Ks Irp Application Schedule C Form

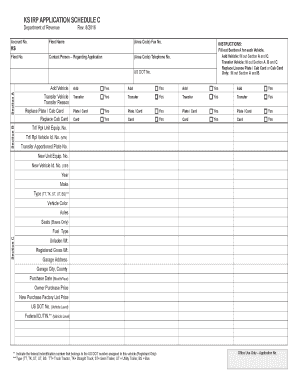

What is the Ks Irp Application Schedule C

The Ks Irp Application Schedule C is a form used by businesses and self-employed individuals in Kansas to report income and expenses related to their operations. This form is essential for accurately calculating the amount of tax owed to the state. It provides a comprehensive overview of the financial activities of a business, ensuring compliance with state tax regulations. Understanding the purpose of this form is crucial for anyone engaged in business activities in Kansas.

How to use the Ks Irp Application Schedule C

Using the Ks Irp Application Schedule C involves several key steps. First, gather all necessary financial documents, including income statements, receipts for expenses, and any relevant tax documents. Next, fill out the form by entering your business income and detailing your expenses. It is important to categorize expenses accurately, as this can affect your tax liability. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Ks Irp Application Schedule C

Completing the Ks Irp Application Schedule C requires a systematic approach. Begin by downloading the form from the Kansas Department of Revenue website or obtaining a physical copy. Follow these steps:

- Enter your business name and contact information at the top of the form.

- Report your total income from all sources related to your business.

- List all deductible expenses, including operating costs, salaries, and other relevant expenditures.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Sign and date the form to certify that the information provided is accurate.

Key elements of the Ks Irp Application Schedule C

The key elements of the Ks Irp Application Schedule C include sections for reporting income, expenses, and net profit or loss. Each section is designed to capture specific financial details:

- Income Section: This section requires you to report all income generated by your business activities.

- Expense Section: Here, you will categorize and list all business-related expenses, such as rent, utilities, and supplies.

- Net Profit or Loss: This calculation determines your overall financial performance and impacts your tax obligations.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Ks Irp Application Schedule C to avoid penalties. Typically, the form must be submitted by April 15 for most taxpayers. However, if you are self-employed or your business operates on a different fiscal year, the deadline may vary. Always check the Kansas Department of Revenue for the most current deadlines and any extensions that may apply.

Legal use of the Ks Irp Application Schedule C

The legal use of the Ks Irp Application Schedule C is critical for ensuring compliance with state tax laws. This form serves as an official record of your business income and expenses, which can be reviewed by tax authorities. Accurate completion of this form helps protect you from potential audits and penalties. Furthermore, maintaining thorough documentation of all reported figures is advisable for legal and financial security.

Quick guide on how to complete ks irp application schedule c 448540182

Complete Ks Irp Application Schedule C effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Ks Irp Application Schedule C on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Ks Irp Application Schedule C effortlessly

- Locate Ks Irp Application Schedule C and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Ks Irp Application Schedule C to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ks irp application schedule c 448540182

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRP Schedule C, and why is it important?

The IRP Schedule C is a crucial form for sole proprietors, as it reports income or loss from a business. Understanding and properly filling out the IRP Schedule C can signNowly impact your tax obligations and ensure you take advantage of all eligible deductions. Using tools like airSlate SignNow can streamline the eSigning process for your IRP Schedule C.

-

How does airSlate SignNow simplify completing the IRP Schedule C?

airSlate SignNow provides an easy-to-use platform that enables businesses to fill out and eSign documents like the IRP Schedule C efficiently. With its intuitive interface, you can quickly gather the necessary signatures and ensure your form is submitted accurately and on time. This streamlined process saves you valuable time and reduces the stress of tax season.

-

What features does airSlate SignNow offer for managing the IRP Schedule C?

airSlate SignNow offers a variety of features tailored for managing the IRP Schedule C, including document templates, secure storage, and real-time tracking of signers. These features enhance collaboration and make it easier to manage multiple documents simultaneously. Utilizing these tools can help ensure your IRP Schedule C is completed correctly.

-

Is airSlate SignNow cost-effective for small businesses needing the IRP Schedule C?

Yes, airSlate SignNow offers various pricing plans that are budget-friendly for small businesses needing to manage the IRP Schedule C. The cost-effective solution includes essential features that streamline document management without compromising quality. This value helps businesses effectively handle their eSigning needs while focusing on growth.

-

Can airSlate SignNow integrate with other platforms for filing the IRP Schedule C?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, allowing for easy management of the IRP Schedule C alongside other accounting and tax software. These integrations enable users to automatically pull data into their forms, reducing manual entry and ensuring accuracy. This capability enhances the overall efficiency of your tax reporting process.

-

What are the benefits of using airSlate SignNow for my IRP Schedule C?

Using airSlate SignNow for your IRP Schedule C offers numerous benefits, including enhanced security for your sensitive information, the convenience of eSigning from anywhere, and the ability to complete documents quickly. By digitizing the process, you minimize the risk of delays and errors common in traditional document handling. This ensures a smoother, more efficient experience.

-

How secure is the data when eSigning the IRP Schedule C with airSlate SignNow?

airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect your data when eSigning documents like the IRP Schedule C. Each transaction is securely logged, ensuring a reliable audit trail. This level of security gives you peace of mind when managing your important documents.

Get more for Ks Irp Application Schedule C

- Petition by landlord for termination of tenancy and judgment form

- Forms and publications pdf

- New mexico judgment for restitutionus legal forms

- Domestic abuse family violence protection act albuquerque form

- Service of process information for petition for order of protection from

- Request for order to omit petitioners address and telephone form

- Response to petition for order of protection from domestic form

- Faqs domestic abuse under new mexico family violence form

Find out other Ks Irp Application Schedule C

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile