Steuerliches info center have access to comprehensive support services. This includes online resources, tutorials, and a dedicated support team ready to assist with any inquiries. We prioritize customer satisfaction and ensure you feel confident using the platform.

Get more for MOD 24 RFI Steuerliches info center

- Ar bond form

- Quitclaim deed from husband and wife to llc arkansas form

- Warranty deed from husband and wife to llc arkansas form

- Arkansas judgment form

- Remove premises form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises arkansas form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497296395 form

- Arkansas landlord form

Find out other MOD 24 RFI Steuerliches info center

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word