Rew 2 2014

What is the REW 2?

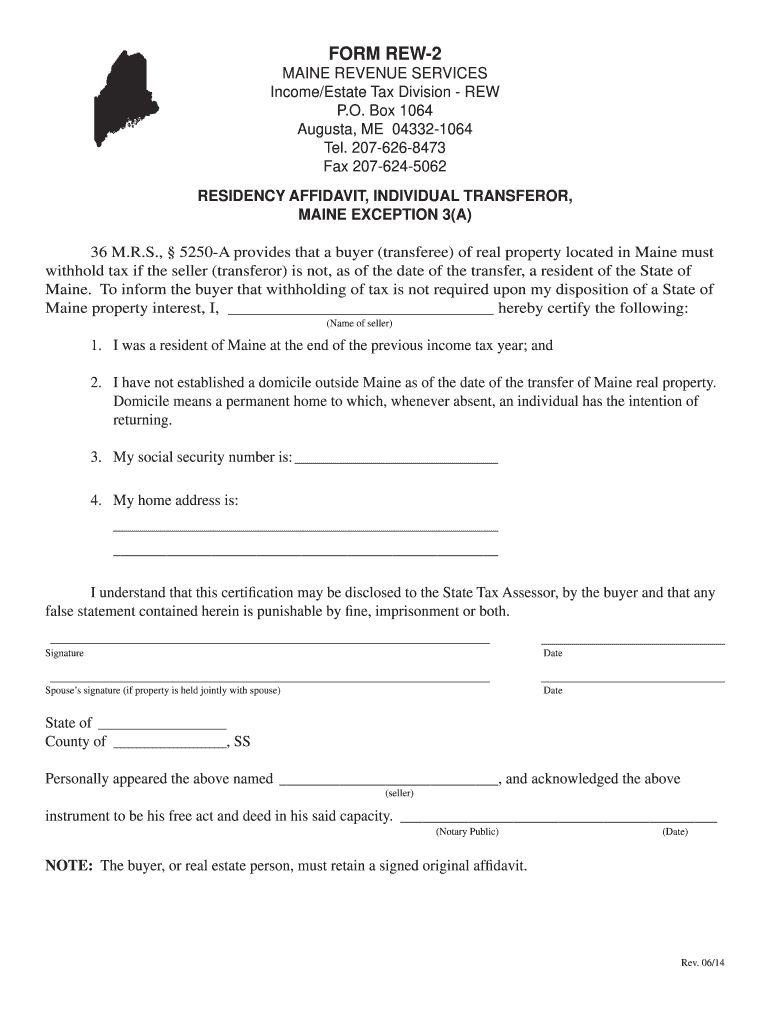

The REW 2 form is a state-specific document used in Maine for reporting various tax-related information. This form is essential for individuals and businesses to accurately report their income and tax obligations. It is designed to ensure compliance with state regulations and to facilitate the proper assessment of taxes owed. The REW 2 form includes sections for detailing income sources, deductions, and credits, making it a comprehensive tool for tax reporting.

How to Use the REW 2

Using the REW 2 form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once the form is filled, review it for any errors before submitting. The REW 2 can be submitted electronically or via mail, depending on your preference and state guidelines.

Steps to Complete the REW 2

Completing the REW 2 form requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Access the REW 2 form through the official Maine state website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- Include information on deductions and credits that apply to your situation.

- Review the completed form for accuracy.

- Submit the form either electronically or by mail, as per the guidelines.

Legal Use of the REW 2

The REW 2 form must be used in accordance with Maine state laws and IRS regulations. It is legally binding when completed accurately and signed. The form serves as an official record of your tax obligations and can be used in case of audits or disputes with the state tax authority. Ensure that you are aware of any updates to legal requirements regarding the REW 2 to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the REW 2 form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year, aligning with the federal tax filing deadline. However, it is essential to check for any specific state extensions or changes in deadlines that may apply. Staying informed about these dates can help ensure timely filing and compliance with state regulations.

IRS Guidelines

The IRS provides guidelines that impact the use of the REW 2 form, particularly regarding eSignature and electronic submissions. Following IRS regulations ensures that the form is accepted and processed without issues. It is important to familiarize yourself with these guidelines, especially if you are using digital methods for filing. Adhering to IRS standards helps maintain the integrity and legality of your tax filings.

Quick guide on how to complete form rew 2 maine revenue services incomeestate tax division rew p maine

Your assistance manual on how to set up your Rew 2

If you’re interested in finding out how to generate and send your Rew 2, here are some brief guidelines on how to simplify tax submission.

To start, you simply need to register your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management tool that enables you to modify, create, and complete your income tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revert to adjust responses as necessary. Streamline your tax processing with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Rew 2 in just a few minutes:

- Create your account and begin editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Rew 2 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that paper filing can increase return mistakes and postpone refunds. It’s essential to check the IRS website for submission guidelines in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct form rew 2 maine revenue services incomeestate tax division rew p maine

Create this form in 5 minutes!

How to create an eSignature for the form rew 2 maine revenue services incomeestate tax division rew p maine

How to make an electronic signature for the Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine in the online mode

How to generate an electronic signature for your Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine in Chrome

How to generate an electronic signature for signing the Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine in Gmail

How to generate an eSignature for the Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine straight from your mobile device

How to create an electronic signature for the Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine on iOS

How to generate an eSignature for the Form Rew 2 Maine Revenue Services Incomeestate Tax Division Rew P Maine on Android

People also ask

-

What is Maine REW 2 and how does it benefit my business?

Maine REW 2 is an innovative electronic signature solution that simplifies the document signing process for businesses. By utilizing Maine REW 2, companies can streamline workflows, reduce paperwork, and enhance operational efficiency. This tool is especially beneficial for organizations looking to save time and improve their document management.

-

How much does Maine REW 2 cost?

The pricing for Maine REW 2 is designed to be cost-effective and adaptable to various business needs. We offer flexible subscription plans, allowing you to select an option that fits within your budget. By integrating Maine REW 2, you signNowly reduce costs associated with paper and manual processes.

-

What features does Maine REW 2 offer?

Maine REW 2 includes a range of features such as customizable templates, secure electronic signatures, and real-time tracking of document status. These features work together to enhance the user experience and ensure that your documents are managed effectively. With Maine REW 2, you can easily create, send, and eSign documents from anywhere.

-

Is Maine REW 2 easy to integrate with my existing tools?

Yes, Maine REW 2 is designed for seamless integration with many existing business tools and software. Whether you use CRM systems or project management platforms, integrating Maine REW 2 will enhance your workflows without disrupting your current processes. Our support team is also available to assist with the integration.

-

Can Maine REW 2 help my team collaborate more effectively?

Absolutely! Maine REW 2 facilitates collaboration by allowing multiple users to access, review, and sign documents quickly. This promotes faster decision-making and ensures that your team is always on the same page. The collaborative features of Maine REW 2 signNowly improve project management and communication.

-

What security measures does Maine REW 2 have in place?

Maine REW 2 prioritizes security with features such as encryption and secure cloud storage. These measures protect your sensitive documents and ensure compliance with regulatory standards. Trusting Maine REW 2 means safeguarding your information and maintaining the integrity of your eSigning processes.

-

Does Maine REW 2 support mobile access?

Yes, Maine REW 2 is fully optimized for mobile use, allowing you to access, send, and eSign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere, making it an ideal solution for busy professionals. The mobile access feature of Maine REW 2 enhances productivity and responsiveness.

Get more for Rew 2

- Corpus christi police department open records form

- Rite amp corda minifit earmold bformb myoticon

- Zoll r series competency checklist form

- Cb8 bond form

- Standard student accident report form pdf springfield public

- Osap continuation of interest status fillable form

- Soapp r pdf form

- Rental vehicle affidavit form

Find out other Rew 2

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple