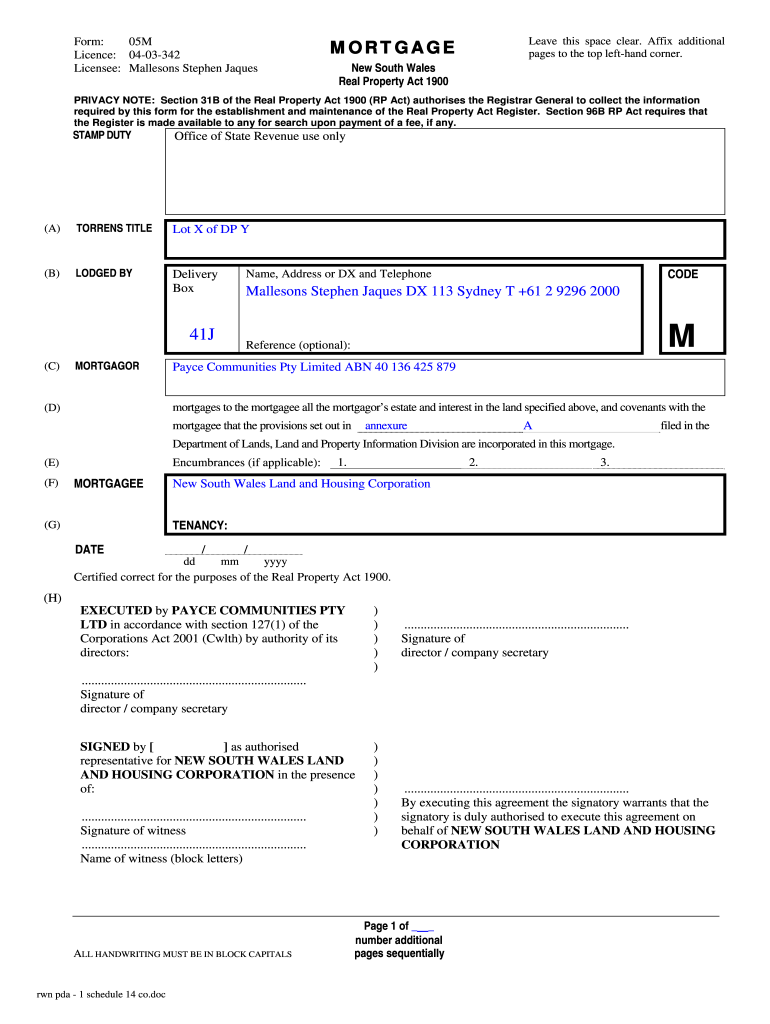

Mortgage 05m Form

What is the Mortgage 05m

The Mortgage 05m form is a crucial document used in the United States for various mortgage-related transactions. It serves as a formal agreement between a borrower and a lender, detailing the terms and conditions of a mortgage loan. This form outlines essential information, such as the loan amount, interest rate, repayment schedule, and any associated fees. Understanding the Mortgage 05m is vital for anyone looking to secure a mortgage, as it lays the groundwork for the financial obligations involved.

How to use the Mortgage 05m

Using the Mortgage 05m form involves several steps to ensure that all necessary information is accurately provided. Begin by gathering personal and financial information, including income details, employment history, and credit information. Next, fill out the form with precise data regarding the property and loan specifics. After completing the form, carefully review all entries for accuracy. Once satisfied, you can proceed to sign the document electronically, ensuring compliance with legal standards for eSignatures.

Steps to complete the Mortgage 05m

Completing the Mortgage 05m form requires a systematic approach to ensure all information is correctly captured. Follow these steps:

- Gather necessary documents, such as proof of income, credit reports, and property details.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the property, including its address, purchase price, and loan amount.

- Specify the loan terms, including interest rates, repayment period, and any fees.

- Review the completed form for accuracy and completeness.

- Sign the form electronically, ensuring that you meet all legal requirements for eSignatures.

Legal use of the Mortgage 05m

The legal use of the Mortgage 05m form is governed by various regulations that ensure its validity and enforceability. In the United States, eSignatures are recognized under the ESIGN Act and UETA, which establish the legal framework for electronic signatures. To ensure that the Mortgage 05m is legally binding, it is essential to use a reputable eSignature platform that complies with these regulations. This compliance guarantees that the document can be upheld in a court of law if necessary.

Key elements of the Mortgage 05m

Several key elements are essential for the Mortgage 05m form to be effective and legally binding. These include:

- Borrower Information: Details about the borrower, including full name and contact information.

- Lender Information: Information about the lending institution, including name and address.

- Loan Details: Specifics regarding the loan amount, interest rate, and repayment terms.

- Property Information: Description of the property being financed, including its address and legal description.

- Signatures: Both borrower and lender must sign the form to validate the agreement.

How to obtain the Mortgage 05m

Obtaining the Mortgage 05m form is a straightforward process. Typically, lenders provide this form as part of the mortgage application package. You can request it directly from your lender or financial institution. Additionally, many online resources offer downloadable versions of the Mortgage 05m form, allowing you to fill it out electronically. Ensure that you are using the most current version of the form to avoid any compliance issues.

Quick guide on how to complete mortgage 05m

Prepare Mortgage 05m seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Mortgage 05m on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Mortgage 05m effortlessly

- Locate Mortgage 05m and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Mortgage 05m and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage 05m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'mortgage 05m' feature in airSlate SignNow?

The 'mortgage 05m' feature in airSlate SignNow allows users to streamline the process of signing mortgage documents electronically. This feature makes it faster and easier to manage documentation for mortgage applications, signNowly reducing turnaround times.

-

How does airSlate SignNow support mortgage professionals?

airSlate SignNow supports mortgage professionals by providing a secure platform for eSigning and sending important documents like loan applications and agreements. With the 'mortgage 05m' feature, mortgage agents can enhance their workflow efficiency and improve client satisfaction.

-

What is the pricing structure for using the 'mortgage 05m' feature?

Pricing for the 'mortgage 05m' feature varies based on the plan chosen, with flexible options that cater to different business sizes. Businesses can opt for monthly or annual subscriptions, making the solution cost-effective for managing their mortgage documentation needs.

-

Can airSlate SignNow integrate with other mortgage management tools?

Yes, airSlate SignNow can seamlessly integrate with various mortgage management tools, which enhances its utility in a mortgage setting. This integration allows users to easily access and send documents from other software platforms while utilizing the 'mortgage 05m' capabilities.

-

What are the benefits of using airSlate SignNow for mortgage documents?

Utilizing airSlate SignNow for mortgage documents offers multiple benefits, including time savings, reduced paperwork, and enhanced security. The 'mortgage 05m' functionality ensures that documents are signed quickly and are always compliant, making it a smart choice for mortgage professionals.

-

Is the 'mortgage 05m' feature user-friendly for clients?

Absolutely! The 'mortgage 05m' feature is designed with user experience in mind, making it easy for clients to sign documents from any device, at any time. This convenience improves the overall client experience and accelerates the mortgage process.

-

How can I get started with the 'mortgage 05m' feature on airSlate SignNow?

Getting started with the 'mortgage 05m' feature is straightforward. Simply sign up for an account on the airSlate SignNow website, choose a plan that meets your needs, and start sending and signing your mortgage documents securely and efficiently.

Get more for Mortgage 05m

Find out other Mortgage 05m

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself